Technology is cutthroat, the realm where only the sharpest innovators survive. Enterprises such as the software titan Oracle (NYSE: ORCL), however, have withstood the relentless test of time.

If you had invested $1,000 into the company’s initial public offering (IPO) in 1986, with dividends reinvested over the years, you’d be looking at a millionaire’s fortune of $2.2 million today.

The Deep-Seated Roots of Oracle in Tech

Larry Ellison co-founded Oracle, laying its foundation on database management software in the late 1970s, as companies were starting to adopt modern computers. Oracle has since broadened its scope to encompass various software and cloud applications, including enterprise resource planning (ERP), human capital management, customer relationship management, and more. Apart from this, Oracle also vends cloud computing and data center services, consulting services, AI and machine learning software, as well as hardware.

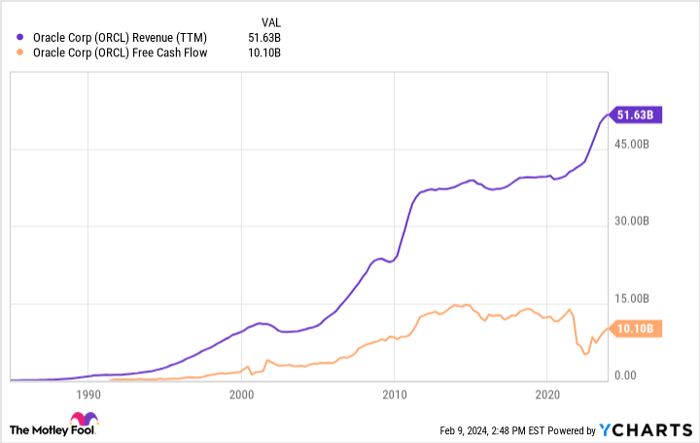

ORCL Revenue (TTM) data by YCharts

The diversified tech juggernaut rakes in over $51 billion in annual revenue and $10 billion in free cash flow. Oracle stands out by packaging products and services to win significant corporate clients. Many of its offerings, like ERP software, are sticky – incredibly hard to switch once implemented, rendering Oracle a formidable incumbent vendor to unseat.

According to Software Path, introducing new ERP software can cost a medium-sized business as much as $750,000, a decision not made lightly. Oracle’s brand recognition also scores points with decision-makers, as opting for a lesser-known provider can backfire severely if things go south.

AI Presents Fresh Opportunities

AI emerges as a monumental software frontier, and Oracle is witnessing activity across its product panorama. Oracle customers have access to AI software tools through its cloud marketplace, where they can procure entry to third-party products and services hosted on the company’s cloud. Companies can leverage tools from Nvidia to train their AI models, Gemelo.ai for voice-based applications, Mosaic for machine learning, and more.

In Oracle’s fiscal year 2024 Q2 earnings, Larry Ellison observed soaring demand for generative AI and cloud infrastructure, propelling total remaining performance obligations (RPO) to $65 billion, outstripping annual revenue – an indicator of imminent growth. Oracle is augmenting 66 existing data centers and intends to construct 100 new centers to cater to the burgeoning demand.

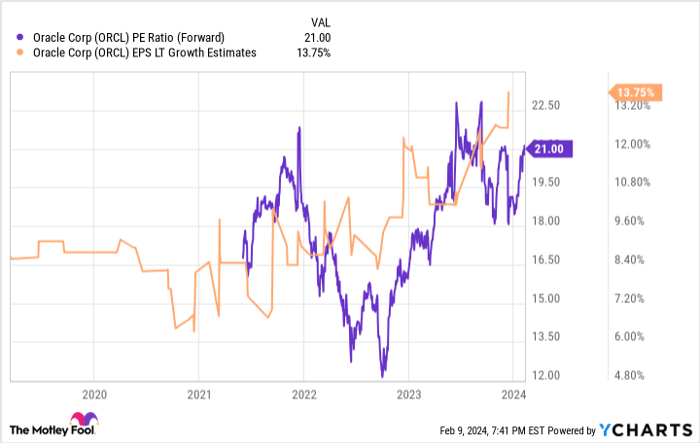

ORCL PE Ratio (Forward) data by YCharts

Responding to this news, analysts hiked long-term earnings growth estimates by over one percentage point to an annualized rate of 13.75%. Note that Oracle’s anticipated long-term earnings growth was merely mid-to-high single digits a few years back. What’s the takeaway? AI is proving to be a shot in the arm for Oracle’s growth.

Predicting the Future for Investors

The surge in anticipated growth is impressive, yet it might not suffice to compensate for overpaying for shares. Investors should exercise caution about the premium they are willing to pay. Presently, Oracle trades at 21 times its estimated earnings for the year ending May 2024, translating to a PEG ratio of 1.5 – roughly the threshold investors can bear and still retain some leeway in case Oracle falls short of expectations.

Oracle is also a dividend stock yielding almost 1.4%, and its dividend has seen a 15-year upward trajectory. Given Oracle performs in line with analysts’ estimates and the valuation remains constant, investors could witness average annual returns of 14% to 15%. Not a quick route to riches, but ample reason to consider shares as a buy-and-hold asset in a diversified portfolio.

Over time, expect the dividend to persist on an upward trajectory and AI momentum to sustain its vigor. Should this materialize, investors stand to fare handsomely with Oracle.

Should you invest $1,000 in Oracle right now?

Before diving into Oracle stock, ponder this:

The Motley Fool Stock Advisor analyst team pinpointed what they believe are the 10 best stocks for investors right now… and Oracle didn’t make the cut. These 10 stocks hold potential to generate substantial returns in the coming years.

Stock Advisor furnishes investors with a clear roadmap for success, inclusive of portfolio construction guidance, regular updates from analysts, and two fresh stock picks monthly. Since 2002, the Stock Advisor service has more than tripled the return of the S&P 500*.

Explore the 10 stocks

*Stock Advisor returns as of February 12, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Oracle. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.