Innovative Industrial Properties (NYSE:IIPR) stands as a riveting REIT in today’s market landscape.

Carrying a substantial dividend of nearly 8% and operating within an unconventional industry, potential investors may ponder whether this company merits inclusion in their investment portfolios.

Today, we embark on a deep analysis of IIPR to gauge its financial robustness.

Financial Stability

IIPR’s financial health is the foremost consideration. Despite prevailing challenges, the company’s financials are remarkably resilient.

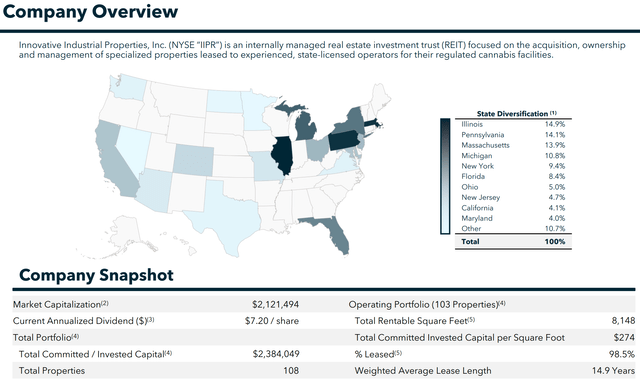

For the uninitiated, IIPR functions as a REIT with specialized properties geared towards cannabis production and processing:

This encompasses 103 facilities across 18 states, totaling 8.1 million square feet. Remarkably, the firm maintains a staggeringly low LT Debt/Capital ratio of only 13%. This minimal debt exposure ensures that the majority of IIPR’s revenues flow directly to FFO, eventually lining investors’ pockets.

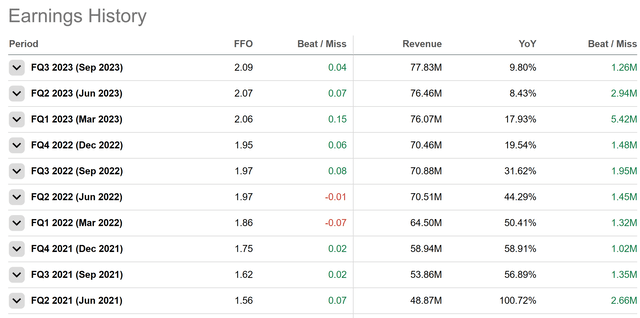

Regarding earnings, the company has posted remarkable performances over the past few years, consistently surpassing top-line sales and missing EPS estimates merely twice:

However, revenue growth has decelerated notably, plummeting from 58% in Q4 of 2021 to upper single digits over Q2 and Q3 of 2023. This slowdown primarily stems from the shortage of fresh capital inflows into the space, coupled with tenant issues dampening financial performance.

Innovative Industrial has grappled with tenant issues, with tenants Parallel & Green Peak Industries defaulting on properties earlier this year. Additionally, affiliates of Medical Investor holdings defaulted on one of their California properties. The past quarter saw the management reclaiming properties from Parallel, Green Peak, and King’s Garden.

In the case of Green Peak, IIPR repossessed two small retail properties leased to the company and anticipates regaining possession of one more by month-end. The management mentioned selling Green Peak’s assets to a buyer last October. These troubled tenants led to a drop in occupancy rates over the past few quarters.

Despite these challenges, the outlook is positive as IIPR has regained possession of its properties and can now re-lease these facilities. Chairman Alan Gold emphasized this during the recent earnings call, touting the company’s strong team, high-quality portfolio, and conservative balance sheet.

Furthermore, the company reported total revenues of $78 million in Q3 and adjusted funds from operations of $65 million. Notably, rent collection for IIP’s operating portfolio stood at an impressive 97% for the quarter. This robust financial performance continues to drive dividend returns, with $7.20 of dividends declared per share in the past 12 months, a 6% increase over the previous 12-month period.

