A Shaky Landscape for Intel – Q4 FY23 Assessment

Intel, a major player in the semiconductor industry, is staring down headwinds as it enters 2024. Declining demand for x86-based chips has dealt a severe blow to the company’s bottom line, compounded by a soft computing environment.

The recent 22% surge in valuations, leaving shares overvalued by approximately 10%, has prompted a significant change in my rating – to a Sell. For discerning investors in search of value, Intel no longer appears to be the promising choice.

The Intel Odyssey

As an American semiconductor chip design and manufacturing company, Intel is renowned as the original architect of the x86 chip architecture prevalent in modern-day personal computers (PCs).

Only recently, Intel diversified its product portfolio by integrating graphics processing units (GPUs) to directly compete with industry giants such as NVIDIA and AMD.

In a bold move, Intel unveiled the “Intel Foundry Services” (IFS) business in 2021, with aspirations to become the world’s second-largest foundry by 2030 and challenge the likes of Samsung and TSMC.

While this vertical expansion could be immensely lucrative, it demands substantial time and capital expenditure to realize such lofty ambitions.

Evaluating the Economic Moat of Intel – Q4 FY23 Update

In a thorough analysis of Intel’s business conducted in September 2023, extensive scrutiny was applied to their business structure, processes, and competitive resilience. However, subsequent developments have led to adjustments in my assessment.

Intel’s latest Core Ultra processors, powered by Intel 4 processes, have hit the market. The integration with Microsoft’s latest Windows operating system aims to outperform competitors in both performance and efficiency.

Nevertheless, independent performance tests have revealed underwhelming results, with Intel’s newest CPUs falling short in various real-world scenarios, often trailing behind rival chips from AMD and Qualcomm. The continued pursuit of x86 architecture is hindering Intel’s ability to match the efficiency achievable with ARM CPU architecture.

The potential for Intel’s mobile PC chips to become obsolete looms large, especially if the upcoming Windows iteration optimizes for ARM-based processors.

Notwithstanding Intel’s strong ties with PC manufacturers, there are clear indicators of the company’s struggle to develop a competitive lineup of consumer-grade chips in pace with its rivals.

While Intel’s IFS segment has experienced rapid growth, the business still faces mounting operating losses as colossal investments are essential to achieve a competitive and profitable scale of operations.

The lack of tangible profitability from IFS, coupled with the necessity for increased investment, has left me hesitant to attribute significant competitive advantages to this business segment until securing partnerships with industry heavyweights.

Hence, in light of the declining performance of Intel’s CCG products and the incremental progress made by IFS, Intel’s moat rating is objectively downgraded from wide to moderate.

Assessing Intel’s Financial Position – Q4 FY23 Appraisal

Intel’s profitability has suffered in recent years due to the substantial investment in their IFS business coinciding with a post-pandemic slump in PC demand.

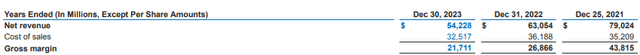

In the Q4 FY23 report, Intel witnessed an 11% decline in net revenues to $54B compared to $63B the previous year and $79B in FY21. Gross margins have contracted by over 50% over the last two years, with COGS remaining essentially unchanged.

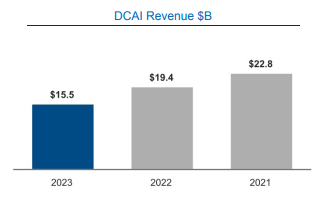

Underperformance in Intel’s CCG, DCAI, and NEX segments has significantly impacted revenues, notwithstanding robust YoY gains by IFS.

Despite some positive growth in Intel’s CCG division, the company’s future appears uncertain – a testament to the challenging times that lay ahead.

The Decline and Dissatisfaction Intel’s Financials Signal

Intel’s recent fiscal year statistics have become a testament to their harrowing trials and tribulations as chipmakers in an ever-evolving industry. The giant has struggled amidst a dwindling demand for its traditional desktop CPUs, a phenomenon exacerbated by fierce competition from the likes of Apple, AMD, and Qualcomm. This competition has drastically disrupted Intel’s Clent Computing Group, resulting in a stark YoY plunge in revenue. By the same token, the Data Center Group has faced a similar predicament, grappling with a 20% revenue drop due to decreasing server volume demand.

The bleak financial forecasts continue with the Network and Edge Group grappling with decline, exhibiting a lackluster performance that left Intel counting the costs of dampened customer purchases. The amplification of these losses underscores an underlying profitability crisis encountered by the once robust business segment. Nonetheless, Intel’s IFS has been a rare bright spot amidst the gloom, achieving significant revenue growth. However, this growth spurt comes with a heavy price tag, as the financial outlay required to sustain this momentum looms.

