Co-authored by Treading Softly.

As 2024 unfolds, markets brace themselves for the impacts of a possible recession and the U.S. election. History provides context, with election years typically bringing positive returns, regardless of the outcome. These economic events hold significant weight, with interest rates affecting various portfolios. Lower interest rates, for instance, could be a boon for startup growth companies. Despite such crucial factors, the U.S. economy remains a place for strong exposure, driven by innovation, perseverance, and patriotism.

Thus, investment in the debt that sustains the entire U.S. economy is desirable. This brings us to the spotlight on a fund that allows broad exposure to debt across the U.S. economy.

Let’s delve into the details!

A Lasting Payoff in the CLO Equity Market

Oxford Lane Capital Corporation (NASDAQ:OXLC), offering an 18.7% yield, is a closed-end fund, investing in CLO (Collateralized Loan Obligation) equity positions. CLOs are investment vehicles that buy leveraged loans, securitize them, and offer premium benefits for being first in line to get paid. The “equity” tranche, where OXLC invests, bears the risk of borrowers defaulting while enjoying the potential for the greatest reward.

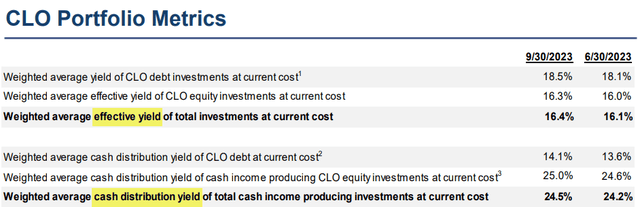

OXLC is reaping an extraordinary yield from its investments.

The “effective” yield of 16.4% projects future defaults, while the “cash distribution” yield annualizes the actual cash OXLC received from its investments last quarter. Notably, both yields are based on OXLC’s current cost, not the market value.

It’s worth noting that OXLC regularly receives payments considered as a return of capital. Concerns have been expressed about some of OXLC’s investments having a fair value near zero. With the accounting complexities surrounding CLO equity positions, the real performance comes to light in OXLC’s annual report.

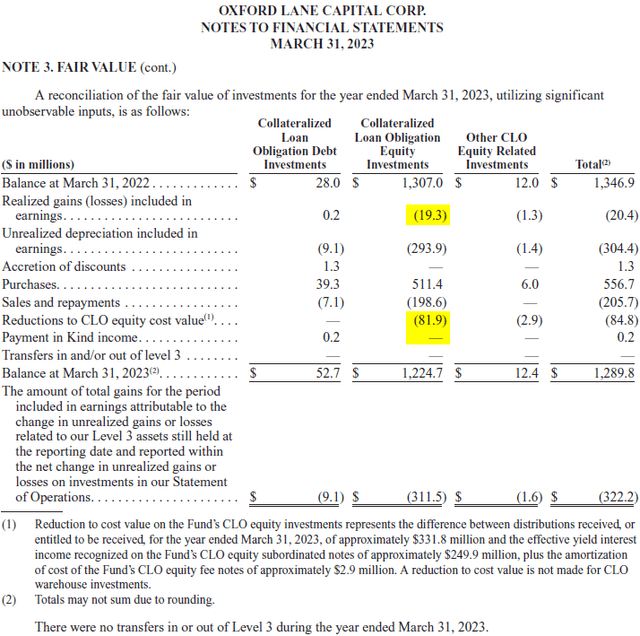

OXLC’s asset value in CLO equity declined from $1.3 billion in March 2022 to $1.2 billion in March 2023, despite investing/reinvesting $511 million in capital. Realized losses totaled $19.3 million, a minimal impact relative to the $1.3 billion asset value.

“Unrealized depreciation in earnings” reflects changes in market value and accounted for a $293.9 million decline in asset value for OXLC last year – the largest impact. “Sales and repayments” amounted to $198.6 million in 2023.

Furthermore, “Reductions to CLO equity cost value” play a dynamic role in accounting for cash in excess of the effective yield. This is done by treating the excess cash as “return of capital” and reducing the cost basis of the investment. The largest detriment to OXLC’s NAV is unrealized depreciation, with realized losses being minimal.

It’s evident that OXLC’s performance is a mix of the complex dynamics within the CLO equity market and the broader economy. Despite market fluctuations, its strategic positioning in the high-yielding CLO equity space has been a source of strong investor interest.

OXLC: A Roadmap of Fiscal Wellness

Quarter-to-quarter, we can track OXLC’s performance in their quarterly presentation for the first half of their 2024 fiscal year as documented in Source.

