Intel Announces $8.75 Billion Sale of Altera Business INTC shares rose over 3% on Monday after the company revealed a deal to sell 51% of its Altera division to Silver Lake. Despite the stock’s positive response, technical indicators suggest that Intel continues to face a bearish trend.

Intel’s Strategic Sale of Altera

In an effort to streamline operations and focus on its core business, Intel is moving forward with the sale of its Altera unit, valued at $8.75 billion. This transaction allows Silver Lake to obtain majority control, while Intel will retain a 49% stake in the FPGA (field programmable gate array) arm.

To facilitate this transition, Intel has appointed Raghib Hussain, a strategic hire from Marvell Technology, as the CEO of Altera. With significant investment from Silver Lake, Hussain aims to advance Altera’s initiatives in AI, edge computing, and robotics.

Read also: Intel Gave Up On Bitcoin Mining Chip Business Nearly 2 Years Ago — Here’s How Its Stock Has Fared Compared With BTC Since Then

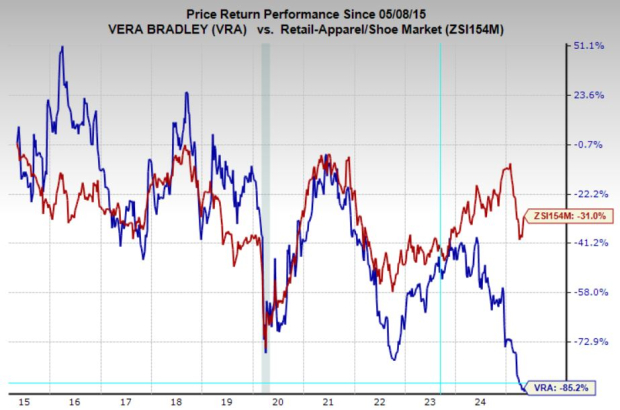

Market Reaction: Stock Rises But Bearish Signals Persist

Chart created using Benzinga Pro

Following the announcement, investor excitement drove shares up by 3% early in the day, pushing Intel stock above the eight-day moving average of $20.19. This indicates a momentary uptick in trading activity due to the news. Nonetheless, shares remain significantly below their 20, 50, and 200-day simple moving averages.

The MACD (moving average convergence/divergence) sits at negative 0.78, reinforcing a bearish outlook, while the RSI (relative strength index) is at 44.45, placing it within the neutral range.

Despite some buying pressure, Intel’s stock remains under negative technical signals, pointing to a medium- to long-term bearish trend.

Upcoming earnings reports in ten days will be pivotal for reevaluating market sentiment toward Intel.

Outlook: Investors Seek More Than Just a Spin-Off

The Altera transaction aligns with Intel’s strategic aims, yet market expectations extend beyond a simple divestiture; investors desire clear evidence of recovery and growth potential.

With earnings on the horizon and the current market conditions remaining challenging, Intel has an opportunity to change the narrative and demonstrate its ongoing value in the semiconductor space.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs