Innospec Approves New $50 Million Share Repurchase Program

Innospec Inc. (IOSP) recently announced a new $50 million share repurchase program, following the expiration of an earlier program of the same value in the first quarter of 2025.

With over $289 million in net cash, Innospec has retained significant flexibility and a strong balance sheet. This positions the company well for future mergers and acquisitions, organic investments, dividend growth, and share repurchases under the newly authorized program.

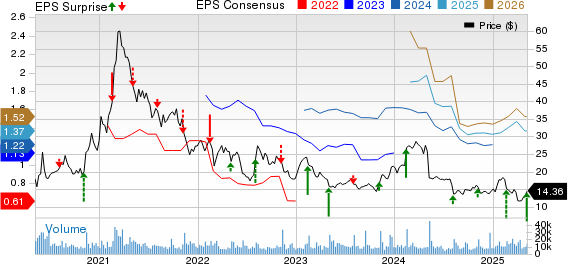

For the fourth quarter, Innospec reported adjusted earnings of $1.41 per share, surpassing the Zacks Consensus Estimate of $1.36. This result compares to earnings of $1.84 per share in the same quarter last year. In fact, the company has outperformed the Zacks Consensus Estimate in three of the last four quarters, with an average surprise of about 3%.

During the fourth-quarter earnings call, the management highlighted a favorable outlook for continued growth in Performance Chemicals and Fuel Specialties, alongside a sequential recovery anticipated in Oilfield Services.

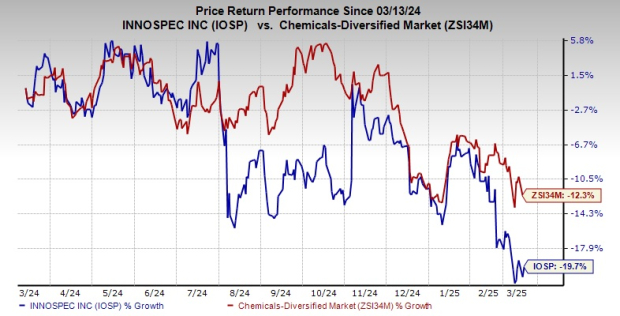

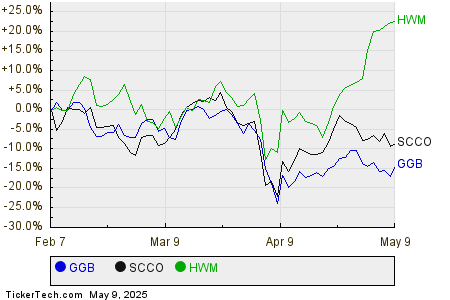

Over the last year, Innospec’s shares have dropped 19.7%, a steeper decline compared to the 12.3% drop in its industry.

Image Source: Zacks Investment Research

Innospec’s Current Ranking and Noteworthy Competitors

Innospec currently holds a Zacks Rank #4 (Sell).

In the basic materials sector, other companies with better rankings include Carpenter Technology Corporation (CRS), ArcelorMittal (MT), and Axalta Coating Systems Ltd. (AXTA).

Carpenter Technology, ranked Zacks #2 (Buy), has consistently exceeded the Zacks Consensus Estimate in the last four quarters, achieving an average earnings surprise of 15.7%. Its shares have appreciated by 179.7% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For ArcelorMittal, which also has a Zacks Rank #2, the consensus estimate for current-year earnings stands at $3.72 per share. The company has surpassed expectations in three of the last four quarters with an average earnings surprise of 4.11%. Its stock price increased by 18.6% in the previous year.

Meanwhile, Axalta Coating Systems holds a Zacks Rank #1 and has bested the consensus estimate consistently over the trailing four quarters. This performance has led to an average earnings surprise of about 16.3%. Over the last year, AXTA’s shares have gained 0.7%.

Stocks with Potential to Double in 2024

Five stocks have been identified by a Zacks expert as top selections likely to gain +100% or more in 2024. Although not every pick can be successful, past recommendations have seen increases of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks featured in this report are currently off Wall Street’s radar, presenting a unique entry opportunity.

Discover These 5 Potential High-Reward Investments >>

Free Stock Analysis Report for ArcelorMittal (MT)

Free Stock Analysis Report for Carpenter Technology Corporation (CRS)

Free Stock Analysis Report for Innospec Inc. (IOSP)

Free Stock Analysis Report for Axalta Coating Systems Ltd. (AXTA)

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.