While the tech realm’s “Magnificent Seven” has dazzled investors with their soaring performances, venturing beyond the glitz to explore value stocks could unearth hidden gems for your portfolio.

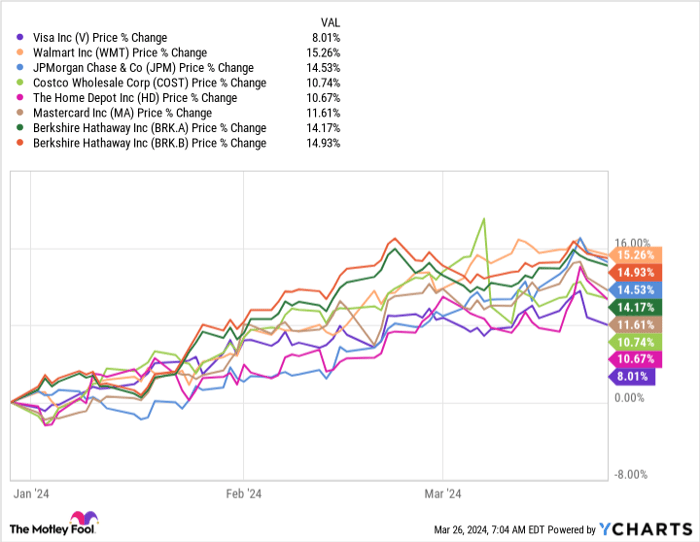

Value stocks aren’t flashy, but they offer solid stability and long-term growth potential. Warren Buffett, the oracle of Omaha, is a staunch advocate of value investing, and his success speaks volumes. If you’re seeking to diversify your holdings, consider adding stalwarts like Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), Visa (NYSE: V), Walmart (NYSE: WMT), JPMorgan Chase (NYSE: JPM), Mastercard (NYSE: MA), Home Depot (NYSE: HD), and Costco Wholesale (NASDAQ: COST).

A Glimpse into the Elite Seven

Berkshire Hathaway prides itself on being a juggernaut in U.S. corporate landscapes, boasting extensive revenues and net income that rival the titans of tech. It’s a conglomerate of significant proportions with a diverse portfolio under Warren Buffett’s astute guidance, making it a gateway to a multitude of robust investment avenues.

Discovering Value Amidst the Giants

Visa, not one to be overshadowed, commands a pivotal position as the top dog in the credit card processing universe. Its towering profit margins and strategic forays into financial tech innovations have fortified its market presence. Additionally, Visa’s commitment to shareholder value is evident through its consistent dividend growth.

Navigating the Seas of Stability

Fronted by revenue behemoth Walmart, the retail giant continues to outpace its competitors in sales and profitability. Its relentless pursuit of growth, coupled with strategic asset optimization, positions Walmart as a beacon of stability amidst market uncertainties.

Mastercard: The Silent Performer

Mastercard, an unsung hero in the credit card domain, is swiftly gaining ground. With robust revenue growth and strong stock performance, this Buffett favorite shines bright. While its dividend yield may be modest, the trajectory of its growth speaks volumes about its future potential.

Building Dreams with Home Depot

Home Depot, the mecca of home improvement, stands tall with a vast network of stores. Adapting to market dynamics early on, Home Depot’s resilience during challenging times underscores its operational prowess. Its dividend yield adds an extra layer of allure for investors seeking long-term stability.

Costco: The Consumer’s Haven

Costco, the haven for bargain hunters, continues to captivate consumers with its membership-driven sales model. Amidst economic uncertainties, Costco’s loyal customer base and strategic expansion plans signal a bright future. Investors relish its potential for growth, complemented by intermittent special dividends.

Value Stocks: Resilient Growth Engines

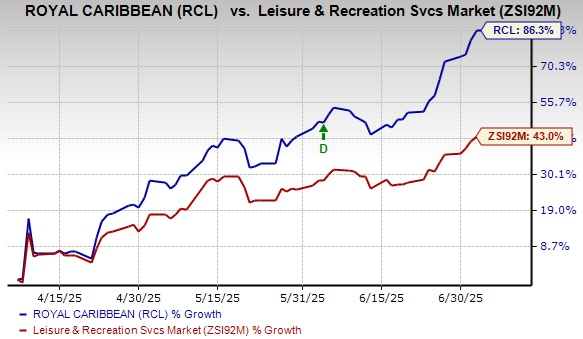

Contrasting the tech boom, these value stocks offer a haven of steady growth and lower risk. The year-to-date performance of these stocks against their high-flying tech counterparts paints a picture of resilience and consistency that few can match.

Whether you opt to invest in all or cherry-pick from this elite roster, each stock presents a unique value proposition and the added allure of dividend income.

Considering a $1,000 Investment in Berkshire Hathaway?

Before diving in, take heed of this advice:

The Motley Fool Stock Advisor analyst team has curated a list of the 10 best stocks poised for stellar returns. While Berkshire Hathaway didn’t make the cut, these top stocks could steer your portfolio towards substantial gains.

With expert advice, regular updates, and exclusive stock picks, the Stock Advisor service has a track record of outperforming the S&P 500 since 2002, offering a blueprint for investment success.

Explore the Top 10 Stocks Now

*Stock Advisor returns as of March 25, 2024

As you ponder your investment choices, remember, the journey of every successful investor begins with a single step — perhaps, in the realm of value stocks that promise steady growth and resilience in tumultuous times.