“`html

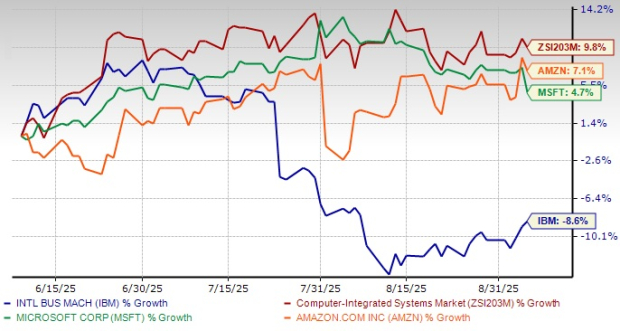

International Business Machines Corporation (IBM) has seen an 8.6% decline in stock value over the past three months, contrasting with a 9.8% growth in its industry. Competitors such as Microsoft Corporation and Amazon.com, Inc. have gained 4.7% and 7.1%, respectively, during this period, attributed to the increasing adoption of enterprise solutions like Azure OpenAI and Amazon Web Services.

IBM is facing significant challenges, including price pressure from Amazon Web Services and Microsoft Azure, eroding margins and profitability. The company is implementing job cuts as part of a “resource action” plan to reduce operating costs, with a portion of these roles being shifted to India. Reports indicate that employees in consulting, cloud infrastructure, and human resources are particularly affected. The company is also aiming to integrate AI into its operations, especially in back-office functions.

Amid these setbacks, IBM’s earnings estimates for 2025 and 2026 have risen by 5.8% and 6.1%, respectively, reflecting growing optimism about its growth potential. However, with a price/earnings ratio of 21.28, IBM trades at a premium compared to its industry average of 19.96.

“`