Peering into the inner workings of the ETF world often unveils hidden gems and untapped opportunities. The First Trust Health Care AlphaDEX Fund ETF (FXH) has recently come into focus, with analysts projecting an enticing future. The implied analyst target price for FXH stands at a tantalizing $122 per unit, hinting at a prosperous journey ahead for investors.

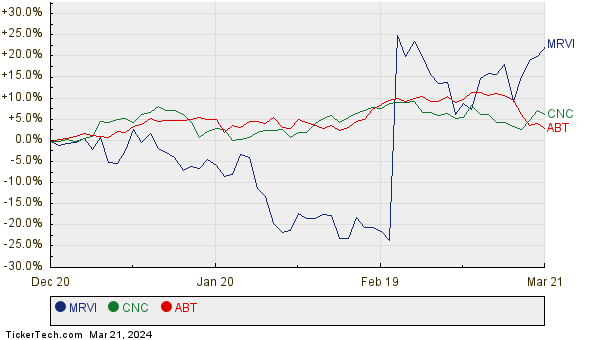

At its current trading price of $108.08 per unit, FXH holds a promising 12.98% upside potential, as per analysts scrutinizing the 12-month forward target prices of its underlying holdings. Among these standout performers are Maravai LifeSciences Holdings Inc (MRVI), Centene Corp (CNC), and Abbott Laboratories (ABT).

Analyst Targets Paint a Rosy Picture

In the case of MRVI, despite trading at $8.19 per share, the average analyst target of $9.55 per share signals a robust 16.67% upside potential. Similarly, CNC boasts a 15.22% upside with an average analyst target price of $89.73 per share, compared to its recent trading price of $77.88. Meanwhile, analysts are eyeing an ambitious target price of $126.73 per share for ABT, representing a promising 13.66% increase from its recent price of $111.50.

Analysts play a crucial role in shaping market sentiments and guiding investor decisions. Their projections not only shed light on the potential growth trajectories of stocks but also offer a glimpse into the future performance of ETFs like FXH.

Indicators of Progress: Historical Price Performance

Delving deeper into the historical performance of MRVI, CNC, and ABT, a twelve-month price history chart reveals fluctuations and trends that have influenced market sentiments and analyst forecasts. This data provides valuable insights into the journey of these companies and their potential for future growth.

Unveiling Potential: Summary of Analyst Targets

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Health Care AlphaDEX Fund ETF | FXH | $108.08 | $122.11 | 12.98% |

| Maravai LifeSciences Holdings Inc | MRVI | $8.19 | $9.55 | 16.67% |

| Centene Corp | CNC | $77.88 | $89.73 | 15.22% |

| Abbott Laboratories | ABT | $111.50 | $126.73 | 13.66% |

As investors ponder on the projected targets set by analysts, questions arise regarding the validity of these estimations. Are the targets grounded in reality, or do they project an overly optimistic scenario for these stocks in the coming year? It’s essential for investors to conduct thorough research and stay informed about recent developments in the respective companies and industries. A high price target may signify optimism, but it could also signal potential revisions if market conditions evolve.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

PFD Dividend History

KOL shares outstanding history

Top Ten Hedge Funds Holding BCC

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.