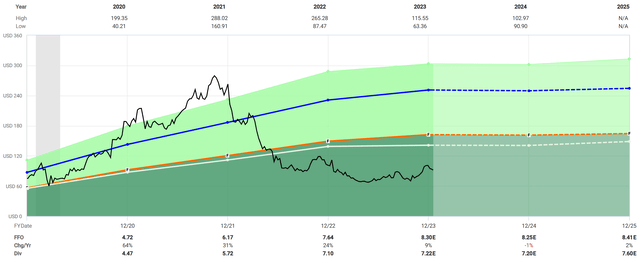

Viewing IIPR’s projected growth rates, 2024 forecasts a marginal negative, turning positive in FY 2025:

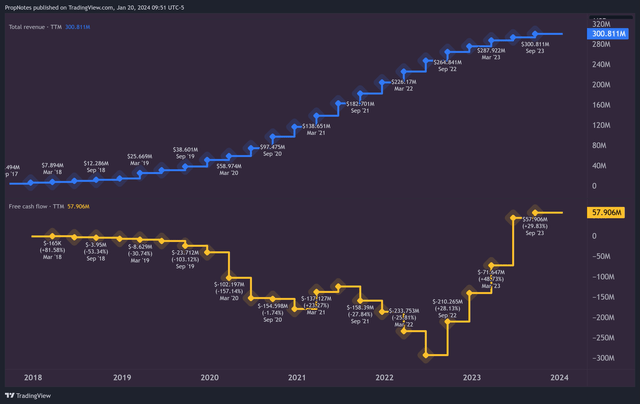

Historically, this narrative of ‘recovery’ holds true when scrutinizing the company’s top-line growth and cash flow. The trailing twelve months’ free cash flow is finally in positive territory again after facing challenges:

On a recent earnings call, CEO Paul Smithers acknowledged the continued strength of the overall cannabis industry in the U.S. Despite the macroeconomic environment, BDSA predicts a 12% growth in cannabis sales in 2023, reaching around $29.5 billion. Additionally, BDSA estimates that approximately 60% of U.S. adults could have access to adult-use cannabis by 2026 with new state programs coming online.

Though it doesn’t guarantee IIPR a lion’s share of this growth due to its tangential position as a landlord, it nonetheless bolsters the demand environment for its facilities over time, adding stability to our outlook on IIPR’s future distributions.

Valuation

Shifting our gaze, it is vital to assess IIPR’s valuation. Despite the turbulent tenant landscape and macroeconomic challenges, the company remains undeniably solid in many financial aspects. With the recent indicators pointing towards a resurgence, prospective investors could find a compelling case for the long-term sustainability of IIPR’s dividends.

Examining Innovative Industrial Properties Inc.

Upon glancing at the aforementioned chart showcasing IIPR’s valuation, one might easily be led astray into believing that the present moment is an opportune time to invest in the company. The blue line on the chart indicates a ‘fair value’ of 30x FFO, while the orange line represents a fair value of 19x based on historical FFO growth.

However, we hold firm in maintaining that an FFO multiple closer to ~12x seems more fitting, particularly in light of the projected anemic nature of IIPR’s future growth. Notably, a lone analyst is anticipating 2025 FFO of $13 per share, a figure that strikes us as rather optimistic:

Nevertheless, when a 12x FFO is plotted, it becomes apparent that IIPR is trading at approximately fair value. This aligns with the industry dynamics, given the notably slower growth trajectory articulated by both management and analysts.

Speaking to the broader portfolio, IIPR maintains a well-diversified range of operations, exhibiting negligible concentration in any single customer or state:

Our portfolio continues to be well diversified with no one tenant representing more than 16% of our annualized base rent and no state representing more than 15% of our annualized base rent.

Factoring in the pristine balance sheet, we are inclined to extend our fair value FFO multiple estimate range to ~14x, positioning it at a slight premium in comparison to the sector.

Management anticipates a revival in growth in the future, attributing the current slowdown to the company’s strategic positioning to capitalize on forthcoming growth opportunities.

However, our confidence in the growth outlook is somewhat restrained.

While industry growth is poised to fortify the dividend, as stipulated in the previous section, IIPR, as a REIT, maintains a loose correlation with the growth of the regulated marijuana industry.

