Inflation Risks Loom Over Stock Market Optimism

Last Wednesday, a significant inflation report slipped under the radar as many investors focused on Thanksgiving preparations.

While some media outlets, like CNBC, reported with a positive angle, stating, “Fed’s preferred inflation gauge rises 2.3% annually, meeting expectations,” it’s essential to unpack the full story.

The report in question pertains to the Personal Consumption Expenditures (PCE) price index for October. On a monthly basis, PCE increased by 0.2%, and the annual figure rose to 2.3%. As mentioned, these results align with what experts predicted.

What’s the concern? Although 2.3% inflation seems close to the Federal Reserve’s 2% target, it’s not the complete picture.

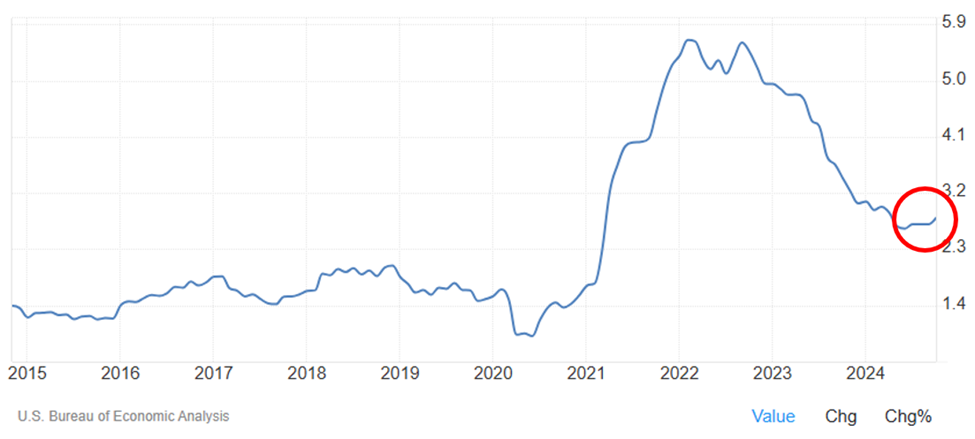

Headline PCE is significantly lower than its peak in 2022, which is a positive development. However, it’s crucial to look at the core PCE readings.

Core PCE: A Closer Look

Core PCE excludes the often volatile food and energy prices.

The core PCE came in at 0.3% for the month and 2.8% year-over-year, indicating inflation is still 40% above the Fed’s desired level.

Some may argue that this is an improvement compared to the 5.6% high seen in 2022, viewing the current reading as a success. However, what’s vital here is the trend.

As illustrated below, core PCE is moving upward again.

Source: Trading Economics

Some may dismiss the slight upward movement as negligible, but it could have significant implications.

While the increase may not reflect a dramatic inflation rebound, it poses challenges for the Fed’s goal of reaching a consistent 2% inflation rate.

To underscore this, consider the core PCE readings over the past six months:

May: 0.1%

June: 0.2%

July: 0.2%

August: 0.2%

September: 0.3%.

October: 0.3%.

Where’s the sustained decrease?

Market’s Expectations Hang in the Balance

The current high prices in the stock market reflect an optimistic outlook that may not be realistic.

The prevailing story among investors suggests that inflation is under control, allowing the Fed to cut interest rates frequently in 2025. This would provide much-needed relief to consumers, strengthen corporate earnings, and justify current high valuations in the stock market.

However, if inflation persists, this scenario could fall apart, leaving the market looking overvalued relative to earnings.

Take a look at the forward price-to-earnings (P/E) ratio. This metric reflects what investors are currently paying for anticipated earnings over the next year. According to FactSet, the forward P/E ratio sits at 22.0, notably above the 5-year average of 19.6 and 10-year average of 18.1. This figure relies on optimistic earnings forecasts from analysts; a less positive outlook would push this ratio even higher.

There is a reasonable argument for this enthusiasm. Here in the Digest, we have discussed how the Trump tax cuts and deregulation could enhance productivity and earnings. However, if that growth does not materialize, stock prices may reflect unrealistic expectations.

Shifting our focus to the Shiller P/E ratio, which assesses current prices relative to the average earnings over the last 10 years, sheds light on the situation. Currently, the Shiller P/E ratio is almost at its second-highest valuation in history.

Source: Multpl.com

So, what does this slight rise in core PCE mean?

It raises concerns about the carefully constructed narrative investors have built, susceptible to disruption.

Insights from Luke Lango

In his recent Daily Notes in Innovation Investor, Luke Lango highlighted these risks:

Imagine a scenario where inflation climbs above 3% and approaches 4%.

In that case, the Fed might halt interest rate cuts. They could even decide to raise rates.

This might lead to the 10-year Treasury yield surging past 5%, impacting the S&P 500.

Navigating Today’s Stock Market: Strategies for Investors

The Current Market Landscape

At present, stocks are trading at 23.5X forward earnings, marking one of the highest valuations in history.

If the 10-year Treasury yield continues to climb, these high valuation multiples may not hold. A significant rise in yields could pressure stock prices, potentially leading to lower multiples.

Interestingly, Luke does not view this scenario as his primary outlook. Nevertheless, being prepared for potential risks can lead to greater success. As Luke suggests, it’s vital to confront this risk and have a plan in place.

Recommended Actions for Investors

Fans of the Digest will likely anticipate our next steps.

It’s crucial to assess your confidence in each stock in your portfolio. Start by establishing reliable trailing stop-loss levels for stocks that you don’t firmly believe in. Be mindful of your position sizes, but maintain your investment momentum until significant changes arise.

While we support this approach, let’s introduce two additional recommendations.

First, consider actively trading the current market instead of solely focusing on long-term buy-and-hold positions, unless those positions are priced attractively. With today’s stock valuations not encouraging a long-term commitment, trading could help you capitalize on positive market momentum while minimizing the risks associated with traditional investing strategies.

With this perspective, I’d like to highlight our new team member, Jeff Clark. A seasoned investor with 40 years of experience, Jeff trades across all market directions—whether up, down, or sideways.

Since he began tracking his trades in 2005, Jeff has provided subscribers opportunities for triple-digit gains more than 50 times and double-digit gains over 160 times.

For insights into Jeff’s trading methods, he recently spoke with our Editor-in-Chief, Luis Hernandez. You can watch their interview here.

In their discussion, Jeff shares his trading philosophy, highlighting a specific technique he refers to as a “magic pattern,” and emphasizes the importance of managing risk in his trading approach. You can find the details in the interview.

This morning, Jeff announced a new position in his newsletter, Jeff Clark Trader. Here’s what he had to say:

Now is not the right time to invest in banks.

The entire financial sector appears vulnerable, making it advisable to consider short positions in this area.

The bullish percent index for the financial sector (BPFINA) has been issuing sell signals over the past few months. While these signals haven’t yet resulted in a significant decline, it’s likely only a matter of time before they do.

Jeff’s latest trade anticipates a downturn in banking. For further analysis and insights, click here to find out more about his newsletter.

The Psychological Aspect of Investing

Next, let’s explore the psychological side of investing.

Are you concentrating on your investment goals and timelines, or are you being distracted by the current market hype?

While this market environment can be rewarding, it can also be daunting. It’s easy to feel excited when stocks perform well but frustrating when they lag behind the latest trends.

This fear of missing out (FOMO) can result in impulsive decisions in the market, often leading to unfavorable outcomes.

Warren Buffett famously commented on this during a past interview with Charlie Rose:

Seeing others profit can lead you to make unwise choices, even if you know you’re better off sticking to your strategy.

Buffett’s partner, Charlie Munger, added:

Envy, not greed, often drives market behavior.

In summary, while it’s essential to seize opportunities in a bull market, remain conscious of today’s valuations. Stay aware of the hopeful assumptions behind optimistic forecasts and be prepared for how you might respond if this market upswing endures for another two years or just two days.

Wishing you a pleasant evening,

Jeff Remsburg