IDEXX is facing difficulties in its IDXX segment due to currency fluctuations and uncertain economic conditions. The stock currently holds a Zacks Rank #4 (Sell).

Challenges for IDXX

Lately, growth in U.S. clinical visits has been hindered by ongoing staffing shortages in veterinary clinics, as well as broader economic concerns affecting consumer behavior. In the Asia-Pacific region, reduced swine testing in China and lower health screening revenues have negatively impacted the organic growth of IDEXX’s Livestock, Poultry, and Dairy (LPD) business. In the third quarter, LPD revenues decreased primarily due to the drop in swine testing and herd health screenings in Asia.

Further complications arise from global economic factors such as escalating geopolitical tensions, supply chain challenges resulting in higher raw material costs, healthcare staffing shortages, currency fluctuations, and capital market volatility. These issues have disrupted IDEXX’s supply chain worldwide. With persistent inflation, controlling costs in revenues and operating expenses may prove difficult for IDEXX. In Q3 2024, the company saw general and administrative expenses increase by 3.2% and sales and marketing expenses rise by 7.8%.

A significant portion of IDEXX’s total revenues comes from international product sales. In the first half of 2024, about 21% of revenues were generated from products made in the U.S. but sold in various countries, which has been negatively affected by the U.S. dollar’s strength against local currencies.

Potential Upside for IDEXX Stock

IDEXX’s commitment to innovation within its Companion Animal Group (CAG) has resulted in a strong product and service portfolio. The demand for diagnostic testing in veterinary clinics has surged, making diagnostics a rapidly expanding sector. IDEXX is known for providing advanced diagnostic tools and solutions that are crucial for veterinarians who need accurate health assessments and treatment pathways. These tools offer a blend of recurring and non-recurring revenue streams for IDEXX.

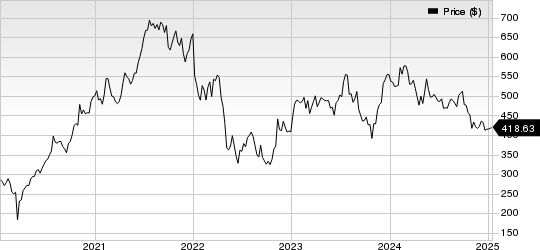

IDEXX Laboratories, Inc. Stock Price

IDEXX Laboratories, Inc. price | IDEXX Laboratories, Inc. Quote

IDEXX is focused on enhancing its global commercial capabilities to ensure robust recurring revenue growth in CAG Diagnostics. In the third quarter, organic revenue growth for IDEXX VetLab consumables was driven by strong double-digit growth in international markets. Global rapid assay revenues grew by 6% organically, thanks to increased pricing and positive adjustments in logistics. Meanwhile, lab revenues rose by 2% organically, reflecting strong international growth. The company’s water segment also performed well, showing a 13% organic revenue increase in Q3, bolstered by success in Europe.

The rising demand for medical services is fueling IDEXX’s innovation efforts in software solutions. These solutions enhance clinic workflows and promote the utilization of diagnostics. In the third quarter, placements of cloud-based products exhibited high double-digit growth, making up more than 95% of total software placements.

Over the past three months, IDEXX shares have fallen by 9.8%, contrasting with a minor 0.2% growth for the overall industry. However, the growing need for advanced diagnostic capabilities may propel the CAG business forward. Additionally, global expansion and efforts to improve clinic efficiency could support the stock’s recovery in the near future.

Top Stock Recommendations

In the wider medical sector, some better-rated stocks include Abbott ABT, Haemonetics HAE, and Phibro Animal Health PAHC, all holding a Zacks Rank #2 (Buy) at this time. You can find a complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Abbott’s shares have declined by 0.7% over the past year. The earnings per share estimate for 2024 remains steady at $4.67. Abbott has exceeded earnings forecasts in three of the last four quarters, with an average surprise of 1.64%, and a 0.83% surprise in the last quarter.

Haemonetics has maintained its fiscal 2025 earnings per share estimate at $4.59 for the past 30 days. Its shares have dropped by 4.4% over the year amidst a 7.8% growth in the industry. The company has surpassed earnings estimates in three of its last four quarters, with an average surprise of 2.82%, and delivered a 2.75% surprise last quarter.

Phibro Animal Health has seen its fiscal 2025 earnings per share estimates rise by 1.9% to $1.62 in the last 30 days. Its shares skyrocketed by 77.6% in the past year, defying the industry’s 7.8% growth. Phibro has exceeded earnings expectations in all four preceding quarters, with an average surprise of 25.47%, and a remarkable 52.17% surprise last quarter.

Explore Profits from the Future of Energy

The demand for electricity continues to rise rapidly, but there is an urgent need to shift away from fossil fuels like oil and natural gas. Nuclear energy is emerging as a sustainable alternative.

Recently, leaders from the U.S. and 21 other countries pledged to triple global nuclear energy capacity. This significant transition could offer substantial profits for nuclear-related stocks—especially for early investors.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, examines the key players and technologies behind this movement, highlighting three standout stocks that stand to gain significantly.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Abbott Laboratories (ABT) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

Phibro Animal Health Corporation (PAHC) : Free Stock Analysis Report

Read this article on Zacks.com

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.