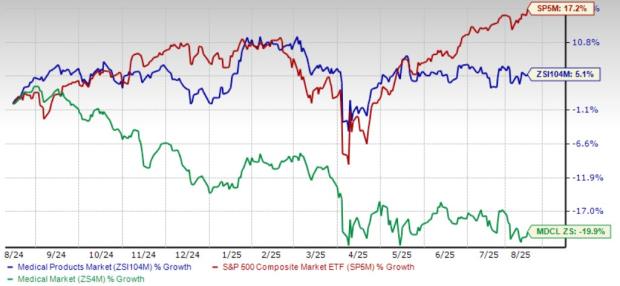

Wall Street experienced a significant sell-off of technology stocks on Tuesday as investors looked to secure profits amid increasing market volatility. The Nasdaq has risen over 90% in the past three years, prompting this profit-taking, even though the bullish market sentiment remains, supported by a strong earnings growth outlook for 2026. The U.S. Federal Reserve is also anticipated to cut interest rates that year.

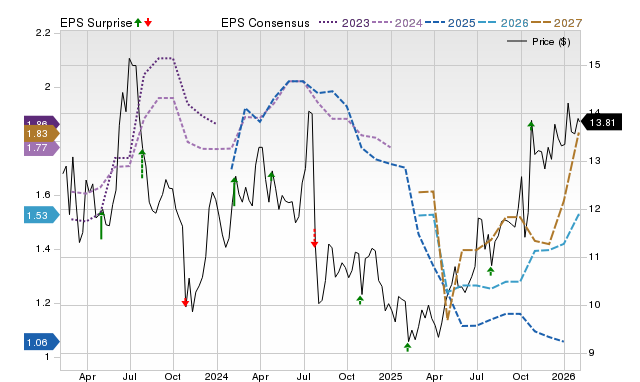

ServisFirst Bancshares, Inc. (SFBS), headquartered in Birmingham, Alabama, is spotlighted as a top-ranked stock amid these market dynamics. The bank, focused on commercial lending and personal banking across several states, has projected a revenue growth of 20% in 2026, leading to an expected earnings increase of 22%. SFBS has surged 370% over the past decade, significantly outperforming its sector, yet it currently trades at a 25% discount compared to its peers.