Wall Street Takes Caution Ahead of Nvidia Earnings: A Look at Strong Stocks to Buy

As Nvidia prepares to announce its earnings on Wednesday, Wall Street has shifted into risk-off mode. Investors are selling a range of assets, including Bitcoin, Constellation Energy, and Tesla, in an effort to safeguard profits following a significant post-Trump election market surge.

This swift selloff is affecting major momentum stocks and starting to ease the pressures of an overheated market.

Check out the Zacks Earnings Calendar to stay ahead of important market developments.

Fortunately, some stocks remain attractive options as they are still trading near their highs. These stocks have not moved too far up during the recent market rally.

With this in mind, let’s explore how investors can utilize a Zacks screen to identify promising stocks ranked Zacks Rank #1 (Strong Buy) as we move into March.

Zacks Rank #1 (Strong Buy) stocks typically outperform the market regardless of economic conditions. At any time, over 200 stocks hold a Zacks Rank #1.

Therefore, knowing how to filter the Zacks Rank helps narrow down this list to a more manageable selection of stocks.

Parameters for Stock Screening

Here are three key items for this stock screen, which have generated impressive returns together.

• Zacks Rank equal to 1

Starting with a Zacks Rank #1 serves as a strong foundation because it has delivered an average annual return of approximately 24.4% since 1988.

• % Change (Q1) Est. over 4 Weeks greater than 0

This indicates positive revisions to current quarter estimates over the past four weeks.

• % Broker Rating Change over 4 Weeks must be in the Top # 5

Highlighting the top five stocks with the best average broker rating changes in the last four weeks.

This stock filtering strategy, known as bt_sow_filtered zacks rank5, is part of the Research Wizard available in the Screen of the Week folder.

Currently, here’s one stock that stands out in the Filtered Zacks Rank 5 strategy…

This Underrated Finance Stock Shows Strong Potential for Investors

1st Source (SRCE) is the largest locally managed financial institution located in northern Indiana and southwestern Michigan. It operates numerous banking centers and offers various consumer and commercial banking services through its specialty finance group and wealth advisory services across the country, along with insurance offices.

Image Source: Zacks Investment Research

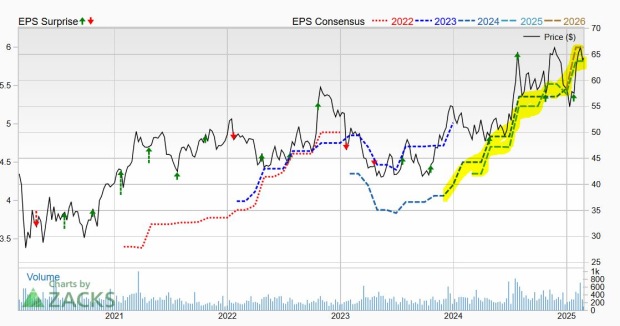

1st Source has consistently exceeded EPS estimates for six consecutive quarters, and its earnings outlook has dramatically improved over the past year. Just in the last month, its FY25 EPS estimate rose by 8%, while FY26 estimates increased by 10%, giving it a Zacks Rank #1 (Strong Buy).

The company recently marked its fourth year of record net income and its 37th year of dividend growth. EPS for 2025 is expected to grow by 6%, followed by 3% in 2026, supported by sales increases of 7% and 3%, respectively.

Image Source: Zacks Investment Research

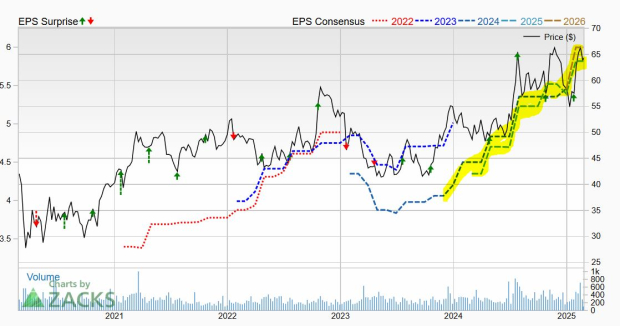

Over the last decade, SRCE’s stock has increased by 130%, surpassing the Finance sector’s average of 85%. Its stock also saw a notable 30% rise in the past year, outperforming its midwestern bank industry peers ranked in the top 6% of Zacks industries. Recently, the stock has surged as it approaches its all-time highs.

Image Source: Zacks Investment Research

Despite its strong performance, 1st Source is currently trading at a 43% discount to its historically high values and is 35% below its sector at a valuation of 11X forward 12-month earnings. Furthermore, it offers a 2.2% dividend yield, which is a solid income source, close to the industry’s average of 3%.

Explore the remaining stocks on this list and start searching for new companies that meet these criteria. Finding your next big investment opportunity can be straightforward, starting today with a free trial of the Research Wizard.

“`html

Zacks Investment Research Shows Unmatched Stock-Picking Success

Exceptional Gains: Zacks Outshines Market Returns

It may be surprising, but since 2000, while the market has increased by +7.7% annually, one of Zacks’ leading stock-picking strategies has averaged an impressive +56.7% per year.

The Top 10 stock screens from Zacks have done even better, boasting an average gain of +35.6%, significantly outperforming the broader market.

Discover Today’s Top Stocks for Free >>

Interested in more? You can access Zacks’ latest insights by downloading the report titled “7 Best Stocks for the Next 30 Days” today at no cost.

For specific stock analysis, check out the report on 1st Source Corporation (SRCE), which offers free stock analysis.

For further insights, visit the full article originally published on Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`