Micron Technology, Inc. MU is set to unveil its fourth-quarter fiscal 2024 results after the market closes on Sept. 25, poised for another impressive financial performance. The semiconductor giant’s success is attributed to the flourishing demand-supply dynamics in the memory chip market and the surge in investments in artificial intelligence (AI).

AI Investment Accelerates Micron’s Q4 Growth

In the era of rapid global expansion in the AI sector, investments have skyrocketed, propelling the need for cutting-edge technologies. The hunger for AI applications, renowned for their data-heavy operations, demands immense computational power and lightning-fast data processing. Micron’s memory and storage solutions have emerged as vital components, perfectly suited for fueling these advanced AI systems.

Micron’s DRAM and NAND flash memory, core products crucial for facilitating high-performance AI tasks, have experienced a surge in demand. Projections indicate a remarkable growth in fourth-quarter revenue for DRAM at $5.26 billion, marking a 91% year-over-year increase. Similarly, NAND revenues are expected to soar by 91.5% to $2.31 billion. This substantial growth underscores Micron’s pivotal role in the ongoing AI revolution.

Micron’s Strategic Partnerships Fuel Growth

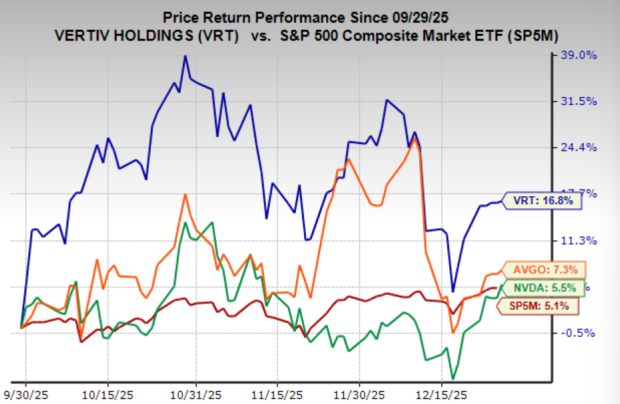

Micron’s collaborations with industry behemoths like NVIDIA Corporation and Advanced Micro Devices, Inc. have notably contributed to its success. NVIDIA and AMD, both leading innovators in AI technology, heavily rely on Micron’s memory solutions to power their latest advancements, propelling Micron’s revenue growth.

The partnership between Micron and NVIDIA took a significant stride in February 2024 with Micron commencing mass production of its groundbreaking HBM3E high-bandwidth memory for NVIDIA’s newest AI chip. On the other hand, Micron’s cutting-edge memory technologies have been instrumental in supporting AMD’s AI initiatives. This collaboration gained further momentum with AMD’s testing of Micron’s GDDR7 graphic memory samples in upcoming devices, fortifying their alliance.

In essence, the escalating AI investments in conjunction with Micron’s strategic alliances with tech giants position the company for sustained success. These factors are anticipated to have a positive impact on MU’s overall performance in the current quarter.

Micron’s Zacks Rank & Strong Performers

Presently, Micron holds a Zacks Rank #3 (Hold), while AudioEye offers a promising Zacks Rank #1 (Strong Buy) in the broader technology sector. AudioEye’s estimated long-term earnings growth rate of 25%, coupled with a significant upward revision in its 2024 earnings estimate, indicates substantial growth potential.

For investors seeking insights on potential growth stocks and upcoming earnings announcements, diligently following resources like the Zacks Earnings Calendar remains paramount.

Embark on the Infrastructure Stock Boom

A forthcoming period of revitalizing the deteriorating U.S. infrastructure is on the horizon. With bipartisan support, massive investments will drive the repair and construction of roads, bridges, transportation systems, and energy infrastructure. Investors looking to capitalize on this impending surge in the infrastructure sector can gain valuable insights from Zacks’ Special Report, designed to guide them towards potentially lucrative opportunities.

If you’re aiming to benefit from the imminent infrastructure boom and make strategic investment decisions, download the free report here.