Retail Investors Continue Buying Amid Turbulent U.S. Markets

The introduction of new tariffs has significantly shaken confidence in U.S. stocks. Markets have corrected rapidly; economic uncertainty has spiked, consumer confidence has dropped, and inflation expectations have risen almost overnight. Some analysts worry that these developments could cause retail investors to pull back from the market. However, recent data suggests that retail investors might be engaging in bargain hunting instead.

U.S. Markets Experience Notable Sell-Off

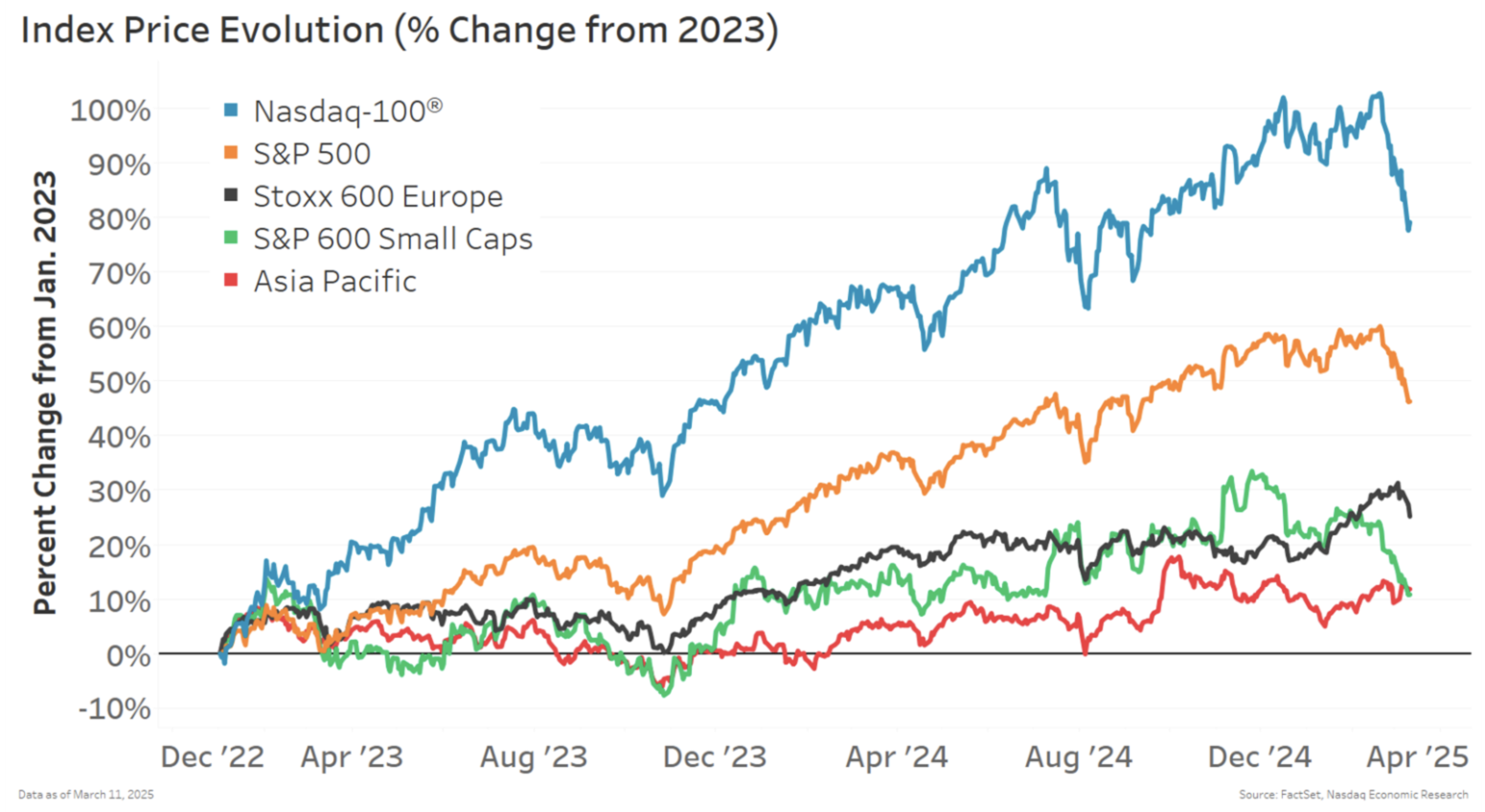

News surrounding tariffs has driven economic uncertainty measures to levels reminiscent of the Covid pandemic and the Great Recession. This surge in uncertainty has contributed to a sell-off in stocks, particularly within the U.S. market. Notably, both large- and small-cap U.S. stocks have underperformed compared to international markets.

