Market Volatility: How Trump’s Tariffs Impact Apple’s Future

President Trump’s economic policies have triggered notable volatility in the stock market. On April 3, he revealed that his administration would implement expansive tariffs affecting most countries. A week later, however, he opted to pause this plan for 90 days for most countries, excluding China, where he raised the previously announced tariffs. This decision has raised concerns for companies like Apple (NASDAQ: AAPL), which relies heavily on manufacturing in China. Should investors rethink their position on the iPhone maker?

Ongoing Uncertainty for Apple

Examining the potential effect of tariffs on Apple’s business is crucial. The company generates a substantial portion of its revenue from hardware sales. In Q1 of its fiscal year 2025, ending on December 28, Apple reported total revenue of $124.3 billion, reflecting a 4% increase compared to the previous year. Hardware sales alone contributed nearly $98 billion, accounting for approximately 79% of overall revenue, with this segment seeing year-over-year growth of 1.6%.

Where to invest $1,000 right now? Our analyst team has revealed the 10 best stocks to buy currently. Learn More »

Given the extent of Apple’s manufacturing abroad, especially in China, tariffs could significantly increase the company’s operational costs. This situation forces Apple to either absorb these costs, negatively impacting margins, or pass them on to consumers, potentially stifling sales in an already slow-growth environment. At present, the administration has exempted electronic devices from the tariffs imposed on Chinese imports. Therefore, Apple’s operations remain shielded temporarily.

Nonetheless, Trump has indicated that tariffs on electronics may be introduced in the future, leaving Apple’s prospects fraught with uncertainty. Financial markets tend to react negatively to this type of unpredictability, particularly when it involves a major player like Apple.

Long-term Outlook: A Case for Caution

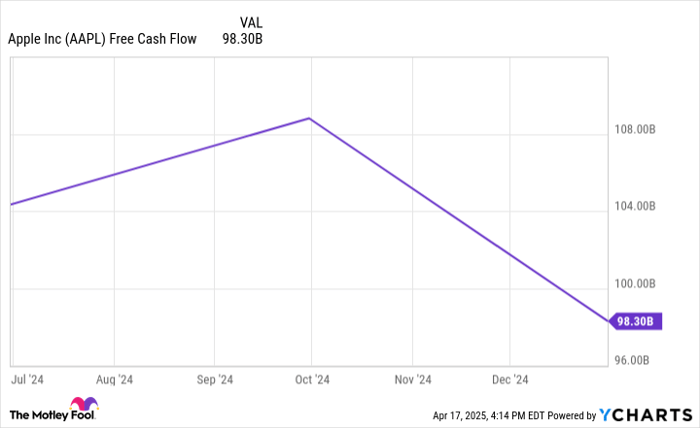

While it’s important to assess the current situation, focusing on Apple’s long-term opportunities is also essential. There is a possibility that even if Trump’s tariffs on imported goods are extensive, they might not extend beyond his administration. Furthermore, successful companies like Apple possess the resources to adapt to such challenges. Over the trailing 12 months, Apple reported a free cash flow of $98 billion.

AAPL Free Cash Flow data by YCharts

This robust capital position provides Apple with financial flexibility to pursue investment opportunities and mitigate operational headwinds. Recently, the company announced its intention to invest $500 billion in the U.S. over the next four years to enhance its manufacturing capabilities. While the specifics remain to be seen, reducing reliance on foreign manufacturing and increasing local production can help Apple navigate tariff implications effectively. Additionally, some companies, including Apple, can raise prices without significantly affecting customer loyalty.

Apple holds a prestigious brand reputation and boasts a loyal customer base. Selling tens of millions of devices annually, it doesn’t need to increase device prices drastically to counteract tariff-related costs. Even a modest price adjustment could make a substantial difference. Though it still trails behind device sales, the services segment is advancing and presents promising growth prospects.

The company now has over 1 billion paid subscriptions across an installed base of 2.35 billion devices. It is forging progress in sectors with high growth potential, like finance, video streaming, and healthcare services. Services provide Apple with higher profit margins, and as this segment continues to grow, overall profits will improve. While the immediate future may be challenging for the devices division, the company is far from jeopardy.

Although Apple may face hurdles in the short term, its strong capital position, brand equity, and the evolving services sector indicate solid long-term performance potential. Investors should consider maintaining their shares and possibly adding more during market dips.

Is Apple a Smart Investment Right Now?

Before deciding to purchase stock in Apple, consider the following:

The Motley Fool Stock Advisor analyst team has identified the 10 best stocks for investors to consider today, and Apple is not among them. The stocks that made this list have the potential for significant returns in the coming years.

Take note of Netflix’s inclusion on this list back on December 17, 2004; a $1,000 investment then would now be worth $524,747!* Or consider Nvidia, which made the list on April 15, 2005; a $1,000 investment at that time is now valued at $622,041!*

The total average return from Stock Advisor is 792%, significantly outperforming the 153% average return of the S&P 500. Don’t miss out on this month’s top 10 list when you join Stock Advisor.

*Stock Advisor returns as of April 21, 2025

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.