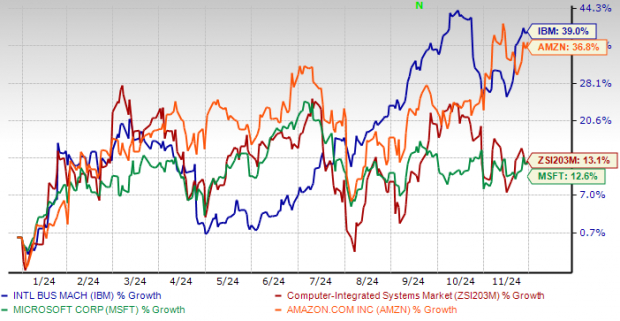

IBM Soars 39% in 2023, Riding the Wave of Cloud and AI Demand

Fueled by strong interest in hybrid cloud and AI (artificial intelligence), International Business Machines Corporation (IBM) has gained 39% this year, significantly outperforming the industry average of 13.1%. This uptick positions IBM ahead of rivals like Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN).

Stock Performance of IBM, MSFT, and AMZN in 2024

Image Source: Zacks Investment Research

IBM’s Strategic Focus: Cloud and AI

The demand for IBM’s hybrid cloud and AI solutions is driving growth in its Software and Consulting segments. Long-term prospects look bright, aided by advancements in analytics, cloud technology, and security. As IBM refines its business approach, improved productivity and strategic investments are expected to enhance profitability.

IBM’s Apptio portfolio has recently launched on Microsoft Azure, Microsoft’s cloud platform. With this expansion, IBM’s software offerings now reach 14 additional countries via Azure Marketplace, further supporting clients in their digital transformations.

The Apptio software facilitates collaboration among portfolio managers and finance teams, streamlining budgeting and workforce alignment across tech priorities. Its integration with Azure DevOps aims to deliver efficiency and cost savings, allowing clients to benefit from Microsoft Azure Consumption Commitments.

IBM’s Watsonx Platform: A Game Changer in AI

The Watsonx platform stands as a key technology for IBM’s AI initiatives. It provides foundational models that help businesses enhance productivity. Watsonx includes three primary products: the watsonx.ai studio for new generative AI and machine learning models, the watsonx.data store designed with an open lake house architecture, and the watsonx.governance toolkit to ensure responsible AI workflow management.

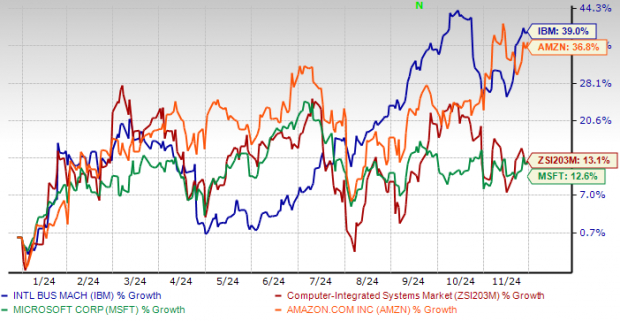

Increasing Earnings Estimates for IBM

IBM is currently experiencing a positive trend in earnings estimate revisions. Projections for 2024 have risen by 3.6% to $10.12, while 2025 estimates have increased by 1.4% to $10.58. This upward momentum reflects growing optimism regarding the company’s growth potential.

Image Source: Zacks Investment Research

Challenges: Margin Erosion at IBM

Despite its success in the hybrid cloud and AI sectors, IBM continues to face significant competition from Amazon Web Services and Microsoft Azure. Increasing pricing pressures have resulted in eroding profit margins, leading to declining profitability over recent years, aside from occasional spikes. Transitioning its business model to focus on cloud services has proven difficult, exacerbated by weaknesses in its traditional sectors and the challenges posed by foreign exchange volatility.

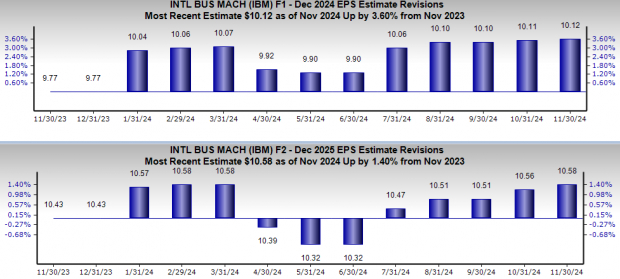

IBM’s Stock Valuation Overview

In terms of valuation, IBM’s shares currently trade at a premium compared to the industry average. The price/book ratio stands at 8.57, in contrast to the industry’s 3.48 and the stock’s historical mean of 5.85.

Image Source: Zacks Investment Research

Conclusion: A Cautious Outlook for IBM

IBM is well-positioned to take advantage of the growing trend among businesses to adopt hybrid cloud and generative AI solutions. As enterprises manage increasingly complex cloud infrastructures, demand for IBM’s services continues to rise.

However, with a Zacks Rank #3 (Hold), new investors should approach with caution. Given the premium valuation and the current market conditions, it may be prudent to wait for a more favorable entry point to invest in IBM’s long-term potential.

Explore Zacks’ top stock recommendations here.

Must-See: Solar Stocks on the Rise

The solar energy sector is set for growth, driven by a broader transition from fossil fuels to renewable energy sources, particularly in tech and AI industries.

With trillions of dollars expected to flow into clean energy in the coming years, analysts project solar power will contribute to 80% of renewable energy growth. This presents significant investment opportunities, but choosing the right stocks is essential.

Get Zacks’ top solar stock recommendations for free.

Download 5 Stocks Set to Double from Zacks Investment Research—free.

Free Stock Analysis Report for Amazon.com, Inc. (AMZN)

Free Stock Analysis Report for Microsoft Corporation (MSFT)

Free Stock Analysis Report for International Business Machines Corporation (IBM)

Read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.