“`html

IBM Faces Regulatory Hurdles in $6.4 Billion HashiCorp Acquisition

International Business Machines Corporation (IBM) began 2025 amid challenges as it attempts to enhance its cloud security offerings through the planned acquisition of HashiCorp Inc. (HCP). The deal, which was finalized in April 2024, has come under scrutiny from the Competition and Markets Authority (CMA), the UK’s antitrust regulator. The CMA is investigating whether the acquisition could harm competition in the market.

The CMA will conclude its initial Phase 1 investigation by February 25, with stakeholders able to voice concerns until January 16.

Analyzing the IBM-HCP Acquisition

HashiCorp, based in California, specializes in software that helps organizations automate multi-cloud and hybrid environments using its Infrastructure Lifecycle Management and Security Lifecycle Management tools.

The growing demand for cloud-native, AI-driven applications has led to complex cloud management strategies within many enterprises. This increase in cloud workloads has prompted companies to seek more flexible and interoperable solutions for secure multi-cloud management. IBM’s acquisition of HCP aims to address these challenges head-on.

With an enterprise value of $6.4 billion, this deal would enhance IBM’s ability to assist businesses in navigating intricate cloud landscapes. Additionally, HashiCorp’s offerings are expected to enrich IBM RedHat’s product line, providing vital capabilities for cloud infrastructure management. Integrating HCP’s technologies could significantly strengthen IBM’s hybrid multi-cloud strategy and contribute positively to earnings.

IBM’s Focus on Hybrid Cloud and AI Growth

IBM is strategically positioned to capitalize on the rising demand for hybrid cloud and artificial intelligence (AI). These sectors are expected to bolster the company’s Software and Consulting divisions. Key drivers of profitability include improved operational efficiency and a diversified business strategy supported by investments in growth areas.

Recently, IBM expanded its Apptio portfolio—which offers enterprise agile planning, IT financial management, and cloud FinOps solutions—by launching it on Microsoft Azure, the cloud platform owned by Microsoft Corporation (MSFT). The company also broadened its software availability on the Azure Marketplace to 14 new countries, catering to customers navigating digital transformations.

The EAP software from IBM promotes collaboration across teams, helping manage budgets and workflows within various technological contexts. It integrates with Azure DevOps, streamlining management tasks and potentially reducing costs for clients benefiting from Microsoft Azure Consumption Commitments.

Watsonx: IBM’s AI Technology Backbone

The Watsonx platform is set to be at the heart of IBM’s AI strategy. It offers foundational models that enhance productivity for enterprises. Comprising three main products—the watsonx.ai studio for generating new models and machine learning, the watsonx.data open lake house data store, and the watsonx.governance framework for responsible AI—the platform aims to accelerate AI implementation across organizations.

IBM’s Stock Performance Insights

Fueled by strong trends in hybrid cloud and AI, IBM’s stock has soared 36.1% over the past year, significantly outperforming the industry’s growth rate of 7.6%, though it trails behind Amazon.com, Inc. (AMZN).

One-Year Price Performance

Image Source: Zacks Investment Research

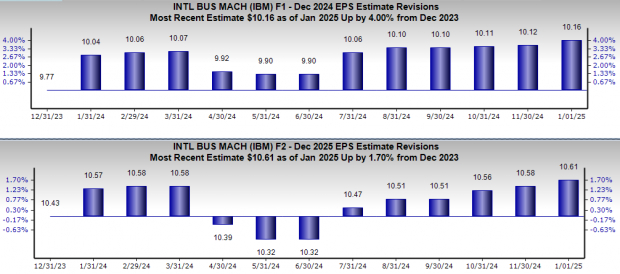

Trends in Earnings Estimates for IBM

Currently, IBM is experiencing an upward trend in earnings estimate revisions. Projections for 2024 have risen by 4% to $10.16 per share over the past year, while estimates for 2025 have increased by 1.7% to $10.61. This positive trend reflects optimism regarding the company’s growth potential.

Image Source: Zacks Investment Research

IBM’s Valuation Overview

From a valuation perspective, IBM appears to be trading at a premium compared to its industry peers, with a price/book ratio of 8.29, significantly higher than the industry average of 3.19 and the stock’s historical mean of 5.85.

Image Source: Zacks Investment Research

Final Thoughts

IBM aims to leverage the increasing trend towards cloud-agnostic and interoperable solutions for secure multi-cloud management, focusing on hybrid cloud and generative AI. As traditional workloads and AI deployments continue to expand, the demand for flexible cloud management solutions is expected to rise.

IBM’s hybrid cloud approach integrates public, private, and on-premises infrastructures, creating a unified and efficient IT framework. The proposed acquisition of HashiCorp is designed to build a comprehensive hybrid cloud platform tailored for AI complexities, offering clients extensive management capabilities for applications and infrastructure. While regulatory scrutiny poses a temporary challenge, the deal is anticipated to support IBM’s long-term strategy for a resilient and diverse cloud portfolio.

Currently holding a Zacks Rank of #2 (Buy), IBM appears well-positioned for price appreciation. Investors could stand to benefit by investing in this promising stock. For more insights, visit the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for…

“`

Discover Zacks’ Top 10 Stocks for 2025: Over 2,100% Gains Since 2012

Sheraz Mian Curates a New Portfolio with High Potential for Investors

Since its launch in 2012, the Zacks Top 10 Stocks portfolio has achieved remarkable success, boasting a total gain of 2,112.6% through November 2024. This performance surpasses the S&P 500’s impressive +475.6%, demonstrating the portfolio’s ability to deliver outstanding returns. Sheraz Mian, Zacks Director of Research, meticulously evaluated 4,400 companies, narrowing it down to the top 10 picks for 2025 that investors can consider buying and holding.

Interested in seeing these newly released stocks with significant potential? You could be among the first to access this sought-after information.

Explore the New Top 10 Stocks >>

For those looking for more investment advice from Zacks Investment Research, you can download a report on “5 Stocks Set to Double” at no cost.

Additionally, you can find free stock analysis reports for these major companies:

- Amazon.com, Inc. (AMZN)

- Microsoft Corporation (MSFT)

- International Business Machines Corporation (IBM)

- HashiCorp, Inc. (HCP)

If you’re interested in the latest from Zacks regarding IBM and its acquisition of HashiCorp, more information is available here.

For more insights and data, visit Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.