Biotech companies like CRISPR Therapeutics have the potential for explosive returns, leveraging innovation to make significant strides in the market. The company, bearing the ticker (NASDAQ: CRSP), is a prominent player specializing in gene editing, a field where it has made considerable advancements in recent years.

But just how good has CRISPR Therapeutics’ stock-market performance been? Let’s delve into how a $10,000 investment in the company in 2019 would have fared today.

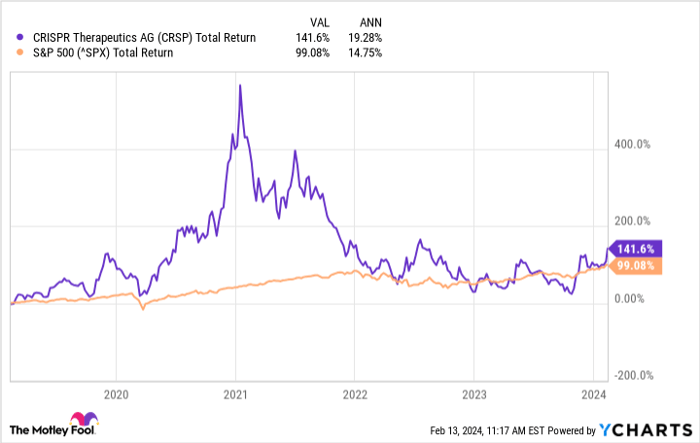

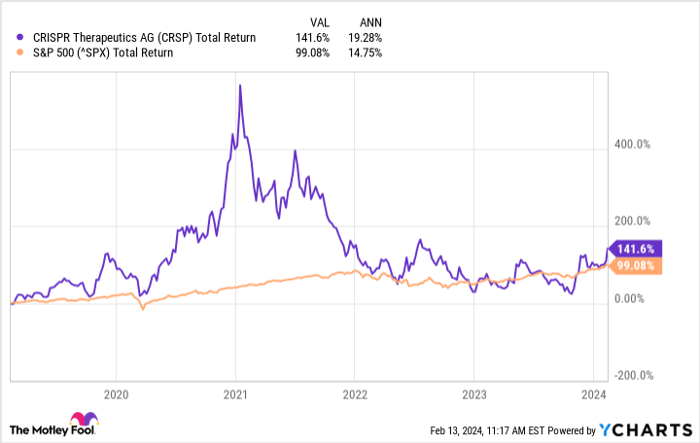

CRSP Total Return Level data by YCharts.

A Rollercoaster Ride

To better understand CRISPR Therapeutics and its specialization in gene editing, it’s essential to remember that gene editing technologies enable scientists to modify an organism’s DNA, offering potential in treating long-elusive diseases. CRISPR Therapeutics focuses on the CRISPR method of gene editing, a technique that has earned its pioneers a Nobel Prize in chemistry.

The past five years have been volatile for the biotech. CRISPR Therapeutics’ shares experienced a surge at the beginning of the pandemic, driven by progress in the clinic. However, as market conditions tightened and investors turned away from somewhat speculative and unprofitable stocks, the company’s stock took a hit.

Despite the volatility, CRISPR Therapeutics closed 2023 with a major achievement by securing approval for its first product: Casgevy, a gene-editing therapy for treating beta thalassemia and sickle cell disease (SCD). The approval, developed in collaboration with Vertex Pharmaceuticals, signifies a significant breakthrough for CRISPR Therapeutics.

So, how much would a $10,000 investment in CRISPR Therapeutics in 2019 be worth today? The company has delivered a compound annual growth rate (CAGR) of 19.3%, turning $10,000 into $24,146. In contrast, the S&P 500’s 14.8% CAGR would have grown the same investment to $19,896.

A Bright Future Ahead

Can CRISPR Therapeutics deliver similar returns over the next five years? The answer hinges on the company’s ability to sustain meaningful clinical and regulatory progress and the potential success of Casgevy in the market. Let’s start with Casgevy, which comes with a U.S. price tag of $2.2 million, an average figure for a gene-editing therapy.

Comparatively, a competing SCD treatment called Lyfgenia, with approval late last year, will cost $3.1 million. Considering Vertex’s expertise in negotiations and its significant resources, Casgevy’s success is likely to surpass that of Lyfgenia. This is aside from the potential risks associated with Lyfgenia, such as the risk of blood cancer.

Vertex and CRISPR Therapeutics plan to target an initial 35,000 patients, representing a potential market of over $70 billion. While revenue from Casgevy may take time to ramp up due to the complexities of gene-editing therapies, it should materialize well before 2029. CRISPR Therapeutics will retain 40% of the profits and cover 40% of the associated costs, a significant opportunity for a company with meager current revenue and consistent unprofitability.

Looking at the biotech’s clinical progress, CRISPR Therapeutics has five other programs in clinical trials, with several more anticipated to enter the clinic in the next couple of years. The company is actively working on cancer therapies and aiming to develop a functional cure for type 1 diabetes, establishing a strong foundation for future success.

In essence, while matching CRISPR Therapeutics’ performance of the past five years is challenging, the company is exceptionally well-positioned to deliver above-average returns in the future.

Should you invest $1,000 in CRISPR Therapeutics right now?

Before investing in CRISPR Therapeutics, it’s worth considering this: The Motley Fool Stock Advisor analyst team identified what they believe are the 10 best stocks for investors to buy now, and CRISPR Therapeutics didn’t make the list. The 10 stocks recognized could yield substantial returns in the years to come. Stock Advisor provides investors with a comprehensive blueprint for success, offering guidance on portfolio building, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has outperformed S&P 500 returns significantly since 2002*.

Explore the 10 stocks

*Stock Advisor returns as of February 12, 2024

Prosper Junior Bakiny has positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends CRISPR Therapeutics and Vertex Pharmaceuticals. The Motley Fool recommends Bluebird Bio. The Motley Fool has a disclosure policy.

The perspectives expressed herein are that of the author and do not necessarily reflect those of Nasdaq, Inc.