ImmuCell Corporation (ICCC) has received an upgrade to “Outperform” due to strong sales execution and gross margin recovery. The company reported record product sales of $8.1 million for Q1 2025, an 11% increase year-over-year, driven by strong demand for its First Defense product line. Gross margin improved to 42%, up from 32% a year earlier, with adjusted EBITDA rising to $2.3 million, compared to $0.46 million in the previous year.

Key Data

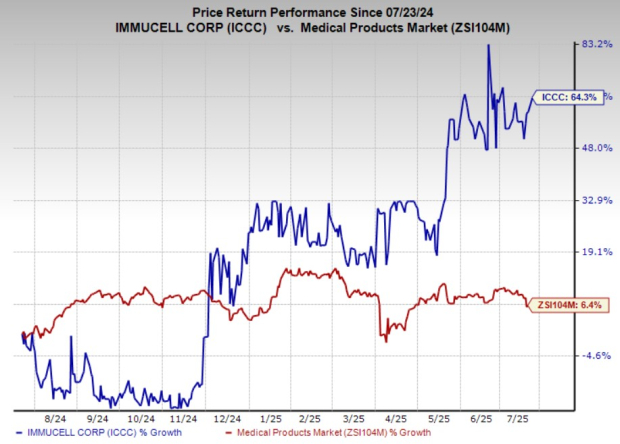

ImmuCell’s stock surged 64.3% over the past year, significantly outperforming the industry average of 6.4%. The Tri-Shield formulation constituted approximately 71% of the product mix in Q1 2025. The company has reduced its order backlog from $4.4 million at the end of 2024 to $3.4 million by May 2025, enabling better customer fulfillment.

Future Plans

Looking ahead, ImmuCell is poised to launch a bulk powder version of its First Defense product in the second half of 2025 and is awaiting FDA review for its novel treatment Re-Tain, targeting subclinical mastitis. The financial outlook is favorable, supported by $4.6 million in cash and $29 million in stockholder equity.