Analysts Project Significant Upside for IGV and Its Holdings

ETF Channel recently analyzed the underlying holdings of various ETFs, comparing their trading prices to average analyst 12-month forward target prices. For the iShares Expanded Tech-Software Sector ETF (Symbol: IGV), the implied target price based on its holdings is $114.99 per unit.

Currently, IGV is trading around $104.69 per unit, indicating that analysts see a 9.84% upside potential for this ETF when considering the average target prices of its underlying assets. Notably, three of these holdings—Lightspeed Commerce Inc (Symbol: LSPD), Procore Technologies Inc (Symbol: PCOR), and Q2 Holdings Inc (Symbol: QTWO)—offer particularly promising prospects relative to their analyst target prices.

Lightspeed Commerce Inc is trading at $10.97 per share, with an average analyst target suggesting a 19.02% increase to $13.06 per share. Similarly, Procore Technologies Inc has a current trading price of $69.63, presenting an 11.86% upside to its target of $77.89 per share. Lastly, Q2 Holdings Inc, currently priced at $89.96, has a projected target price of $100.50, indicating an expected increase of 11.72%.

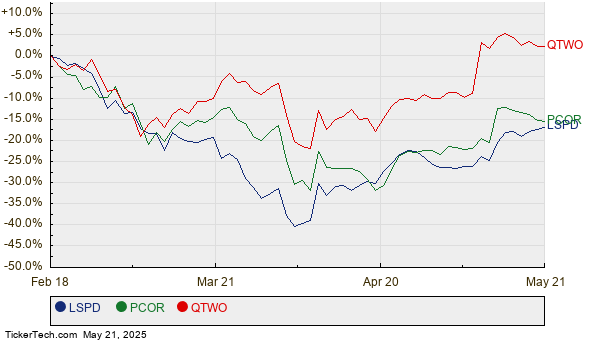

Below is a chart illustrating the twelve-month price performance of LSPD, PCOR, and QTWO:

Additionally, here’s a summary table of current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Expanded Tech-Software Sector ETF | IGV | $104.69 | $114.99 | 9.84% |

| Lightspeed Commerce Inc | LSPD | $10.97 | $13.06 | 19.02% |

| Procore Technologies Inc | PCOR | $69.63 | $77.89 | 11.86% |

| Q2 Holdings Inc | QTWO | $89.96 | $100.50 | 11.72% |

As analysts set these target prices, it’s important to consider whether they are justified or perhaps overly optimistic. Investors may need to evaluate recent developments within these companies and the broader industry. While high target prices can signal optimism, they may also imply potential downgrades if they reflect outdated perspectives. Investors are encouraged to conduct further research into these stocks.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of IIVI

• Funds Holding CGUS

• Funds Holding ONYX

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.