Immunovant Reports Q4 Loss, Cash Reserves Increase to $714M

Fourth-Quarter Results Overview

Immunovant, Inc. (IMVT) reported a fourth-quarter fiscal 2025 net loss of 64 cents per share, better than the Zacks Consensus Estimate of a 72-cent loss. However, this loss widened from 52 cents per share in the same quarter last year.

The company currently lacks any approved products, resulting in no revenue generation.

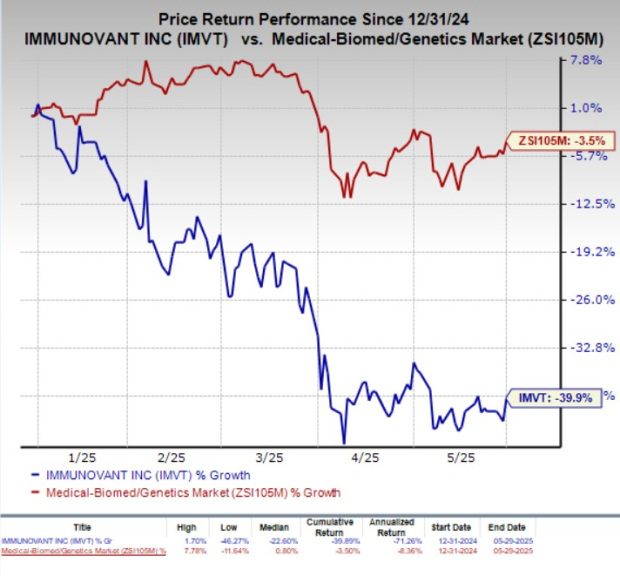

Following the earnings announcement, IMVT stock rose by 5.6%. Year-to-date, shares have fallen 39.9%, in contrast to a 3.5% decline in the industry.

Detailed Financials for Q4

Research and development expenses were $93.7 million, a 42% year-over-year increase, driven by clinical study costs for IMVT-1402 and personnel expenses.

General and administrative expenses hit $20.2 million, up 36% from the prior year, primarily due to increased personnel costs and professional fees.

As of March 31, 2025, Immunovant reported cash reserves of $714 million, significantly higher than $374.7 million on December 31, 2024. The company believes this funding will support operations through 2027.

Fiscal 2025 Performance

For the fiscal year 2025, Immunovant posted a loss of $2.73 per share, matching the Zacks Consensus Estimate, compared to a loss of $1.88 per share in the previous year.

Pipeline Developments

Immunovant is prioritizing IMVT-1402 as its lead drug candidate, targeting multiple indications. The company plans to initiate clinical studies for 10 indications by March 31, 2026.

Currently, six indications for IMVT-1402 include: Graves’ disease, difficult-to-treat rheumatoid arthritis, myasthenia gravis, chronic inflammatory demyelinating polyneuropathy, Sjögren’s disease, and cutaneous lupus erythematosus.

Patient enrollment has begun for potentially registrational studies of IMVT-1402 in both myasthenia gravis and chronic inflammatory demyelinating polyneuropathy.

An initial registrational study of IMVT-1402 in adult patients with hyperthyroid Graves’ disease has also commenced, with a second study anticipated to start in summer 2025.

In March, the company initiated a study of IMVT-1402 in patients with difficult-to-treat rheumatoid arthritis, with plans for an early-stage study for cutaneous lupus erythematosus also under review.

A study for Sjögren’s disease is expected to commence in summer 2025.

Immunovant continues to evaluate batoclimab in mid to late-stage studies for Graves’ disease and thyroid eye disease. Results from batoclimab’s six-month treatment-free remission for Graves’ disease are scheduled for summer 2025.

Top-line data from the late-stage thyroid eye disease study is expected in the second half of 2025, which will inform regulatory decisions.

Market Position and Comparisons

Immunovant has a Zacks Rank of #3 (Hold). In the biotech sector, Bayer, Lexicon Pharmaceuticals, and Amarin hold better ranks at #2 (Buy).

Over the past 60 days, Bayer’s earnings estimates for 2025 increased from $1.19 to $1.25, while shares gained 44.7% year-to-date.

Lexicon’s loss estimates have narrowed, with a year-to-date decline of 10.7%. Amarin’s loss estimates have also improved, with shares up 20.4% year-to-date.