Recent economic data unveils a slight surge in inflation rates, demonstrating the enduring nature of inflation. Investors must be mindful of inflation and strategically position their portfolios to weather the storm.

So, which companies can not just weather inflation but thrive in its midst? Look no further than Visa (NYSE: V) and Mastercard (NYSE: MA). These industry giants in the payment network arena have what it takes to shield your portfolio from the ravages of inflation.

Let’s delve into how these market titans can manage this below.

The Resilience of Visa and Mastercard Against Inflation

First, it’s crucial to grasp the essence of inflation and its detrimental effects. Inflation denotes the uptick in prices, primarily stemming from two sources. Demand-pull inflation occurs when demand exceeds supply, resulting in price hikes. Conversely, cost-push inflation arises when production costs escalate, leading producers to raise prices to offset the surge in expenses. While inflation is commonplace, excessive inflation can jeopardize consumers, particularly when it surpasses wage growth, eroding their purchasing power and standard of living.

Visa and Mastercard operate as conduits that facilitate information flow between merchants and banks during payment card transactions. Analogous to toll booths, Visa and Mastercard levy a small fee, a percentage of each transaction passing through their networks.

With price hikes, these fees also escalate since they are proportionate to the transaction value. Therefore, Visa and Mastercard are perceived as potentially impervious to inflation.

Dual-Pronged Ascendancy

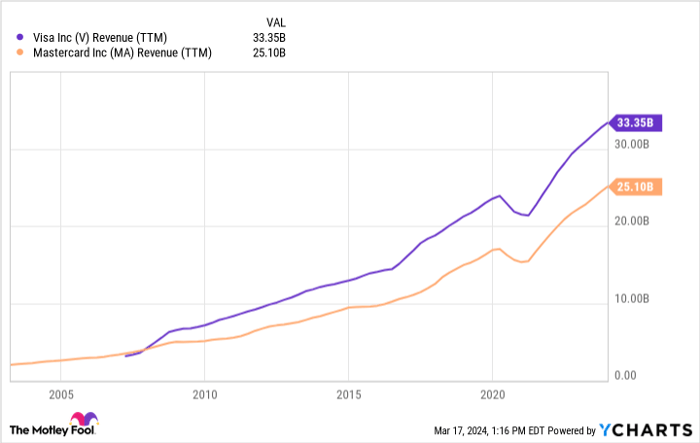

Visa and Mastercard’s remarkable growth trajectory has been intermittently stymied only by crises curbing consumer expenditure. The chart below vividly illustrates the downturn during the economic standstill induced by COVID-19 lockdowns.

V Revenue (TTM) data by YCharts

Over the long haul, Visa and Mastercard stand to benefit from sustained, inflation-driven revenue growth, coupled with a broader transition away from cash as a mode of payment. Visa’s transaction count has nearly quadrupled from 58 billion in 2013 to 212 billion in 2023, while Mastercard has exhibited even superior growth, surging from 18 billion to 171 billion.

The global digital payment market is anticipated to expand by 15% annually, reaching over $24 trillion by 2030. It is conceivable that Visa and Mastercard could sustain revenue growth at nearly double-digit rates for the foreseeable future.

Are These Stocks Still Empowering Your Portfolio?

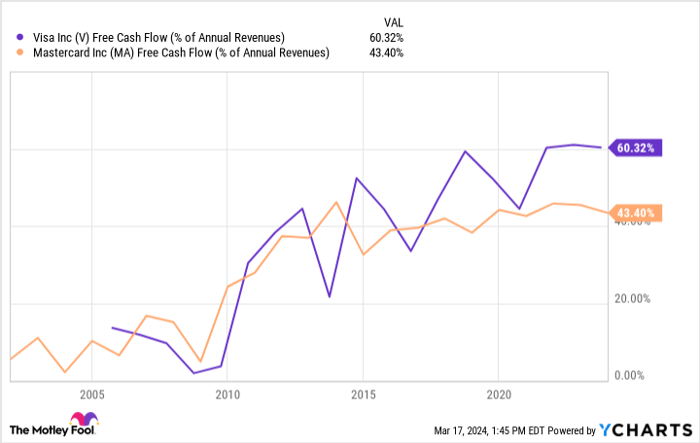

Both Visa and Mastercard are primed to yield commendable long-term investment returns provided they sustain revenue growth. The rationale is twofold. Besides double-digit revenue growth serving as a solid foundational return pillar, Visa and Mastercard boast exceptional profitability, accruing substantial cash flow from their revenues.

V Free Cash Flow (% of Annual Revenues) data by YCharts

While both companies dispense dividends, the bulk of cash flow is channeled into share buybacks, further amplifying earnings growth. Retiring shares translates to enhanced profit per share. Over the preceding decade, Visa’s share count dwindled by over 18%, and Mastercard’s by over 20%. This trend is foreseeable to continue.

Presently, these market outperformers trade at rational valuations. Both entities sport comparable price-to-earnings-to-growth (PEG) ratios at around 2. While not exactly bargain deals (as I typically favor PEG ratios of 1.5 or lower), the valuation is arguably justifiable for firms of Visa and Mastercard’s caliber, boasting strong profits and a robust track record of growth. Despite being conventionally perceived as “expensive” for over a decade, these stocks have consistently outpaced the market.

Investors contemplating enriching their long-term portfolios could contemplate adding both Visa and Mastercard while looking to capitalize on market downturns and holding onto shares indefinitely.

Could investing $1,000 in Mastercard now be opportune?

Before diving into Mastercard stocks, consider this:

The Motley Fool Stock Advisor team of analysts has identified what they regard as the 10 premier stocks for investors to acquire presently… and Mastercard did not make the cut. The 10 selected equities hold the potential to yield staggering returns in the forthcoming years.

Stock Advisor furnishes investors with a user-friendly roadmap to success, encompassing portfolio construction guidance, regular analyst updates, and two fresh stock recommendations monthly. Since 2002, the Stock Advisor service has outperformed the S&P 500 returns threefold*.

Explore the 10 stocks

*Stock Advisor returns as of March 18, 2024

Justin Pope holds no positions in any of the stocks mentioned. The Motley Fool holds positions in and endorses Mastercard and Visa. The Motley Fool endorses the subsequent options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool adheres to a disclosure policy.

The opinions and viewpoints expressed here are those of the author alone and do not necessarily mirror those of Nasdaq, Inc.