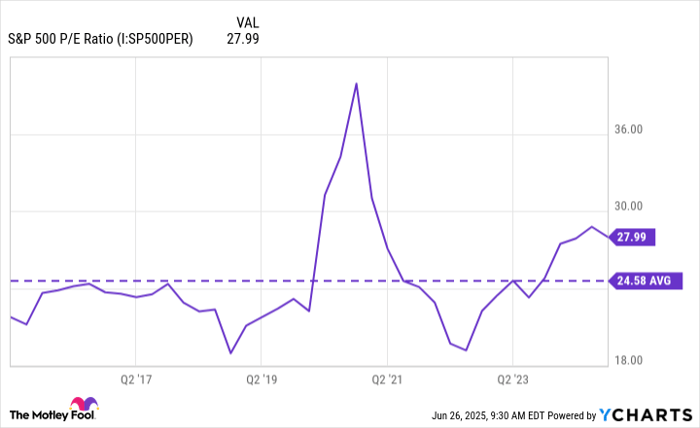

Stocks are currently viewed as overvalued, with the S&P 500’s price-to-earnings (P/E) ratio at 28, exceeding its 10-year average of 25. This valuation trend coincides with a projected increase in initial public offerings (IPOs) for 2025, following below-average years in 2022, 2023, and 2024.

As of now, Roku (NASDAQ: ROKU) is down about 15% since 2020 despite the S&P 500’s rise during the same period. The company’s recent partnership with Amazon signals potential growth in advertising revenue, leveraging data for targeted marketing. This partnership is set to launch officially by the end of 2026.

Roku’s partnerships aim to enhance advertising capabilities, but the company has struggled to convert viewership into revenue, reporting lower average revenue per user in 2024 compared to 2022. The effectiveness of the Amazon partnership will determine Roku’s future viability as an investment.