IBM Strengthens Collaboration with Juniper Networks for Enhanced IT Solutions

International Business Machines Corporation (IBM) has renewed its collaboration with Juniper Networks, Inc. (JNPR) to enhance productivity in core enterprise workflows. Under the updated agreement, IBM plans to integrate its watsonx platform with Juniper’s Mist AI (artificial intelligence) technology. This collaboration seeks to simplify the management of IT networks and improve user experiences while reducing operational costs.

Specifically, the partnership will focus on two internal projects at IBM: IBM Guest Services and IBM AskNetwork. IBM Guest Services aims to automate IT network support, reducing the need for manual intervention when addressing guest Wi-Fi issues. Meanwhile, IBM AskNetwork will tackle network infrastructure challenges by converting complex technical data into easily understandable, actionable insights for end-users.

By offering personalized real-time support, this extended partnership will not only free up IT resources but also empower users to obtain quick and accurate solutions. This is expected to boost operational efficiency and open new avenues for staying competitive in the market.

Watsonx Platform: A Key Growth Driver for IBM

The watsonx platform is central to IBM’s AI capabilities and represents a significant driver of its growth. This enterprise-ready AI and data platform offers three key products to help organizations scale and accelerate their AI initiatives. The components include the watsonx.ai studio for foundational models and generative AI, the watsonx.data fit-for-purpose data store built on an open lake house architecture, and the watsonx.governance toolkit that promotes responsible and transparent AI workflows.

Strong Demand for Hybrid Cloud Solutions

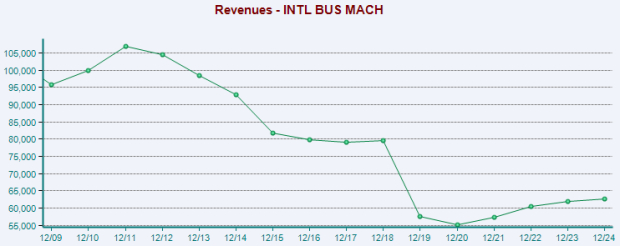

IBM’s growth trajectory is expected to be bolstered by its analytics, cloud computing, and security services over the long term. As enterprises increasingly manage traditional cloud-native workloads and adopt generative AI, they face complex infrastructure needs. This shift has encouraged companies to pursue cloud-agnostic and interoperable strategies for secure multi-cloud management, leading to heightened demand for IBM’s hybrid cloud solutions. Consequently, IBM has seen a positive trend in revenue in recent years.

The acquisition of HashiCorp has further enhanced IBM’s ability to support businesses in navigating complex cloud environments. HashiCorp’s tools complement IBM’s RedHat portfolio and add functionality for managing cloud infrastructure. The integration of HashiCorp’s software has reinforced IBM’s hybrid multi-cloud strategy. Additionally, acquiring StreamSets and webMethods has upgraded IBM’s AI and automation capabilities, enhancing key areas such as integration, API management, and data ingestion.

Image Source: Zacks Investment Research

Revising Earnings Estimates for IBM

Recent trends indicate an upturn in earnings estimate revisions for IBM. Over the past 60 days, 2025 earnings estimates have increased by 1.6% to $10.78, while 2026 estimates rose by 3.3% to $11.61. These favorable revisions reflect positive sentiments regarding the stock’s growth potential.

Image Source: Zacks Investment Research

Price Performance Overview

IBM’s stock has gained 27.9% over the past year, in stark contrast to a 19.2% decline in the industry. This performance has positioned IBM favorably compared to key competitors such as Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN).

One-Year IBM Stock Price Performance

Image Source: Zacks Investment Research

Conclusion

Given its solid fundamentals and strong revenue potential driven by demand trends, IBM appears to be a strong investment opportunity. The company’s focus on hybrid cloud solutions and effective execution of operational strategies, along with its AI initiatives, are likely to enhance customer value. IBM anticipates at least 5% revenue growth on a constant currency basis for 2025, fueled by a robust portfolio mix and productivity achievements.

With a strong history of earnings surprises—averaging a 6.1% positive surprise over the last four quarters—IBM boasts a Zacks Rank #2 (Buy). Investors might consider this opportunity as IBM seems poised for continued stock price appreciation.

Discover Zacks Buys for Just $1

We’re not kidding.

Years ago, we surprised our members by offering a 30-day access to all our stock picks for only $1, with no further obligations.

Many have taken advantage of this unique opportunity. While some hesitated, thinking there must be a catch, we want you to familiarize yourself with our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, which achieved 256 positions with double- and triple-digit gains in 2024 alone.

see Stocks Now >>

For the latest investment recommendations from Zacks Investment Research, you can download our report on the 7 Best Stocks for the Next 30 Days. Click to access this free report.

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.