ICICI Bank Reports Strong Q4 Results Amid Rising Expenses

ICICI Bank Ltd. announced a net income of INR126.3 billion ($1.5 billion) for the fourth quarter of fiscal 2025, which concluded on March 31. This marks an 18% increase from the same period last year.

The growth can be attributed to higher net interest income (NII), increased non-interest income, and a rise in loans and deposits. However, the results were tempered by increased operating expenses and provisions.

IBN’s NII & Fee Income Growth, Expenses Increase

NII reached INR211.9 billion ($2.5 billion), reflecting an 11% annual increase. The net interest margin also improved to 4.41%, gaining 1 basis point.

Non-interest income rose to INR70.2 billion ($821 million), showing an 18.4% year-over-year growth, while fee income grew by 16% to INR63.1 billion ($738 million).

This quarter, IBN reported treasury income of INR2.4 billion ($28 million), bouncing back from a treasury loss of INR2.8 billion ($33 million) from the previous year.

Operating expenses increased to INR107.9 billion ($1.26 billion), marking an 11.1% rise compared to the prior year.

ICICI Bank’s Loans & Deposits Show Solid Growth

As of March 31, 2025, ICICI Bank’s total advances hit INR13,417.7 billion ($157 billion), reflecting a sequential increase of 1.2%. This growth was mainly driven by a significant rise in business banking loans.

Total deposits climbed 5.9% sequentially to reach INR16,103.5 billion ($188.4 billion).

IBN’s Credit Quality Presents Mixed Results

As of March 31, 2025, the net non-performing assets (NPA) ratio improved to 0.39%, down from 0.42% a year earlier. Recoveries and upgrades of NPAs (excluding write-offs and sales) amounted to INR38.17 billion ($447 million) in this quarter.

In the fiscal fourth quarter, IBN saw net additions of INR13.25 billion ($155 million) to gross NPA. The total additions to gross NPA were INR51.42 billion ($602 million), while gross NPA write-offs reached INR21.18 billion ($248 million).

Provisions, excluding tax provisions, rose by 24.1% year over year to INR8.9 billion ($104 million). The bank held a contingency provision of INR131 billion ($1.5 billion) as of March 31, 2025.

ICICI Bank Maintains Strong Capital Ratios

In accordance with the Reserve Bank of India’s Basel III guidelines, ICICI Bank’s total capital adequacy ratio stood at 16.55%. The Tier-1 capital adequacy ratio was 15.94% as of March 31, 2025, both well above regulatory requirements.

Our Perspective on IBN

ICICI Bank can expect continued support from rising consumer loan demand, improved deposit balances, and growth in both NII and non-interest income. Nonetheless, elevated operational costs and concerns regarding asset quality amid broader economic uncertainties present ongoing challenges.

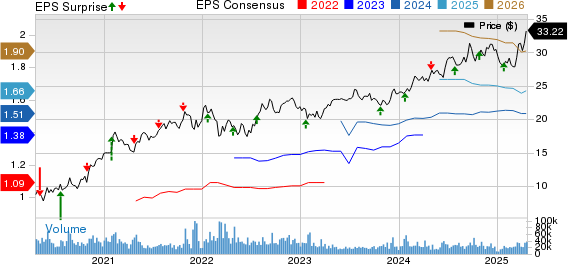

ICICI Bank Limited Price, Consensus and EPS Surprise

ICICI Bank Limited price-consensus-eps-surprise-chart | ICICI Bank Limited Quote

ICICI Bank currently carries a Zacks Rank #3 (Hold). You can see our full list of Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Dates for IBN’s Global Peers

HSBC Holdings is set to announce its first-quarter 2025 results on April 29. The consensus estimate for HSBC’s earnings remains steady at $1.60, indicating a projected decline of 5.9% from the same quarter last year.

Barclays is scheduled to report its first-quarter 2025 results on April 30. The Zacks Consensus Estimate for Barclays’ earnings is also unchanged at 58 cents, reflecting an 11.5% increase year over year.

Zacks Research Chief Identifies Potential “Double” Stock

Experts have recently highlighted five stocks with the highest potential for significant gains. Among these, Director of Research Sheraz Mian emphasizes one particular Stock that stands out.

This leading pick is recognized for its innovation within the financial sector, boasting a customer base exceeding 50 million and a range of advanced solutions. Many will remember past Zacks picks like Nano-X Imaging, which saw a rise of +129.6% in just over nine months.

Free: See Our Top Stock And Four Runners Up.

For the latest recommendations, access Zacks Investment Research’s report detailing the 7 Best Stocks for the Next 30 Days. Click for your free report.

Barclays PLC (BCS) : Free Stock Analysis report

ICICI Bank Limited (IBN) : Free Stock Analysis report

HSBC Holdings plc (HSBC) : Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.