Chart 1: U.S. stocks are underperforming other countries so far in 2025

Retail Engagement Remains Strong

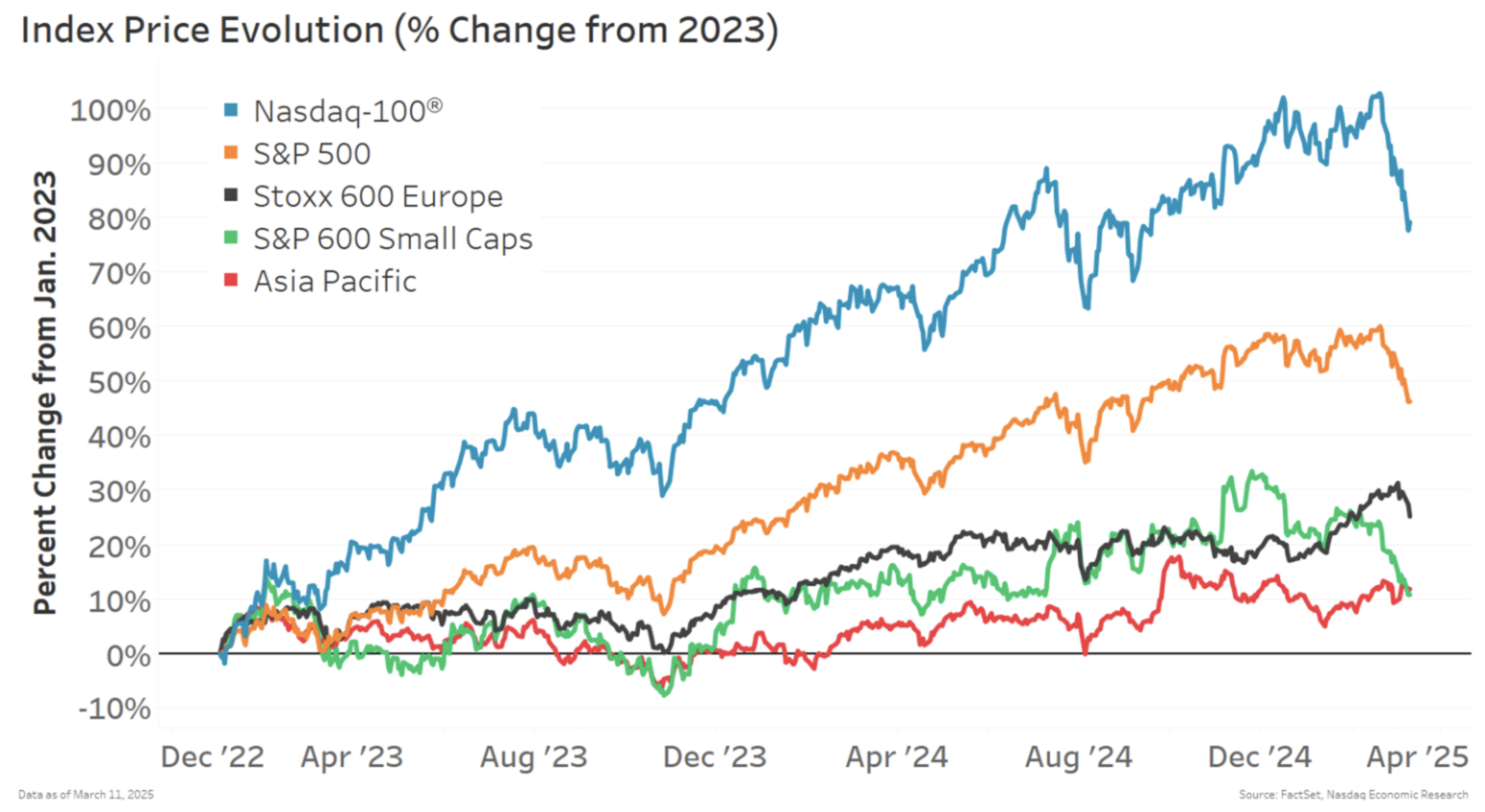

Contrary to expectations, retail trading data indicates that engagement remains robust. In fact, retail trading volume has surged nearly 49%, averaging $62 billion daily in 2025. This increase has been evident since the election, occurring well before tariff fears triggered the market sell-off and a spike in market-wide trading (blue line).

