Nvidia Emerges as a Leading AI Stock with Promising Growth

Nvidia (NASDAQ: NVDA) stands among the largest companies globally, leading the charge in AI-related stocks. The firm specializes in producing highly sought-after graphics processing units (GPUs) essential for the training and deployment of complex artificial intelligence models.

Despite a market capitalization of approximately $3 trillion, Nvidia’s shares appear surprisingly affordable based on certain financial metrics.

Nvidia’s Stronghold in the AI Market

Almost every AI application today, whether consumer-facing like ChatGPT or specialized neural networks used in select enterprises, relies on cloud computing infrastructure. Without it, developers would incur significant costs and delays to obtain their own infrastructure, making scaling up a lengthy and expensive endeavor. Cloud infrastructure allows for flexible scaling through rented servers, operational anywhere.

These servers predominantly run on specialized GPUs. Remarkably, Nvidia commands about 90% of the data center GPU market, highlighting its strategic foresight and early investments. The demand for Nvidia’s latest generation of GPUs was so high that they were sold out for a full year at one point. The company’s gross margins also exceed those of competitors such as Advanced Micro Devices and Intel, reflecting strong customer demand for its products.

Nvidia finds itself in a prime position as the AI industry continues to expand. The United Nations projects the AI market’s growth from $189 billion in 2023 to nearly $5 trillion by 2033. While some measures suggest Nvidia’s shares are highly priced, one particular metric indicates they could be undervalued.

Nvidia Shares: An Unexpected Value

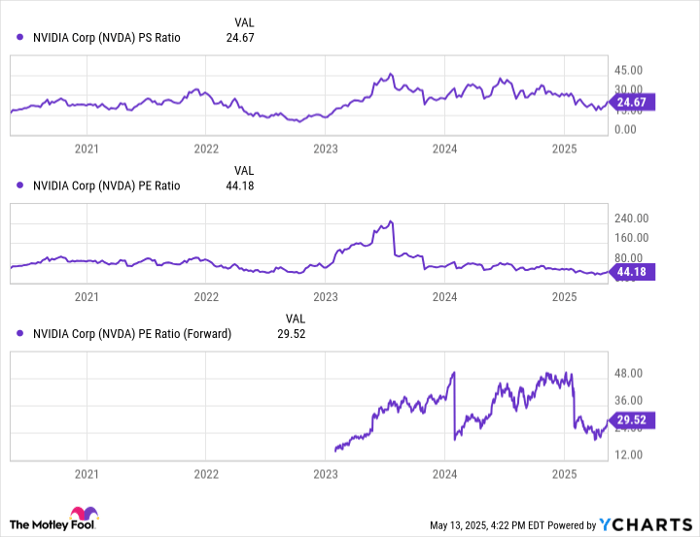

One would assume a high-quality stock with strong growth prospects would be priced at a significant premium. Although Nvidia does trade at a premium to the broader market, it’s not as steep as it might initially appear, especially when evaluating its earnings potential. The S&P 500 currently trades at approximately 28 times earnings, while Nvidia trades at around 44 times earnings. However, its anticipated earnings growth far surpasses that of the average S&P 500 company. Looking ahead, the S&P 500 is valued at 21 times forward earnings, compared to Nvidia’s just under 30 times earnings—making Nvidia’s current valuation more attractive than it seems.

NVDA PS Ratio data by YCharts

In a few years, Nvidia’s shares may trade at similar valuations to the S&P 500 based on today’s purchase price. This presents a significant opportunity for investors, suggesting that sturdy growth in the coming years could justify the current premium. The key for investors is to exercise patience and hold long enough for that growth to manifest.

Nvidia exemplifies how strategic, patient investing can yield profitable opportunities in blue-chip stocks. Given its strong market share and the high growth prospects in its underlying market, Nvidia represents an investment where patience could result in significant returns in the future.

A Second Chance for Investors

If you’ve ever felt you overlooked chances to invest in successful stocks, this could be your moment. Rarely, analysts issue a “Double Down” recommendation for stocks they believe are set for substantial growth. If you think you might’ve missed your shot, now could be the best opportunity to engage before prices rise further.

- Nvidia: investing $1,000 when we issued a double down in 2009 would yield $350,971!*

- Apple: a $1,000 investment during a double down in 2008 would now be worth $40,309!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $620,719!*

Currently, “Double Down” alerts are being issued for three noteworthy companies, and joining may provide exposure to significant investment opportunities.

*Returns as of May 12, 2025

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, and Nvidia.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.