Analyst Insights

Delving into the underlying holdings of various ETFs within our network at ETF Channel unveils intriguing insights. The iShares U.S. Real Estate ETF (Symbol: IYR) stands out with an implied analyst target price of $95.78 per unit, signaling a significant potential gain based on current market trends.

Exploring Opportunities

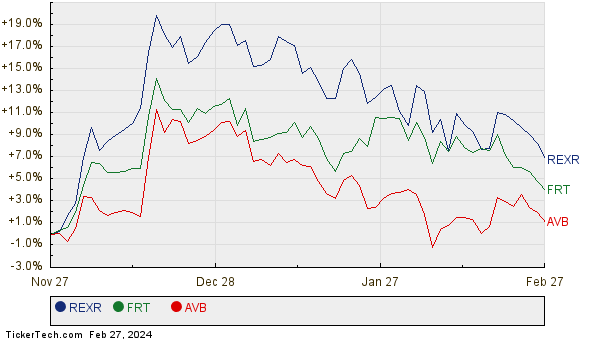

Trading near $86.78 per unit, IYR appears primed for a promising upswing as analysts foresee a 10.37% potential upside rooted in the average analyst targets of its underlying holdings. Noteworthy among these are Rexford Industrial Realty Inc (Symbol: REXR), Federal Realty Investment Trust (Symbol: FRT), and AvalonBay Communities, Inc. (Symbol: AVB). While REXR, at $51.04/share, boasts a 16.65% upside as per the average analyst target of $59.54/share, FRT and AVB are also poised for gains of 12.17% and 11.25%, respectively, if they reach their analyst target prices.

Key Data Points

For a concise overview, the table below highlights the current analyst target prices for the discussed holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Real Estate ETF | IYR | $86.78 | $95.78 | 10.37% |

| Rexford Industrial Realty Inc | REXR | $51.04 | $59.54 | 16.65% |

| Federal Realty Investment Trust | FRT | $97.40 | $109.25 | 12.17% |

| AvalonBay Communities, Inc. | AVB | $173.62 | $193.15 | 11.25% |

Evaluating Projections

Do the anticipated target prices align with realistic market projections, or are analysts veering towards over-optimism? Evaluating these projections against recent market trends and industry dynamics is essential. While high target prices can signify optimism for the future, they may also hint at potential downgrades if not aligned with current market realities. Investors are encouraged to conduct thorough research to make informed decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

CMS Energy 13F Filers

ABNB MACD

IOT Split History

The insights presented are a reflection of the author’s views and opinions and may not necessarily mirror those of Nasdaq, Inc.