Mid-Cap Value ETF Shows Potential According to Analyst Targets

Analysts are optimistic about the iShares Morningstar Mid-Cap Value ETF (Symbol: IMCV), predicting a significant upside based on forecasts for its underlying stocks.

Recent analysis from ETF Channel reveals that the implied analyst target price for IMCV is $86.59 per unit. Currently, the ETF is trading at approximately $79.01 per unit, suggesting a potential upside of 9.59% when considering the average analyst targets for the underlying holdings.

Several underlying stocks within IMCV are contributing to this positive outlook. Equitable Holdings Inc (Symbol: EQH), for instance, has a recent trading price of $47.25/share, but analysts predict a target increase of 12.74% to $53.27/share. SS&C Technologies Holdings Inc (Symbol: SSNC) also shows promise, with a current price of $76.12 and a target price of $83.72/share, indicating a possible upside of 9.99%. Baker Hughes Company (Symbol: BKR) rounds out the list, trading at $41.31 with an expected target of $45.27/share, marking a 9.59% increase.

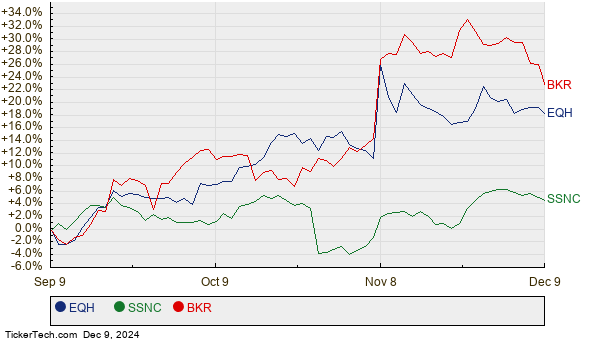

Below is a twelve-month price history chart of EQH, SSNC, and BKR:

For a clearer view, here is a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Morningstar Mid-Cap Value ETF | IMCV | $79.01 | $86.59 | 9.59% |

| Equitable Holdings Inc | EQH | $47.25 | $53.27 | 12.74% |

| SS&C Technologies Holdings Inc | SSNC | $76.12 | $83.72 | 9.99% |

| Baker Hughes Company | BKR | $41.31 | $45.27 | 9.59% |

The key question remains: Are analysts’ targets reasonable or overly optimistic? It’s vital for investors to consider whether the expectations reflect current market realities or if they fail to account for recent developments. A higher target price may signal optimism, but can also lead to downgrades if those targets no longer align with market conditions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding CATF

• BPL shares outstanding history

• Top Ten Hedge Funds Holding UVT

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.