IOSP Reaches 52-Week Pinnacle: Understanding the Lift-off

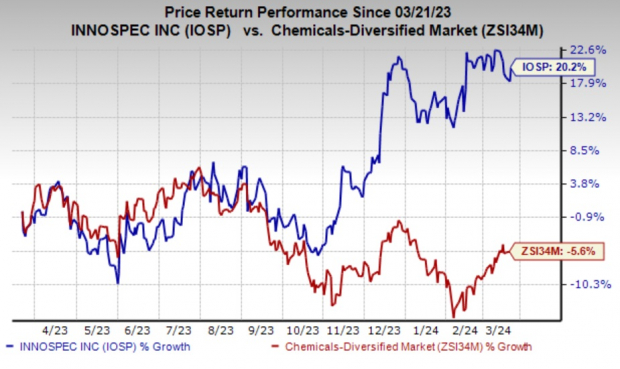

The ascent of Innospec Inc. to a new 52-week high of $128.6 on Mar 19, closing at $123.55, unveils a stock transcending its expected trajectory. Over the past year, Innospec has outshone the industry, marking a 20.2% rally while the industry witnessed a 5.6% descend.

Diving into the Factors Fueling Innospec’s Flight

The fourth quarter showcased Innospec’s metamorphosis, boasting an adjusted earnings per share of $1.84 – soaring past the Zacks Consensus Estimate of $1.59. Despite a 3% decline in revenues year-over-year, Innospec marked revenue of $494.7 million, surpassing the Zacks Consensus Estimate of $474 million. The stellar performance in the Oilfield Services unit and notable growth in the Performance Chemicals and Fuel Specialties segments proved to be catalysts in this growth trajectory.

The acquisition of QGP Quimica Geral in Brazil signifies a significant step for Innospec in expanding its global reach. This addition not only strengthens its Performance Chemicals vertical but also sets a firm manufacturing foothold in South America, accentuating the company’s M&A strategy. Looking forward optimistically to 2024, Innospec anticipates a flourishing year with a promising lineup of organic opportunities and the fruitful integration of QGP. The future seems ablaze with potential as production capacity expansion becomes a reality and technological advancements signal prosperous prospects ahead.

A Glimpse into the Stock’s Trajectory

Innospec has consistently surpassed Zacks Consensus Estimates, painting a picture of stability and growth. With a Zacks Consensus Estimate for 2024 pointing towards earnings of $6.72, a healthy rise of 10.3% from the previous year, the stock seems to be charting a track of sustained success. Eyes are also set on a 9.8% earnings growth projection for 2025, enhancing the allure of this vibrant stock.

Seeking Stars in the Constellation

Among its peers, Innospec holds a Zacks Rank #2 (Buy). Other top players in the Basic Materials space include Carpenter Technology Corporation with a Zacks Rank #1 (Strong Buy), Ecolab Inc., and Hawkins, Inc., both carrying a Zacks Rank #2. These stars in the firmament of Basic Materials offer a constellation of opportunities worth exploring.

Zacks Investment Research