Chart 2: Retail activity picked up before the start of 2025; market-wide activity spiked more recently

Predominantly Buying Activity Among Retail Investors

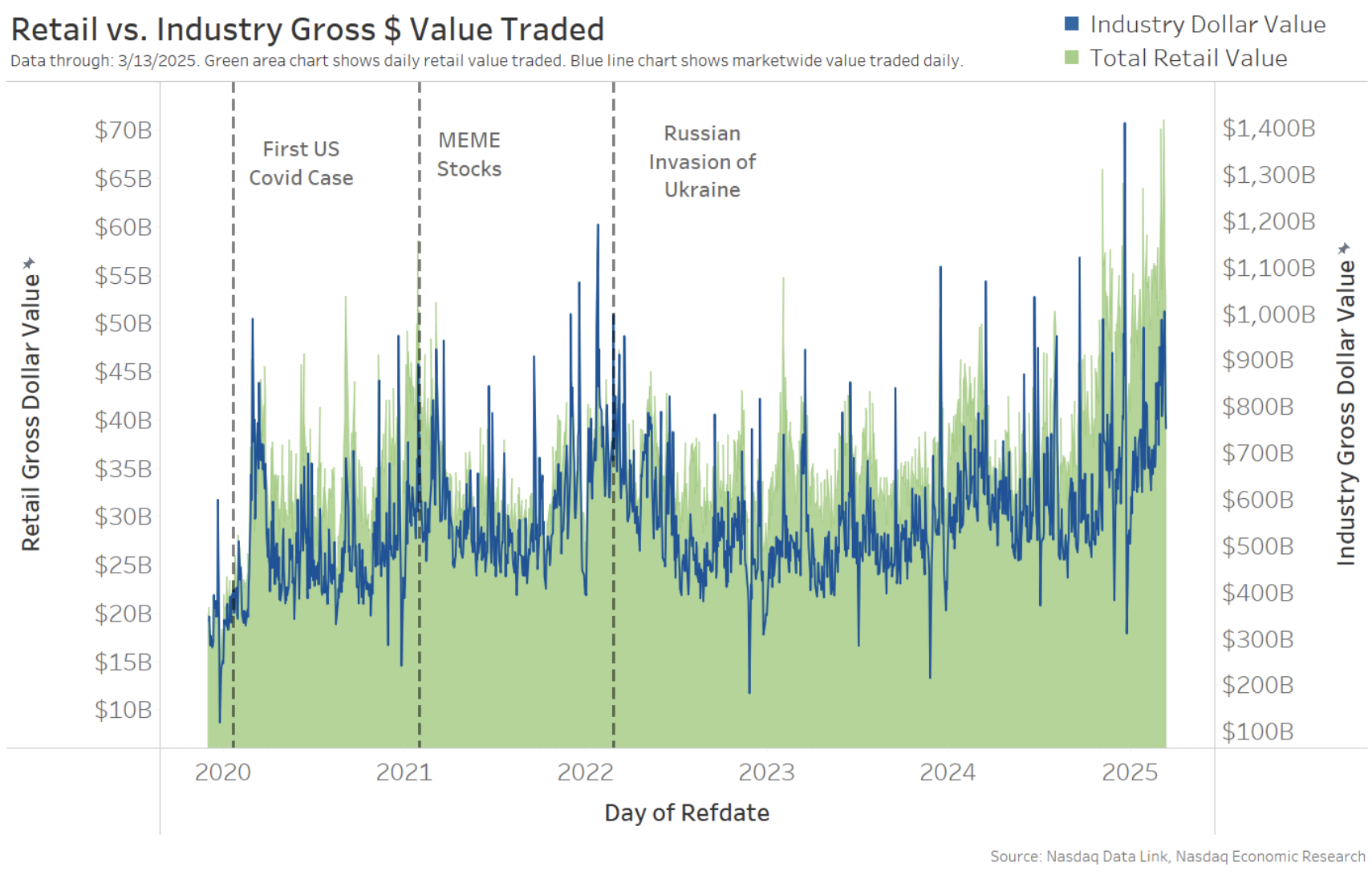

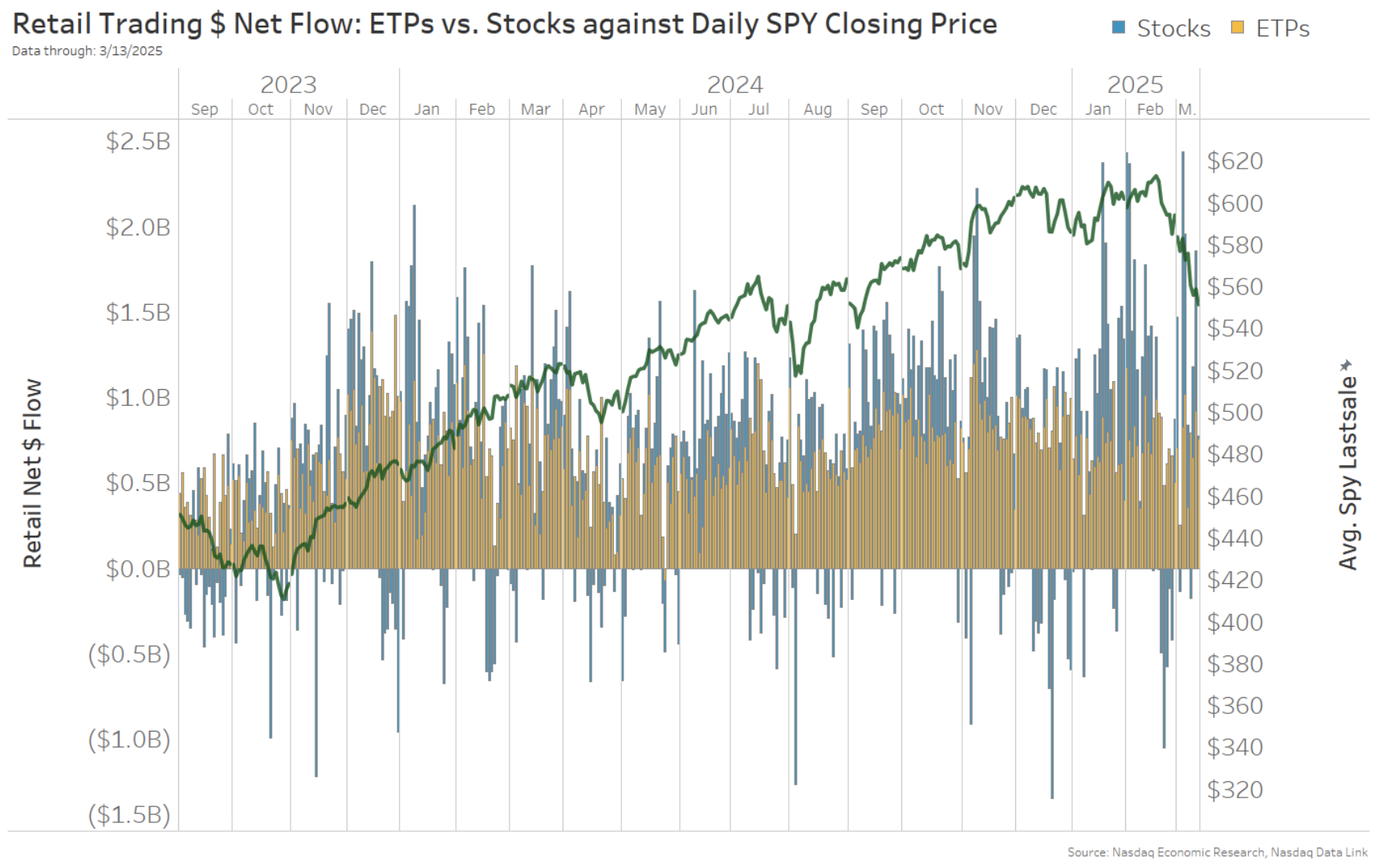

Interestingly, retail trading in individual company stocks initially leveled off to a net sell immediately after the election. However, since the beginning of 2025, notable changes have emerged in trading patterns:

- ETFs Showing Net Purchasing: The level of buying in exchange-traded funds (ETFs) remains consistent with typical trends.

- Strong Buying in Stocks: Corporate stocks have seen strong net buying on most days throughout 2025, although there was some net selling at the end of February.