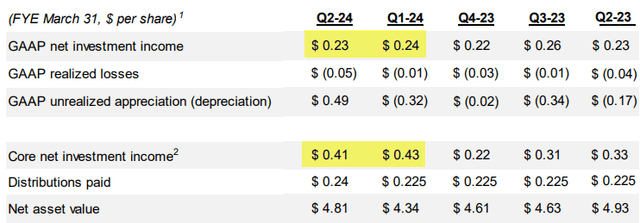

OXLC’s “GAAP Net Investment Income,” derived from the effective yield, has totaled $0.47 for the past two quarters – a continued coverage of OXLC’s distribution. Core net investment income, factoring in an adjustment for the actual cash received, has marked $0.84/share for the two quarters. This surplus will be accounted for as a reduction in cost.

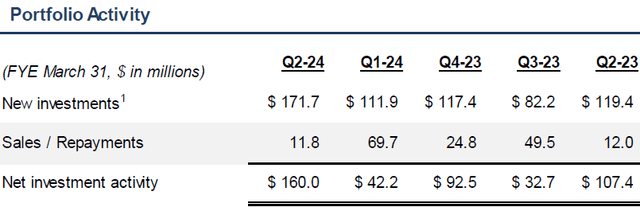

The numbers suggest that OXLC’s actual cash flow significantly surpasses GAAP predictions. Yet, OXLC has chosen to not distribute the excess cash. The question arises – what is OXLC doing with that cash? The answer: reinvesting it.

Realized losses stand at approximately the same level as last year at $0.06/share.

A notable development is the unrealized appreciation in Q2 offsetting all the unrealized depreciation in Q1, as well as offsetting a portion of the unrealized depreciation from last year. Loan prices have shown improvement, and with the Federal Reserve’s softened stance and contemplation of a pivot, loan prices have exhibited considerable strength this quarter as well.

When investors witness a high yield, they naturally ponder if the yield is “covered” by cash flow. They fret over their principal being “eroded” as a result of the company overpaying on distribution. Although a legitimate concern, it is essential for investors to be cognizant of such a possibility.

Asset prices are subject to change, and these fluctuations may not always signify actual losses. Determining the origin of cash flow supporting a dividend often requires some diligent analysis. Delving into OXLC’s financials, it becomes clear that last year, OXLC generated a surplus in cash flow, far surpassing what was necessary to cover its dividend. The decline in OXLC’s Net Asset Value (NAV) last year was primarily propelled by unrealized losses stemming from the mark-to-market change in the value of its portfolio. OXLC had an abundance of cash flow and chose to reinvest a substantial portion of it – a pattern it has continued to follow this year.

OXLC is disbursing an exceptionally high yield while retaining significant capital for reinvestment. This confluence presents a compelling opportunity for investors willing to weather the inherent price volatility of collateralized loan obligations (CLOs).

A Testament to Resilience

The overarching concern with any form of debt investment or credit product pertains to the default rate. A CLO structure is engineered to withstand a certain level of defaults while upholding a positive return. Given that OXLC is invested in the lowest tranche of a CLO, its exposure to default rates is heightened.

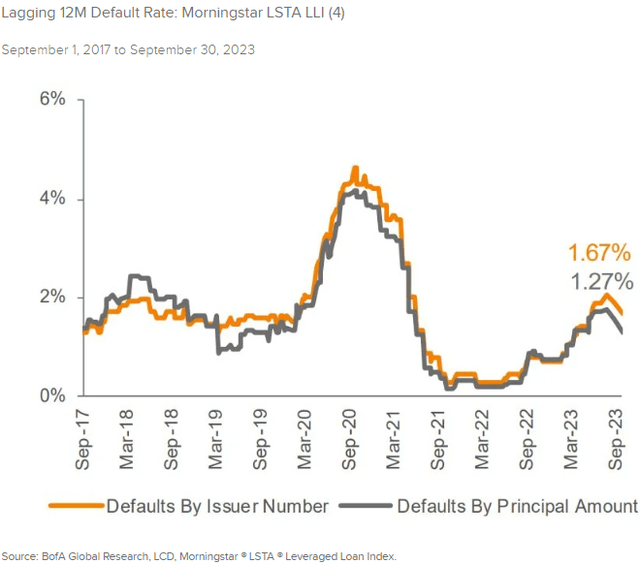

Before one delves into projected default rates for 2024, it is worth noting that both SP Global and Fitch overestimated the default rates for 2023. For instance, Fitch foresaw a default rate in the 3-3.5% range in December 2023, after initially predicting upwards of 4.5% in May 2023. The actual default rate barely breached 2% over the past 12 months.

Relying on doomsday predictions is akin to standing on shaky ground. Time and again, such prognostications have failed to accurately predict default rates for the very markets they are meant to oversee. The robustness of the U.S. economy serves as a poignant reminder. Frequently underestimated, the United States continually defies skeptics by producing robust economic returns and weathering unpredictable challenges. It is prudent to bet on the U.S. rather than against it. In my retirement portfolio, a sturdy income from the market is paramount, and one of the most reliable sources is the U.S. economy – a place where the American Dream thrives and endures.

That’s the essence of the Income Method. That’s the essence of income investing.