Intel’s Technological Lag Behind TSMC

I am bearish on Intel (NASDAQ:INTC) due to 3 key reasons:

- Efforts to catch up to TSMC in foundry technology may fall short

- Intel faces various business headwinds heading into FY24

- Valuations seem steep with a lower margin of safety

Strategic Imperative: Intel’s Technological Gap with TSMC

The world continues to move toward smaller, faster computing with greater memory. The semiconductor chip is at the backbone of technological developments and new product upgrades. Caught in a high-stakes battle for chip miniaturization and speed, Taiwan Semiconductor Manufacturing Company (TSMC) currently leads the charge.

Intel’s long-term prospects hinge on its ability to close the gap in foundry technology leadership with industry leader TSMC. This is the strategic imperative that management is focusing on, as evidenced by CEO Patrick Gelsinger’s remarks in the Q4 FY24 earnings call.

Q4 was the culmination of a year of tremendous progress towards our IDM 2.0 transformation. We consistently executed on our plan to reestablish process leadership, further build out our capacity and foundry plans.

IDM stands for an integrated device manufacturer.

A key milestone in Intel’s journey is Intel 18A, which is expected to have manufacturing readiness in H2 FY24. This is the key product that CEO Gelsinger is relying on to regain process leadership vs. TSMC.

TSMC’s CEO, Wei, made a strong claim that leaves no room for ambiguity, stating that TSMC’s N3P technology demonstrated comparable power, performance, and area (PPA) to 18A, Intel’s technology, with better technology maturity, and better cost. Furthermore, TSMC’s N2P technology without backside power is expected to surpass both N3P and 18A, cementing TSMC’s leadership in 2025.

The implications of TSMC’s technological lead over the next few years undermine the longer-term bullish case for Intel.

Challenges Ahead: Business Headwinds for Intel

Moving onto considerations of the medium-term outlook, Intel’s Client Computing Group (57% of overall revenues) is seeing a growth rebound as customer inventory levels have normalized.

However, the other two segments that make up 36% of the business continue to see headwinds. The Data Center and AI segment, particularly in programmable solutions, faces “material inventory correction” and competitive pressures from Advanced Micro Devices (AMD), NVIDIA (NVDA), and ARM Holdings (ARM).

Intel’s Network and Edge segment has been suffering from weak telecommunication market demand and elevated

Intel’s Future: A Bumpy Road Ahead for Investors

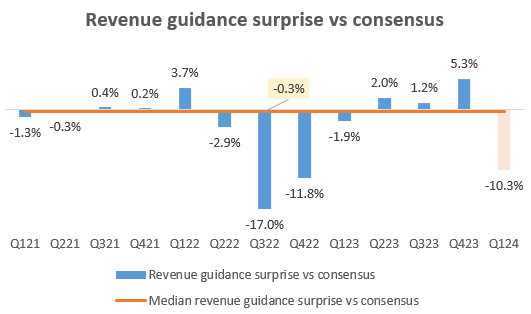

Intel Corporation startled investors with a bleak outlook, resulting in a 10.3% drop in its Q1 FY24 revenue guidance compared to consensus expectations. The company pegged its revenue guidance for Q1 FY24 at $12.7 billion, significantly lower than the anticipated figure. This downturn reflects a larger concern regarding the weakness in customer inventory, which management foresees persisting throughout the year.

Assessing Valuations: Is There Adequate Margin of Safety?

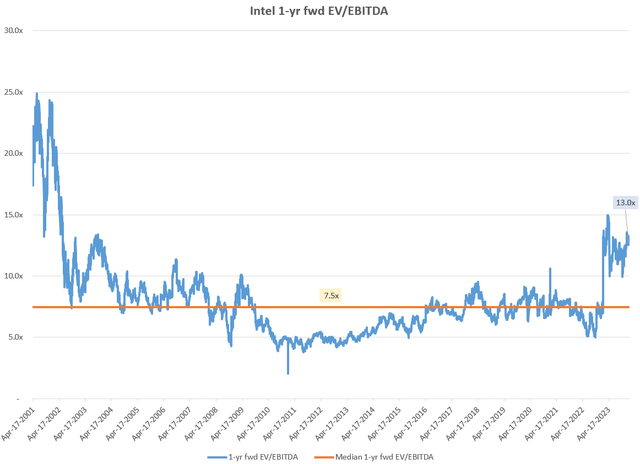

When evaluating Intel’s 1-year forward EV/EBITDA perspective, the company’s trading multiple of 13.0x is a significant 74.1% higher than its longer-term median of 7.5x. While some premium over the long-term average is justifiable due to the burgeoning demand for AI and high-performance computing, Intel’s current position and operational momentum suggest that its valuation may be overly inflated, rendering it less attractive for value investors.