Chart 3: Stocks have seen strong net buying much of 2025

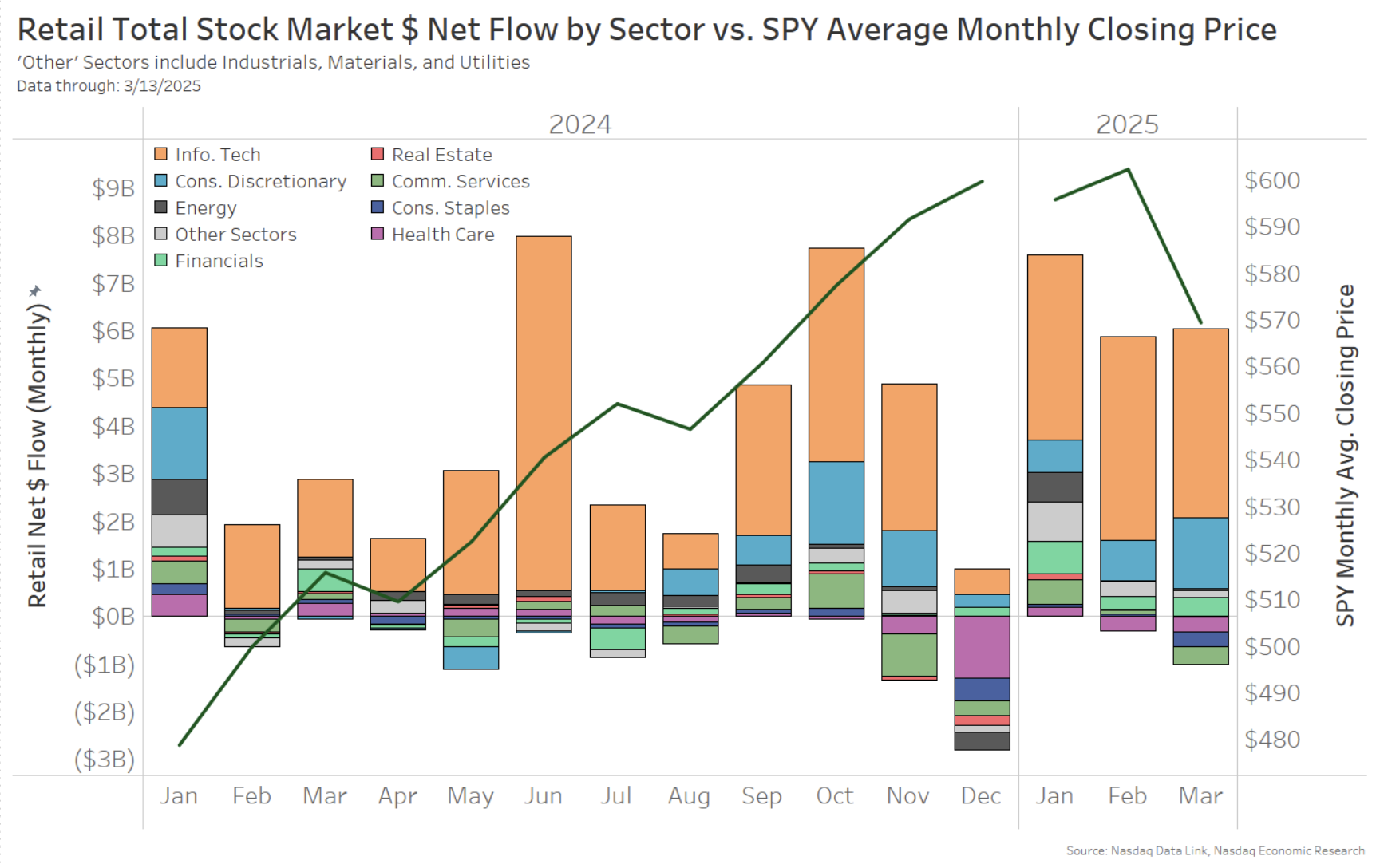

Sector-Specific Retail Buying Trends

Analyzing company stock trading by sector on a monthly basis reveals no visible downturn from the selling period in February. Instead, three months of net buying is evident, particularly in the Information Technology sector. A closer look shows that since the start of February, significant buying in Tech stocks has centered on NVDA, while more than half of the net buying in Consumer Discretionary has been focused on TSLA. However, as the year progresses, the overall breadth of buying has decreased, with net selling observed in the Communications, Healthcare, and Staples sectors throughout March.

Chart 4: Majority of buying in Technology, despite the sell-off in that sector in March

Retail Investors Actively Buying in 2025

Instead of retreating due to market volatility, retail trading activity appears to have increased. Recent trends indicate that retail investors are actively buying the dip across various stocks and sectors.