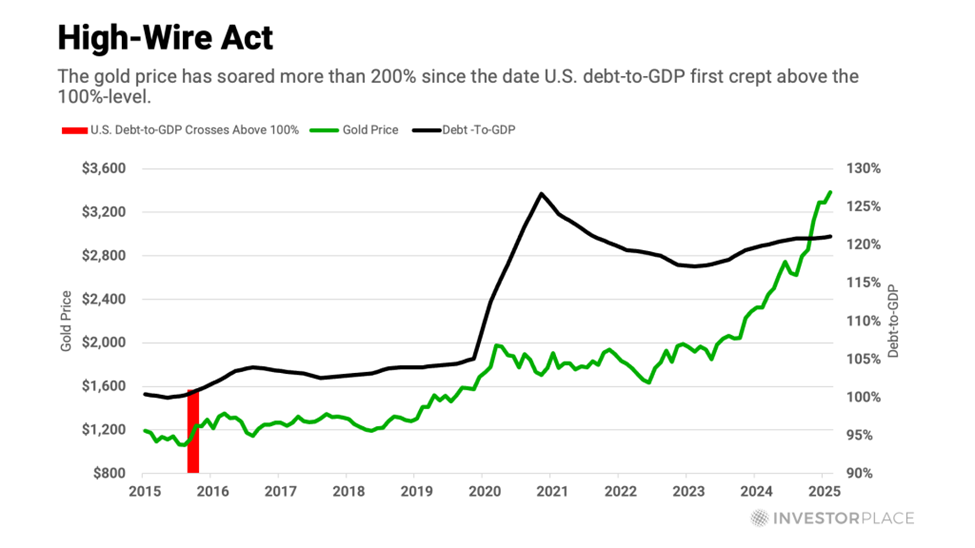

The U.S. national debt has surpassed 125% of GDP, a significant increase from just above 100% in 2016. This alarming growth has led to rising concerns, with interest payments on U.S. Treasury debt now exceeding $1.1 trillion annually, 30% more than the entire Department of Defense budget. As a consequence, Moody’s has downgraded the U.S. credit rating, citing the failure of successive administrations to address large annual fiscal deficits.

In response to these trends, gold prices have surged, reflecting a shift in investor sentiment. Historically viewed as a hedge against economic distress, gold is increasingly seen as a reliable asset amid growing doubts over U.S. financial stewardship. With geopolitical tensions in the Middle East also influencing demand, experts suggest a strategic allocation of gold in investment portfolios.

As market dynamics continue to evolve, investors are advised to pay attention to gold’s performance, especially given its recent rise to all-time highs in conjunction with U.S. debt accumulation.