Intel Loses Dow Status as NVIDIA Rises in Semiconductor Dominance

Intel Corporation (INTC) has lost its place in the Dow Jones Industrial Average (DJIA), being replaced by NVIDIA Corporation (NVDA). This change ends Intel’s 25-year streak on the index and highlights the shift in the semiconductor industry driven by the increasing importance of artificial intelligence (AI).

The Reasons Behind Intel’s Decline

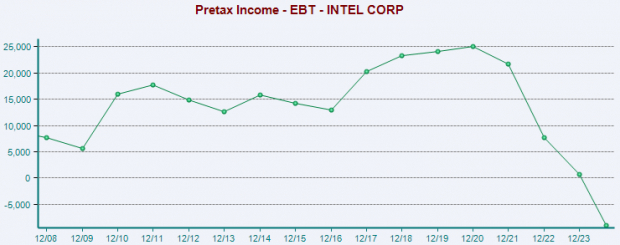

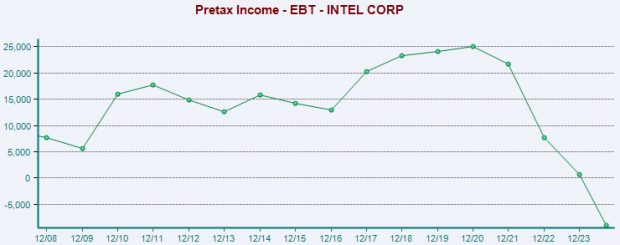

Despite launching its AI-focused Core Ultra processors and the Gaudi 3 accelerator, Intel has not kept pace with NVIDIA. The latter’s successful H100 and Blackwell GPUs have greatly contributed to its widespread adoption among tech companies focusing on AI, resulting in significant revenue growth.

Moreover, Intel’s shift in production to its higher-cost facility in Ireland has affected short-term profit margins. Increased operational costs, combined with excess capacity charges and an unfavorable mix of products, added to the financial pressure.

In addition, the rise of over-the-top service providers has put pressure on Intel’s core business, leading to intense competition for customer retention and impacting overall revenue.

US-China Relations Create Additional Challenges

China is a crucial market for Intel, accounting for more than 27% of its total revenues in 2023. However, recent efforts by the Chinese government to rely less on foreign-made chips are threatening Intel’s revenue prospects. A new directive to phase out foreign chips from vital telecom networks by 2027 underscores these challenges amid escalating trade tensions between the US and China.

As the US tightens its restrictions on tech exports, China is pushing for self-sufficiency in its technology sector, posing significant risks for Intel. The company’s second-quarter 2024 revenues already reflected the adverse impact of losing certain export licenses. Additionally, slowed spending in both consumer and business markets has led to increased inventory levels, further dampening demand.

Image Source: Zacks Investment Research

Stock Performance Overview

Intel’s stock has dropped by 53.6% this year, underperforming the industry, which has seen growth of 123.6%. This slump results from significant financial and operational challenges faced by the company, prompting management to reassess its strategies.

The company is considering separating its product design and manufacturing sectors and possibly scrapping some factory projects. Furthermore, Intel Foundry will likely become an independent subsidiary to enhance operational efficiency. Last quarter, the division reported an operating loss of $5.8 billion.

Year-to-Date Stock Performance

Image Source: Zacks Investment Research

Revised Earnings Estimates for INTC

Earnings forecasts for Intel have been revised downwards by 87.8% for 2024, now at 23 cents per share. Projections for 2025 have also fallen 54.2% to $1.03, reflecting a negative outlook for the company.

Image Source: Zacks Investment Research

Final Thoughts

While Intel’s advancements in AI technology hint at future possibilities, the company faces several immediate challenges, including workforce reductions and declining capital expenditures, intended to cut costs and streamline operations. However, with a Zacks Rank of #4 (Sell), market perceptions remain negative, and there are concerns that Intel’s efforts may be insufficient compared to its competitors. Given declining earnings estimates and dismal performance relative to peers, it seems prudent to be cautious with Intel at this time.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Highlights The Top Semiconductor Stock

While NVIDIA has gained substantial value since its recommendation, a new semiconductor stock is emerging with significant potential for growth driven by escalating demand for technology such as AI, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is forecasted to grow from $452 billion in 2021 to an astonishing $803 billion by 2028.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.