Nvidia Stock Faces Turbulence Amid Market Adjustments

Nvidia (NASDAQ: NVDA) has been a star performer in the stock market throughout 2023 but has recently seen a downturn, mirroring declines among other growth stocks. Its prominence as a leading Stock is largely due to its pivotal role in the artificial intelligence (AI) space, as its products are essential for much of the technology’s training and inference processes.

Despite its strong fundamentals, Nvidia’s stock is now down over 30% from its all-time high, an impact attributed partly to President Donald Trump’s tariff announcement. Yet, the question arises: Is Nvidia genuinely affected by these tariffs, or is this merely a case of guilt by association?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Tariff Exemptions for Semiconductor Products

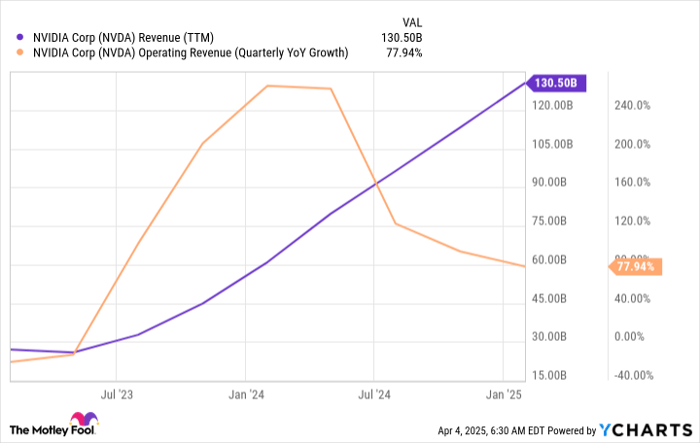

Nvidia’s graphics processing units (GPUs) have witnessed remarkable growth, driven by surging demand for AI technology. Its revenue skyrocketed from under $30 billion to $130 billion in just two years, distinguishing it as a frontrunner in the industry.

NVDA Revenue (TTM) data by YCharts. TTM = trailing 12 months.

Concerns have emerged that new tariffs could adversely impact Nvidia’s operations. Nvidia relies heavily on Taiwan Semiconductor Manufacturing (NYSE: TSM), a major chip supplier with production primarily located overseas. A recent 32% tariff on Taiwanese goods raises fears about increased costs for Nvidia’s GPU components.

However, there’s a key point to consider: Semiconductors are exempt from these tariffs. As a result, Nvidia continues to pay the same prices for its chips as it did previously, alleviating some concerns from investors about potential pricing pressures on its Stock.

Addressing Nvidia’s Customer Landscape

Nvidia’s clientele mainly consists of AI hyperscalers—large tech firms investing heavily in AI infrastructure. Many of these companies have projected record capital expenditures this year to enhance their data centers for AI processing and cloud services.

As these hyperscalers prepare to report first-quarter earnings in late April and early May, it’s anticipated that their plans remain firm. The urgency of establishing a strong foothold in the AI market makes it unlikely that they’ll pull back on spending significantly. Despite potential cost increases, these firms possess substantial cash flows and are well-positioned to absorb any price hikes.

Thus, while there might be a slight decline in data center investments, the overall impact on Nvidia appears manageable, indicating a stable outlook for the company.

Nvidia Stock Valuation: A Potential Bargain

In light of the recent market sell-off, Nvidia’s Stock is trading at attractive levels.

NVDA PE Ratio (Forward) data by YCharts; PE = price to earnings.

The stock is currently trading at 20.9 times forward earnings, close to the S&P 500’s (SNPINDEX: ^GSPC) average of 20. This valuation reflects an exceptional opportunity for one of the market’s fastest-growing firms.

Turning Nvidia’s Stock around will likely depend on positive commentary from AI hyperscalers during upcoming earnings reports. Until then, consider this a strong buying opportunity.

Seize This Moment for Potential High Returns

Are you feeling like you missed investing in some of the best-performing stocks? You might want to pay attention now.

Occasionally, our analytics team issues a “Double Down” Stock recommendation on companies poised for substantial growth. If you think you’ve missed your chance to invest, now is the ideal time to act before prices increase. The numbers tell an impressive story:

- Nvidia: if you had invested $1,000 when we recommended it in 2009, you’d have $244,570!*

- Apple: if you had invested $1,000 when we recommended it in 2008, you’d have $35,715!*

- Netflix: if you had invested $1,000 when we recommended it in 2004, you’d have $461,558!*

Currently, we are issuing “Double Down” alerts for three exceptional companies; an opportunity like this may not come again soon.

Continue »

*Stock Advisor returns as of April 5, 2025

Keithen Drury has positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.