Constellation Energy Signs New Nuclear Power Deal with Meta

Constellation Energy (NASDAQ: CEG) has announced a deal to supply nuclear power to Meta Platforms (NASDAQ: META). This follows their previous announcement offering power to Microsoft server farms. Investors responded positively, boosting Constellation shares by up to 15% in pre-market trading, although the stock is currently flat compared to yesterday’s close.

Nuclear Sector Rally

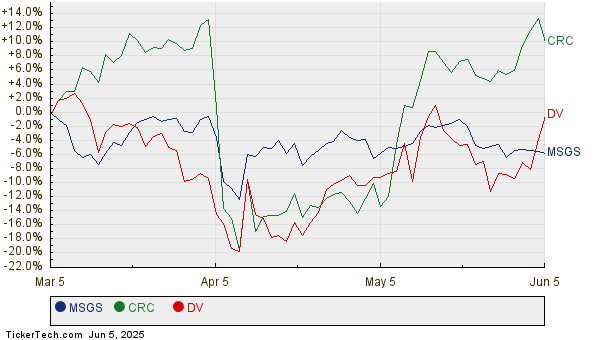

Other nuclear stocks are experiencing gains as well. Vistra (NYSE: VST) is up 4.4%, Fluor (NYSE: FLR) has increased by 5.1%, and Centrus Energy (NYSEMKT: LEU) leads with a 7.1% rise.

Details of the New Agreement

Instead of utilizing Three Mile Island, Constellation will leverage the Clinton Clean Energy Center (CCEC) in Illinois to provide Meta with 1,121 megawatts of nuclear energy starting June 2027 and lasting 20 years. This agreement coincides with a planned increase in CCEC’s output by 30 megawatts and extends the plant’s operational life to potentially the 2040s.

Additionally, Constellation may seek to develop advanced nuclear technologies or small modular reactors at the CCEC site, depending on future power demand.

Implications for the Nuclear Industry

This announcement has reinvigorated investor sentiment towards Constellation and the broader nuclear sector. The company earned $3.7 billion in its power business last year. Recent concerns arose when Microsoft scaled back data center leases, suggesting reduced demand for nuclear power. However, Meta’s commitment to the new power agreement appears to mitigate such concerns.

Investment Considerations for Nuclear Stocks

Investors are now evaluating how to respond to this positive news in the nuclear sector. Options include investing in Fluor, which constructs nuclear plants; Centrus, which provides nuclear fuel; or Vistra, a competitor to Constellation. Fluor currently trades at a low earnings multiple but faces inflated earnings due to one-time accounting gains. Vistra is on a growth trajectory and has shifted back to profitability, while Centrus, valued at $2.1 billion, shows promising growth potential.

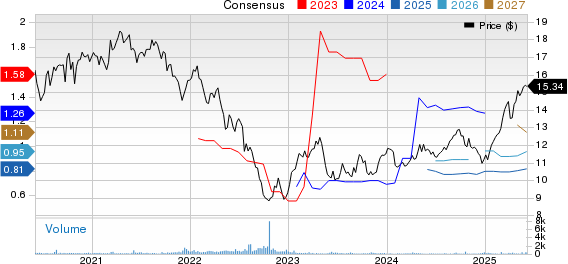

Should You Invest in Constellation Energy?

Before purchasing Constellation Energy shares, analyze the company’s long-term strategies and financial health.

Top Analyst Team Lists 10 Best Stocks for Investment

Advisor analysts have identified the 10 best stocks for investors at this time, excluding Constellation Energy. These selected stocks are anticipated to offer significant returns in the coming years.

For example, Netflix was recommended on December 17, 2004; a $1,000 investment then would now be worth $657,385*. Similarly, Nvidia made the list on April 15, 2005; a $1,000 investment would now equal $842,015!*

The Stock Advisor boasts an impressive average return of 987%, significantly outperforming the S&P 500’s 171%. Investors are encouraged to review the latest top 10 list upon joining Stock Advisor.

*Returns as of June 2, 2025

Randi Zuckerberg, former Facebook director and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board. Rich Smith holds positions in Meta Platforms. The Motley Fool has investments in and recommends Constellation Energy, Meta Platforms, and Microsoft. The Motley Fool also recommends NuScale Power and relevant options on Microsoft.

The views expressed are those of the author and do not reflect those of Nasdaq, Inc.