Analysts Predict Upside Potential for iShares Expanded Tech Sector ETF

Recent analysis from ETF Channel reveals that the iShares Expanded Tech Sector ETF (Symbol: IGM) could experience noteworthy growth. The implied target price for this ETF, based on its underlying holdings, stands at $110.96 per share.

Current Pricing and Analyst Predictions

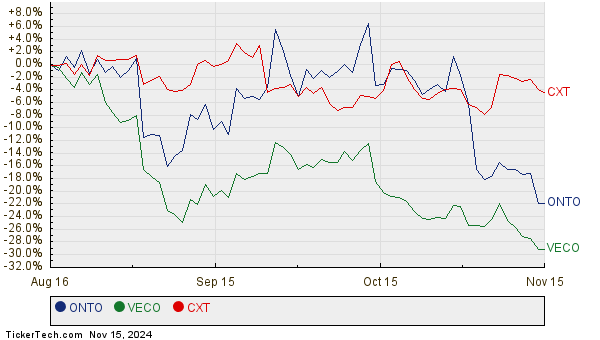

Currently trading at approximately $101.06 per unit, IGM presents analysts with a forecasted upside of 9.80%. This potential rise is derived from the average analyst targets for its underlying assets. Among these holdings, three stocks show significant room for growth: Onto Innovation Inc (Symbol: ONTO), Veeco Instruments Inc (Symbol: VECO), and Crane NXT Co (Symbol: CXT). Despite ONTO’s recent trading price of $164.75 per share, its average analyst target is an impressive 54.35% higher at $254.28. Similarly, VECO, currently trading at $27.31, has a target of $40.28, suggesting a 47.51% upside. Analysts expect CXT to reach a target price of $79.00, marking a 42.88% increase from its recent price of $55.29. Below, a twelve-month price history chart illustrates the performances of ONTO, VECO, and CXT:

Summary of Analyst Target Prices

The following table outlines the current analyst target prices for IGM and its notable underlying holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Expanded Tech Sector ETF | IGM | $101.06 | $110.96 | 9.80% |

| Onto Innovation Inc | ONTO | $164.75 | $254.28 | 54.35% |

| Veeco Instruments Inc | VECO | $27.31 | $40.28 | 47.51% |

| Crane NXT Co | CXT | $55.29 | $79.00 | 42.88% |

Analyst Targets: Realistic Expectations or Overly Optimistic?

Investors might wonder if these analyst targets are justified or if they reflect an optimistic outlook. High price targets can indicate confidence in future performance but may also lead to adjustments if reality falls short. Investors should conduct further research to assess the validity of these predictions and consider the latest developments in the companies and their industries.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• ELOS Historical Stock Prices

• Top Ten Hedge Funds Holding FSLR

• Funds Holding SDOW

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.