In-depth Analysis: Navigating Through Technicalities

First time reading a Hunting Alpha article using Technical Analysis? Check out this post, which details the principles of Flow, Location, and Trap, explaining how and why the charts are interpreted in such a manner.

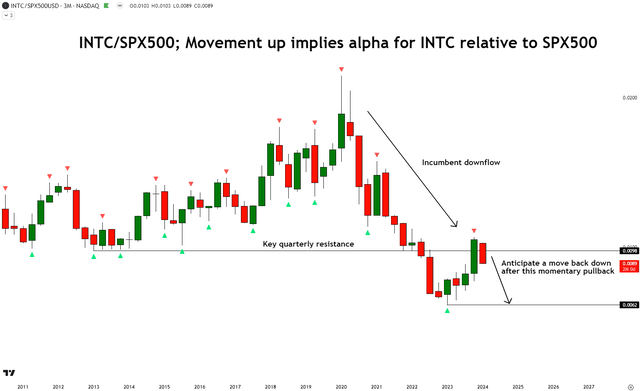

A close scrutiny of the quarterly chart of INTC vs. the S&P500 reveals a consistent downward trend in the ratio prices, indicating a bearish response at the critical resistance level. Anticipating a setback to the local lows suggests a potential negative alpha for Intel in comparison to the S&P500.

Monitoring Risks and Opportunities

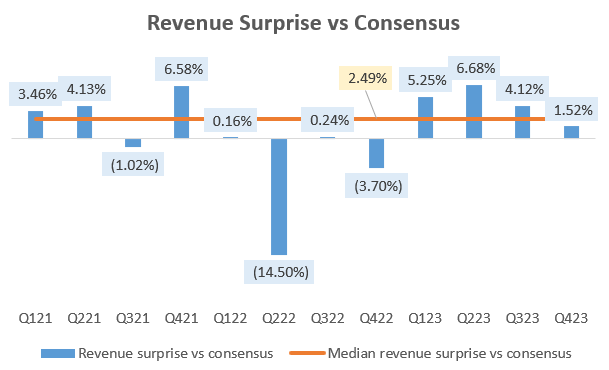

Despite the downward revision in Q1 FY24 guidance, Intel has historically registered revenue surprises, with a median of 2.49%. With Intel’s top customers, Dell, Lenovo, and HP, accounting for 40% of its revenues, vigilant tracking of these companies’ performance and outlook could provide early indicators of Intel’s trajectory. Moreover, Intel’s Foundry Day scheduled for February 21, 2024, holds critical importance, potentially paving the way for a more promising long-term outlook.

Final Verdict

Despite Intel’s management projecting a promising future through technological advancements, the company faces strong headwinds due to inventory corrections. This, coupled with the premium valuation and negative technical indicators, paints a grim picture for future performance.

Consequently, it is prudent to view Intel as a ‘Sell’ based on the current assessments.

Understanding Hunting Alpha’s Ratings:

– Strong Buy: Anticipate outperformance vis-à-vis the S&P500 with heightened confidence.

– Buy: Expect the company to outperform the S&P500.

– Neutral/Hold: Foresee the company delivering in line with the S&P500.

– Sell: Expect the company to underperform the S&P500.

– Strong Sell: Anticipate the company to significantly underperform the S&P500 with heightened confidence.

The typical horizon for these views spans multiple quarters to about a year, yet it is subject to adjustments. Any modifications in stance will be communicated through a pinned comment to this article or a separate piece delineating the rationale behind the shift.

Editor’s Note: This article expounds on securities not directly traded on major U.S. exchanges. Readers should factor in the associated risks before making any investment decisions.