Apple Inc. (AAPL) has struck a multi-year collaboration agreement with Alphabet Inc. (GOOGL) to leverage Google’s Gemini AI models and cloud technology for its future AI initiatives, including improvements to Siri. This deal aims to enhance Apple’s AI capabilities, which previously lagged behind competitors such as Microsoft and Amazon, particularly in rapidly growing markets like Greater China.

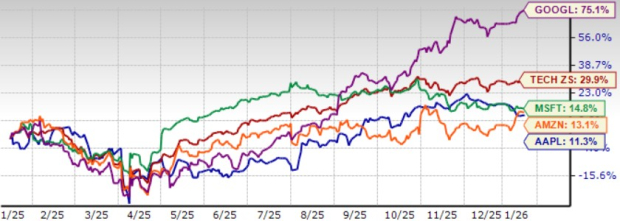

The collaboration comes as Apple faces challenges in executing its AI strategies and competing effectively in the market. Apple’s Services segment, accounting for 26% of net sales, is expected to benefit significantly from the integration of Google’s AI models, potentially increasing demand among developers. As of now, Apple shares have only risen 11.3% over the past year, compared to the tech sector’s average gain of 29.9%, highlighting an underperformance in the current competitive landscape.

Looking forward, analysts have revised Apple’s Q1 FY2026 earnings estimate to $2.65 per share, reflecting a 10.42% year-over-year increase, with projected revenues of $137.40 billion, up 10.54% from the previous year. While the partnership with Alphabet may address some of Apple’s execution issues, industry competition and a stretched valuation remain key concerns for investors.