New Options Available for Charles Schwab Investors

Investors in The Charles Schwab Corporation (Symbol: SCHW) have access to new options as of today, specifically for the May 30th expiration. At Stock Options Channel, our YieldBoost formula has scanned the SCHW options chain and pinpointed one put and one call contract of interest.

Put Contract Analysis

The put contract at the $72.00 strike price currently has a bid of $1.96. Selling to open this put contract obligates an investor to buy shares of Schwab at $72.00, while also collecting a premium. This arrangement effectively reduces the cost basis of the shares to $70.04 (excluding broker commissions). For investors looking to acquire SCHW shares, this option may offer an appealing alternative to purchasing them at today’s market price of $74.10 per share.

This $72.00 strike represents an approximate 3% discount to the current trading price, placing it out-of-the-money by the same percentage. Market analysis indicates a 60% chance of the put contract expiring worthless. Stock Options Channel will monitor these odds, publishing a chart on our website under the contract detail page. Should the put expire worthless, the premium represents a 2.72% return on the cash commitment, or an annualized return of 19.87%, which we refer to as the YieldBoost.

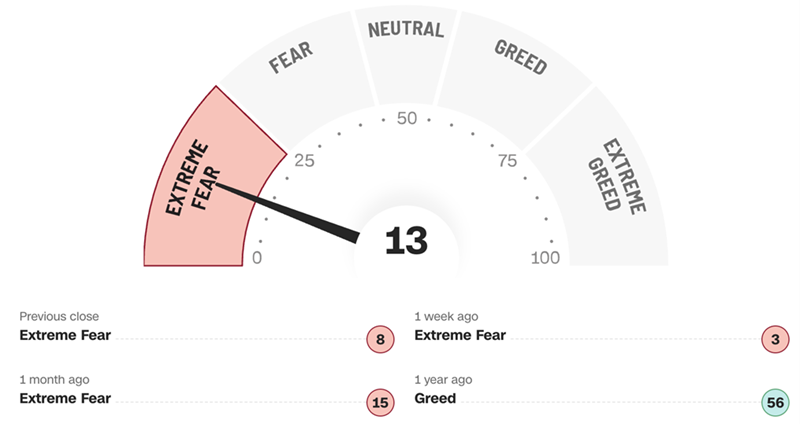

Below is a chart that shows the trailing twelve months of trading history for The Charles Schwab Corporation, marking the position of the $72.00 strike in green:

Call Contract Analysis

On the calls side of the options chain, the call contract at the $76.00 strike price has a current bid of $1.89. Buying shares of SCHW at $74.10 and then selling to open this call as a “covered call” entails committing to sell the stock at $76.00. If the stock is called away by the May 30th expiration and excluding dividends, the return would amount to 5.11% from the combination of the share price and the premium collected. However, if SCHW experiences significant price appreciation, investors risk losing out on potential gains.

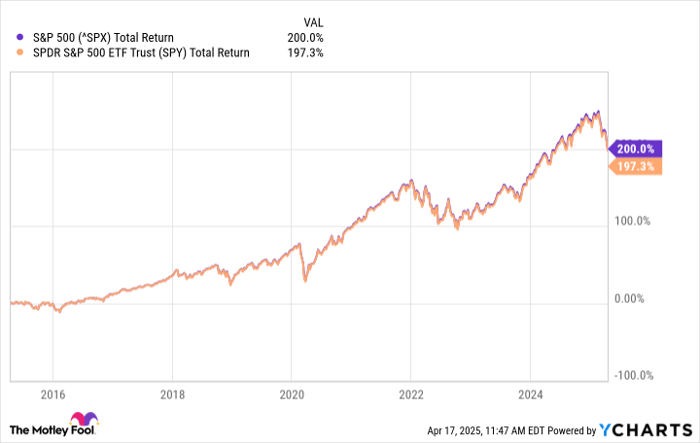

A review of SCHW’s trailing twelve-month trading history is critical for investors, which helps assess whether the covered call strategy aligns with their objectives. The following chart illustrates SCHW’s trading history, highlighting the $76.00 strike in red:

This $76.00 strike price is approximately a 3% premium to SCHW’s current trading price, indicating it is also out-of-the-money by the same margin. Consequently, there is a chance the covered call contract might expire worthless, allowing the investor to retain both shares and premium collected. Current analytical data suggests a 56% probability of this scenario. As with the put options, these odds will be tracked and published for reference on our site.

Should the covered call expire worthless, the premium would yield an additional return estimate of 2.55%, equating to an annualized return of 18.62%, also referred to as the YieldBoost.

The implied volatility for the put contract is 36%, while that for the call contract stands at 34%. Meanwhile, actual trailing twelve-month volatility, calculated from the last 251 trading days and the current price of $74.10, is noted at 30%. For more options insights, visit StockOptionsChannel.com.

![]() Top YieldBoost Calls of Stocks with Recent Secondaries »

Top YieldBoost Calls of Stocks with Recent Secondaries »

also see:

- Top Ten Hedge Funds Holding DIV

- SCON market cap history

- Institutional Holders of NCLH

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.