Analysts Project Significant Upside for ILCB and Key Holdings

At ETF Channel, we analyzed the core holdings of various ETFs to compare their trading prices against the average analyst 12-month forward target prices. For the iShares Morningstar U.S. Equity ETF (Symbol: ILCB), the implied analyst target price is $90.82 per unit, based on its holdings.

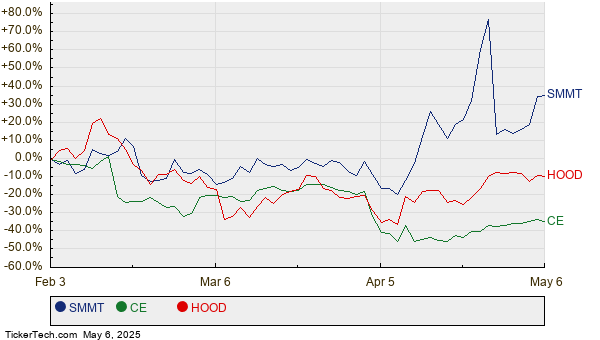

Currently, ILCB is trading at approximately $78.02 per unit, indicating that analysts anticipate a 16.41% upside, according to their projections for its underlying assets. Key holdings that show notable potential for appreciation include Summit Therapeutics Inc (Symbol: SMMT), Celanese Corp (Symbol: CE), and Robinhood Markets Inc (Symbol: HOOD). SMMT is priced at $28.02 per share, while analysts expect it to rise by 33.83%, with a target of $37.50 per share. CE, currently at $44.77, has a target price of $56.31, representing a 25.79% upside. Lastly, HOOD, with a recent price of $48.00, has a target price of $59.10, indicating a 23.14% potential increase. Below, we present a twelve-month price history chart for SMMT, CE, and HOOD:

Here’s a summary of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Morningstar U.S. Equity ETF | ILCB | $78.02 | $90.82 | 16.41% |

| Summit Therapeutics Inc | SMMT | $28.02 | $37.50 | 33.83% |

| Celanese Corp | CE | $44.77 | $56.31 | 25.79% |

| Robinhood Markets Inc | HOOD | $48.00 | $59.10 | 23.14% |

The validity of these analyst target prices is worth scrutinizing. Are they optimistic about future performance, or simply out of touch with recent developments in the companies and industries? High target prices compared to current trading values can signal optimism but may also precede downgrades if based on outdated information. Investors are encouraged to conduct further research to assess these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Next Steps:

• Cheapest Stocks Right Now

• PFNX Insider Buying

• TAC Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.