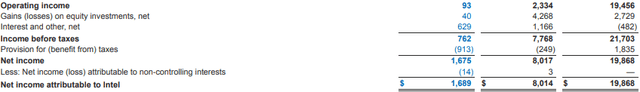

The financial fallout makes for distressing reading, with Intel’s meager operating income dwindling to a paltry $93M, a far cry from the bonanza it had previously enjoyed. Such a drastic decline in profitability and revenue is a clear indication of the wholesale calamity that has befallen Intel’s key business operations, a cogent consequence of its failure to navigate the changing market terrain and surmount the crescendo of competition.

In light of these financial hemorrhages, Intel’s once robust balance sheet is now showing signs of strain, shedding light on a less sanguine state of affairs. With current assets amounting to $43.3B pitted against current liabilities of $28.1B, the precariousness of its financial footing is unmistakable. Notwithstanding the seemingly sound financial ratios, the underlying financial bedrock of Intel appears less sturdy than previously believed.

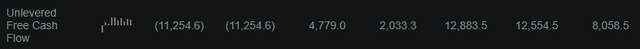

As if that weren’t enough, Intel’s unlevered FCF for FY23 was a festering wound, standing at a disheartening -$11.3B, a compound fracture that has laid bare the firm’s inability to rustle up the resources required to sustain its extensive investment in the IFS business. Intel’s aspirations of long-term profitability hinge on the IFS, but it is evident that the firm will require an outsized influx of external financing to propel this vision to fruition.

Nevertheless, Intel’s long-term debt profile seems to be walking a tightrope, teetering precariously on the edge of an imminent spike in debt levels. Moody’s affirmation of their A2 credit rating masks the severity of their financial discord. While the firm may derive a glimmer of hope from its credit rating and a stable outlook, the harsh reality of Intel’s financial frailty casts a lengthening shadow.

In the face of these financial squalls, Intel’s 2024 outlook looks increasingly somber. The projected downturn in Q1 revenues to the tune of $12.5B seems to foreshadow a grueling year ahead, one fraught with challenges.

Overall, Intel’s financial statement paints a sobering portrait of a titan brought low by its inability to fend off the encroaching tides of change and competition. The road to recovery appears steep and strewn with obstacles, leaving investors and stakeholders alike to ponder whether Intel can reclaim its former glory or if its heyday is irretrievably consigned to the annals of history.

Intel’s Uphill Battle in the Semiconductor Market

Intel, a longtime tech industry powerhouse, is currently facing a challenging reality. The company’s struggle to maintain its competitive edge in the PC market, coupled with the rapid ascent of the IFS business, has led to declining revenues and margins. Additionally, Intel’s significant capital expenditure and investment requirements have further compounded its financial predicament, making the company increasingly reliant on potentially volatile external funding.

Challenges in Valuation

Seeking Alpha’s Quant has assigned Intel with a “D+” Valuation rating, reflecting the uncertainty surrounding the firm’s path to profitability. Intel’s current P/E GAAP TTM ratio of 109.66x and P/CF TTM of 16.16x highlight the company’s struggle to generate positive earnings, resulting in inflated share prices. Moreover, with TTM EV/EBITDA of 22.21x and an EV/Sales TTM of 3.95x, Intel’s valuations appear to be elevated, especially when compared to its 5-year average.

Reviewing a 5-year chart, Intel shares are currently trading at relatively low valuations. Nonetheless, the company’s performance has been overshadowed by a 160% outperformance by the tech fund QQQ, tracking the Nasdaq 100 index, over the same period. While there was a notable 40% rally in shares over the last 3 months, a 15% drop following disappointing Q4 results has introduced downward momentum.

Using The Value Corner’s Intrinsic Value Calculation (IVC), it is discerned that Intel is currently trading at a fair valuation, with base and best-case scenarios indicating a slight overvaluation and undervaluation, respectively. The uncertainty surrounding Intel’s turnaround timeline creates ambiguity in short-term valuations, while the company’s long-term prospects hinge on its ability to become the second-largest fab in the world.

Risks on the Horizon

Intel faces substantial risks, particularly within their CCG business segment and the profitability prospects of IFS. The continued increase in competition within the CCG segment, primarily from ARM-based processors which outperform Intel’s CPUs in power and efficiency, poses a significant threat. Reports of Microsoft, Apple, and Qualcomm releasing their own ARM-based mobile chips further exacerbate the pressure on Intel, indicating a potential shift in the mobile computing space.

Despite these challenges, Intel’s ESG risk profile remains unchanged, with no significant threats in these categories.

Assessment

While the potential for a compelling future still exists for Intel, the company’s struggles in FY23, culminating in a disappointing Q4, have cast a shadow over its prospects. A combination of uncompetitive CCG products and a softening demand for computing devices has strained Intel’s profitability and its ability to finance growth. As the current valuation suggests that shares are trading near fair value, building a position in the company at this time is a difficult proposition.

Hence, it is with regret that I must downgrade my rating from a Buy to a Sell, reflecting the dear valuation amid the headwinds facing Intel. The road to recovery for Intel appears rough and uncertain, amplifying the challenges that lie ahead.