CPI Inflation and Federal Reserve Interest Rate Outlook

The Consumer Price Index (CPI) reported a monthly increase of 0.3% and a year-over-year rise of 2.7%, both aligning with forecasts and indicating stable inflation. Core CPI, excluding food and energy, rose 0.2% monthly and 2.6% annually, also below expectations by 0.1 percentage point. These metrics suggest there is no immediate threat of runaway inflation, thereby allowing the Federal Reserve to maintain its current interest rate policy, with a 97.2% probability of no change during the January Federal Open Market Committee (FOMC) meeting on January 28.

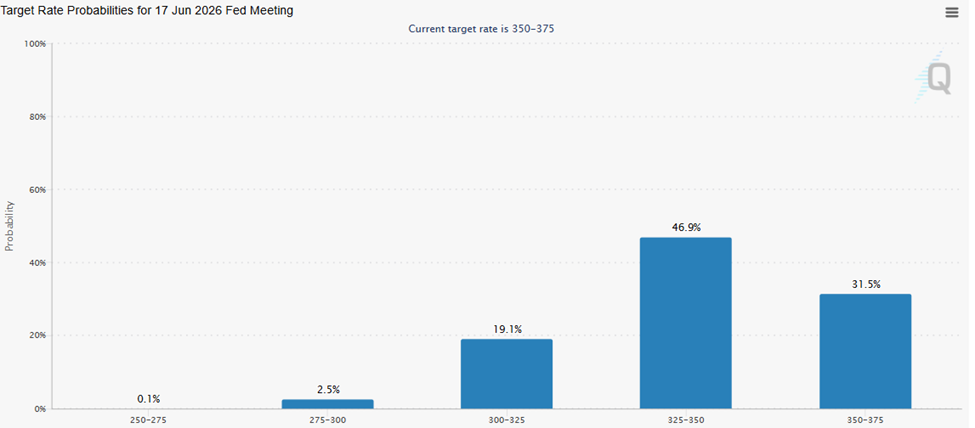

Market predictions indicate that the first potential rate cut by the Fed could occur in June 2026, with the odds for a 25-basis-point cut sitting at 47%. The looming decision on the next Fed Chair adds uncertainty, particularly as the nomination process involves balancing political affiliations with the credibility of the Fed’s independence.

Additionally, caution is advised as the CAPE Ratio for the U.S. stock market ended 2026 at 40, historically correlated with negative real returns over the next decade. Investors are encouraged to adopt a selective investment strategy as the combination of stable inflation and elevated market valuations creates a challenging environment moving forward.