Amazon’s Strong Buy: What Analysts Are Saying

Investors frequently rely on Wall Street analysts for guidance before deciding to Buy, Sell, or Hold a stock. Although news of rating changes from these analysts can sway stock prices, it raises an important question: Are these recommendations genuinely reliable?

This article examines the insights of analysts regarding Amazon (AMZN) and discusses how investors can make sense of brokerage recommendations.

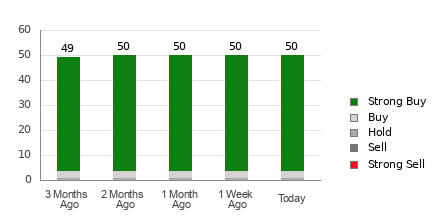

As of now, Amazon holds an average brokerage recommendation (ABR) of 1.10, which falls on a scale of 1 to 5, where 1 indicates a Strong Buy and 5 indicates a Strong Sell. This ABR is derived from the assessments (Buy, Hold, Sell, etc.) of 50 different brokerage firms. Notably, an ABR of 1.10 suggests a leaning toward Strong Buy.

Out of the 50 assessments contributing to this ABR, 46 are classified as Strong Buy, while three are designated as Buy. Together, these ratings signify that 92% of the recommendations are Strong Buy, and 6% represent Buy.

Analyzing AMZN Recommendations

For price target and stock forecast details on Amazon, click here>>>

Despite the ABR suggesting a buy for Amazon, it may not be prudent to base your investment decisions solely on this figure. Several studies indicate that brokerage recommendations often have limited success in aiding investors to find stocks that will appreciate significantly.

So, why is that the case? Due to the inherent interests of brokerage firms in the stocks they cover, their analysts tend to show a strong positive bias in their ratings. Research indicates that brokerage firms offer five “Strong Buy” recommendations for every “Strong Sell” rating.

This pattern suggests that the interests of brokerage firms do not always align well with individual investors, casting doubt on their predictions about stock price movements. Therefore, the most effective approach might be to use this data to support your own research or as a tool to validate other proven indicators of stock performance.

One such effective tool is Zacks Rank, a proprietary stock rating system with a strong track record. It categorizes stocks into five groups from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) and is known to predict short-term stock price movements accurately. Using the ABR in conjunction with Zacks Rank could enhance investment decision-making.

Understanding the Difference: ABR vs. Zacks Rank

Although both the ABR and Zacks Rank use a 1 to 5 scale, it is crucial to recognize that they measure different aspects.

The ABR reflects brokerage recommendations, often shown as decimals (e.g., 1.28). In contrast, Zacks Rank focuses on earnings estimate revisions, presented in whole numbers — 1 to 5.

Historically, brokerage analysts have been overly optimistic in their ratings due to their firms’ vested interests, often resulting in misleading guidance for investors. On the other hand, Zacks Rank relates directly to earnings estimates, which have been shown to correlate closely with stock price movements based on empirical research.

Moreover, Zacks Rank maintains calibration across all stocks with provided earnings estimates by brokerage analysts. This balance ensures that all five ranks receive equitable representation.

Freshness is another primary distinction; the ABR may not always reflect the latest information. In contrast, Zacks Rank rapidly adjusts to changes in earnings estimates, making it a more timely indicator of future stock prices.

Is Investing in AMZN a Good Idea?

Regarding earnings estimate revisions, the Zacks Consensus Estimate for Amazon has seen a 1.6% increase over the past month, now standing at $5.28.

This growing optimism among analysts, shown by a consensus of higher EPS estimates, indicates potential for Amazon’s stock to rise in the near future.

The significance of the revised consensus estimate, along with other related factors, has culminated in a Zacks Rank #1 (Strong Buy) for Amazon. For a complete overview of today’s Zacks Rank #1 stocks, click here>>>>

Hence, the Buy-equivalent ABR for Amazon may offer valuable guidance to investors.

Access All Zacks Buys and Sells for Just $1

We’re being serious.

A while back, we surprised our members by granting them 30-day access to all our picks for just $1 — absolutely no further obligation.

While thousands have taken advantage of this deal, many hesitated, assuming there must be a catch. Our reasoning? We seek to introduce you to services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which had 228 double- and triple-digit gains just last year.

See Stocks Now >>

Interested in the latest recommendations from Zacks Investment Research? Download your copy of the 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.