Investors React to Trump’s New Tariffs: Amazon Faces Challenges

On April 2, President Donald Trump unveiled a new round of tariffs, triggering significant market fluctuations that investors are now grappling with. The S&P 500 fell over 10% in the two days following the announcement, while the Dow Jones entered correction territory and the Nasdaq Composite plunged into bear market conditions. Notably, tech stocks bore the brunt of these declines.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

One technology stock significantly affected by these tariffs is Amazon (NASDAQ: AMZN). After a tough start to 2025 with a decline of over 13% in the first quarter, the recent tariffs have exacerbated the situation.

For those invested in Amazon or considering an investment, here are three critical points to understand.

1. Price Increases Expected for Amazon Sellers and Consumers

The newly implemented tariffs are likely to lead to higher prices for both Amazon sellers and consumers due to the substantial 34% tax on goods imported from China. While Amazon operates its marketplace, it does not own all the products sold within it. A significant portion of these products comes from third-party sellers, many of whom source their merchandise from China. As of the end of 2024, over 50% of Amazon’s top sellers were based in China.

Sellers faced with rising import costs may either absorb these expenses or pass them on to consumers through price increases. Given the generally low margins many sellers operate within, the latter option appears more probable. While Amazon could consider measures like freezing or reducing seller fees, such an adjustment amid high tariffs poses a serious challenge.

2. Amazon Web Services (AWS) Remains Mostly Unaffected

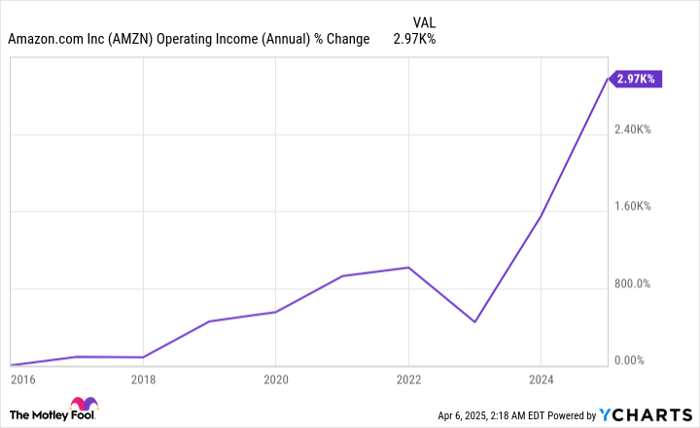

Despite the challenges facing Amazon’s e-commerce segment, its cloud platform, Amazon Web Services (AWS), remains a financial stronghold. In 2024, Amazon’s operating income was reported at $68.6 billion, with AWS contributing 58% of that figure, amounting to $39.8 billion. This division has been instrumental in driving Amazon’s growth over the past decade.

Since the new tariffs primarily target physical goods, AWS is minimally impacted, as it deals with digital services. Some costs may arise from the necessary hardware for AWS operations, such as chips and servers. However, this is likely to be a short-term issue, and Amazon could potentially absorb these costs without impacting AWS customers.

Amazon has made strides to reduce its dependence on external suppliers for hardware needs, launching two AI chips in November 2023. The new tariffs may intensify this push, although shifts in supply chains require time. Importantly, these hardware cost challenges are not unique to Amazon, as competitors like Microsoft‘s Azure and Alphabet‘s Google Cloud face similar risks.

3. Amazon’s History of Stock Price Volatility

Despite being one of the most remarkable success stories in the market, Amazon has experienced significant price fluctuations over the years. The following table outlines some of its largest stock price drops:

| Date Range | Percentage Change |

|---|---|

| Dec. 1999 to Sept. 2001 | (94%) |

| Dec. 2007 to Nov. 2008 | (60%) |

| Feb. 2020 to March 2020 | (23%) |

| Jan. 2022 to Dec. 2022 | (52%) |

| Jan. 2025 to April 2025 | (23%) |

Data sources: YCharts and Google Finance. April 2025 percentage is as of April 4.

Despite these significant declines, Amazon’s stock has surged a staggering 9,960% over the past 20 years:

AMZN data by YCharts.

While this history does not guarantee similar future returns, it underscores the importance of a long-term investment mindset. Market downturns are an expected part of investing; they shouldn’t trigger immediate selling.

Although Amazon faces short-term obstacles, it remains a leading global company. Investors are uncertain about how much further the stock may decline, but this could be an opportune moment for dollar-cost averaging and acquiring shares, especially while prices are at their lowest since August 2024.

Don’t Miss This Second Chance at a Potentially Lucrative Investment

If you’ve ever felt you missed opportunities in top-performing stocks, now could be your chance. From time to time, our expert analysts issue a strong “Double Down” Stock recommendation for companies poised for growth. If you’re concerned about having passed up the chance to invest, now might be the ideal moment to act before it’s too late. The numbers highlight our past successes:

- Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $244,570!*

- Apple: A $1,000 investment when we doubled down in 2008 would now be worth $35,715!*

- Netflix: A $1,000 investment when we doubled down in 2004 would now be worth $461,558!*

Currently, we’re offering “Double Down” alerts for three outstanding companies, providing a unique opportunity before it slips away.

Continue »

*Stock Advisor returns as of April 5, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is also a member of The Motley Fool’s board. Stefon Walters holds positions in Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.