The Energy Sector’s Roller Coaster under Trump: What Lies Ahead?

When Donald Trump defeated Hillary Clinton in the 2016 presidential race, investors in commodities celebrated.

Shares of the S&P 500 climbed 1% the day after the election, fueled by a 1.9% uptick in energy stocks and a 2.3% rise in basic materials, according to iShares sector indices.

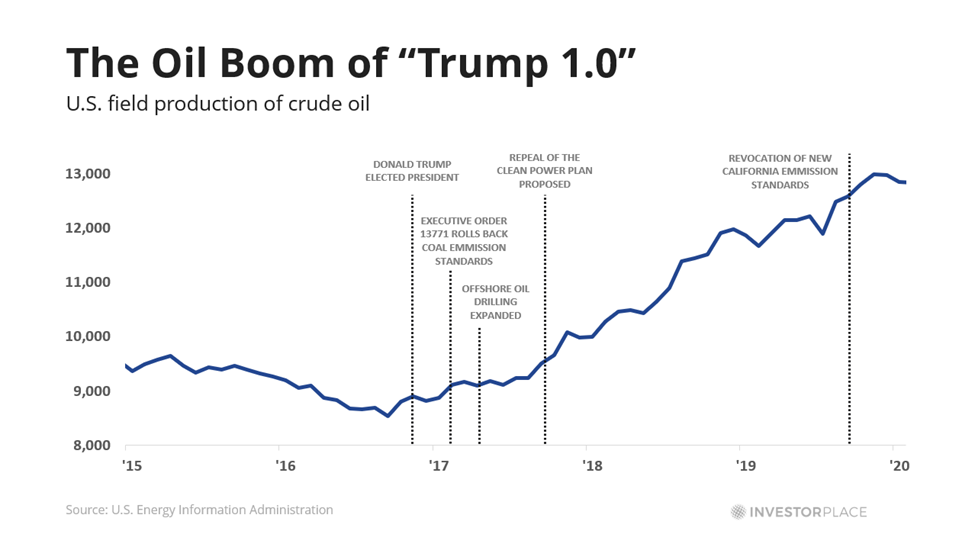

The energy stocks jumped partly because of Trump’s pro-energy policies.

Trump proclaimed during his campaign in Pittsburgh, “The shale energy revolution will unleash massive wealth for America. And we will end the war on coal and the war on miners.”

Market players believed in Trump’s promises.

Within a month of his election, the president-elect observed an 8.6% increase in the iShares U.S. Energy ETF (IYE). Investors anticipated an increase in fossil fuel production.

However, the reality for energy investors turned out to be bleak.

In the two years following Trump’s inauguration in 2017, shares of energy companies fell by 17.3%. The decline continued throughout his presidency.

Let’s examine how energy stocks performed during Trump’s first term, consider the potential effects of a “Trump 2.0” presidency on the sector, and identify effective strategies for investors.

Inexpensive Gas, High Costs

After a challenging 2019 for the energy sector, the U.S. Energy Information Agency (EIA) revealed that…

Increases in U.S. petroleum production put downward pressure on crude oil prices…

Furthermore, these production increases likely mitigated the impact on prices from attacks on Saudi Arabia, production cuts from OPEC, and U.S. sanctions on Iran and Venezuela that restricted their crude oil exports.

Essentially, America’s shale revolution exacerbated an already increasing U.S. oil oversupply.

Oil production surged by 24%, causing domestic prices to drop and leading to the failure of numerous major producers. During this period, over sixty major energy firms declared bankruptcy, with the top five alone erasing $11 billion in capital.

Consumers benefited from low gas prices, but oil producers bore the brunt of the downturn.

Despite this, some energy firms managed to prosper.

Cheniere Energy Inc. (LNG) adjusted its focus towards liquefying and exporting the large quantities of affordable gas available, experiencing a 50% share price increase by 2019. Meanwhile, petroleum refining firm CVR Energy Inc. (CVI) enjoyed an impressive 69% rise. Other refiners, such as Valero Energy Corp. (VLO), Marathon Petroleum Corp. (MPC), and ConocoPhillips (COP), all recorded double-digit gains.

These companies thrived because their earnings depend on the volume of hydrocarbons processed, rather than on prices. The cheaper USA’s oil and gas became, the more profit these “downstream” firms generated each quarter.

Pipeline companies profited by charging consistent fees, similar to toll roads, regardless of the market price of gas. Refiners benefited from cheaper raw materials, while exporters thrived as demand for America’s low-cost fuels surged globally.

Conversely, upstream energy companies saw the value of their reserves diminish with each drop in energy prices.

A parallel situation may unfold if Trump secures a second term.

What a Second Term Could Mean

In the aftermath of Trump’s 2024 electoral victory, shares of the S&P 500 increased by 2.5%, and energy stocks rose 3.5%. As in 2016, investors now anticipate reductions in “green” regulations and other Biden administration restrictions on energy production.

However, many are overlooking American upstream oil and gas producers at this point.

While some upstream firms have appreciated up to 20% since the election, the potential long-term winners will likely be those that remain profitable even amid declining prices.

The current landscape, however, is quite different from 2016.

A proposed 10% to 20% baseline tariff could lead to retaliatory actions, making U.S. energy exports less competitive. Additionally, renewable energy has become price-competitive with U.S.-produced coal, further diminishing the likelihood of a coal resurgence. Major oil-producing countries like Russia and Saudi Arabia are facing increased threats, making their actions unpredictable.

If conditions unfold as anticipated, investing in a diverse selection of volume-sensitive energy companies may be the most effective strategy to navigate a Trump 2.0 presidency.

An essential approach, irrespective of market trends during a Trump presidency, involves focusing on cash.

Genuine, tangible cash is vital in the current environment.

InvestorPlace analyst Louis Navellier has developed a stock grading system to pinpoint stocks poised for short-term gains, which can subsequently generate income.

For instance, an initial investment of $7,500 in previous recommendations yielded a profit of $3,375 within a month, $4,650 in three months, $11,925 in five months, and $16,875 after eleven months.

His Quantum Cash Project aims to identify income opportunities regardless of economic uncertainties, inflation risks, or fluctuating market conditions.

In a recent presentation, Louis outlined this income-generating strategy, projecting it will reveal at least $60,000 in potential income opportunities over the coming year.

The system requires no special expertise, involves no risky leverage, and can produce income for anyone, whether currently employed or retired.

For more insights into this proven strategy and how it operates, click here to watch Louis’s special presentation.

Regards,

Thomas Yeung

Markets Analyst, InvestorPlace