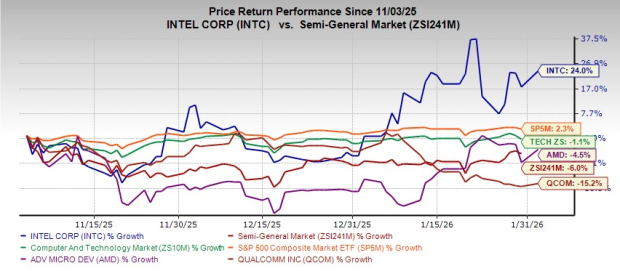

Intel Corporation (INTC) saw its stock price rise by 24% over the past three months, contrasting with a 6% decline in the tech industry, as well as outperforming competitors like Advanced Micro Devices (AMD), which fell by 4.5%, and Qualcomm Incorporated (QCOM), which decreased by 15.2%. This performance is primarily driven by strong demand in the Data Center & AI segment, where revenues increased by 15% sequentially.

However, Intel is grappling with supply constraints, particularly in its Client Computing Group, where revenues slipped to $8.19 billion from $8.77 billion. Additionally, its foundry business reported an operating loss of $2.5 billion in the fourth quarter attributed to lower yield rates for its new Intel 18A technology. Overall, Intel’s earnings estimates for 2025 have decreased by 15.25% to $0.50, and by 14.04% to $0.98 for 2026, highlighting growing investor concerns.

Geopolitical tensions, especially concerning China, pose additional risks, as Intel generates a significant portion of its revenues from the region amid uncertainties related to tariffs and local production directives. Despite strategic collaborations to bolster its AI initiatives, increasing competition from firms like NVIDIA and Qualcomm further complicates Intel’s growth trajectory.