Over the past couple of years, this has been a relative boon for the stock, considering the considerable depreciation in valuations and growth for major companies such as Canopy (CGC) and Tilray (TLRY).

Conversely, going forward, IIPR is anticipated to exhibit less dependence on industry growth as an insulated real estate play. Hence, discerning IIPR’s prospective sources of growth becomes rather challenging, coinciding with the projection that the company’s organic sale-leaseback program is unlikely to substantially boost growth either:

Unveiling the Dividend

Where does the upside manifest in this scenario?

Currently resting at approximately 8%, IIPR’s yield emerges as the most compelling aspect of the stock.

While IIPR’s FFO growth decelerates amidst the array of challenges confronting the industry, the stock itself, when evaluated based on future growth, appears to be trading at a value akin to fair. Nevertheless, the dividend proposition remains remarkably alluring.

Presently, IIPR dispenses roughly 79% of FAD, culminating in an annual yield of 7.93% on a forward-looking basis.

The company has augmented this payout for 6 consecutive years, escalating from $2.32 per share in 2019 to $7.22 in FY 2023:

This growth has been consistently rapid and commendable, with the true appeal surfacing upon scrutiny of the minimal overall risk:

Seeking Alpha’s Quant Rating System bestows IIPR’s dividend safety with an ‘A’ grade, a well-deserved commendation when examining some of the key ratios.

Among these metrics is an interest coverage ratio of 9.6 (4 times higher than the sector), signaling IIPR’s minimal interest obligations that could impede future payouts.

Moreover, the company displays an exceptionally high FFO to Gross Margin percentage, indicative of an effective cost management strategy.

Finally, IIPR’s Total Debt/Capital, as previously alluded to, is remarkably low, underscoring the company’s robust balance sheet. This stands out as one of the primary perils when investing in REITs – the leverage. Overly indebted REITs can pose an incredibly precarious proposition for equity holders, as financial institutions will ultimately seek repayment, potentially curtailing or even halting payouts altogether.

Thus, the dividend emerges as evidently secure. As for growth, it appears contingent on IIPR’s broader FFO growth, which, as discussed, is anticipated to be relatively subdued.

Assessing the Risks

A multitude of risks are inherent to IIPR’s business, inclusive of regulatory issues and the associated threats to the company’s tenants. These hazards could materialize in the following ways:

- Cannabis industry changes: IIPR’s operations are heavily contingent on the legal status of cannabis. Alterations in regulations, encompassing prohibition or heightened restrictions, could impinge on tenant demand and rental income.

- Tenant compliance: IIPR leases properties to cannabis operators, some of whom may confront legal or compliance challenges in the future, potentially leading to rent defaults and impacting IIPR’s financial performance.

- Licensing delays: Securing state licenses for cannabis cultivation and processing is intricate and time-consuming. Delays in licensing for IIPR’s tenants could affect property occupancy and rent remittances.

All of these factors might also influence IIPR’s multiple, which has exhibited considerable variability over the years. Historically, IIPR has averaged an FFO valuation of around 30x. However, if growth plateaus or delves into negative territory, our 12-14x FFO estimate might prove overly optimistic, potentially resulting in further sell-offs of the company’s shares.

Ultimately, the company is set to report earnings in approximately a month and will continue to do so going forward, a development that invariably sparks short-term volatility. We anticipate a moderately stronger quarter for Q4 2023, characterized by a 9.5% rise in top-line growth and marginal FFO improvements. However, any alteration in this trajectory or an unfavorable market response to the figures could precipitate a decline in the stock’s value.

Summation

Altogether, IIPR presents an intriguing case owing to its robust existing operations juxtaposed against its correspondingly feeble growth profile. Consequently, the shares appear fairly valued at present, yet the dividend exhibits substantial strength and coverage.

For investors seeking income, this presents a compelling option.

Conversely, for those eyeing capital appreciation, exploring alternate avenues might prove more advantageous.

Overall, we assign the stock a “Buy” rating due to its competitive Total annualized ROR profile, recognizing nonetheless that the stock may not align with every investor’s preferences.

Cheers!