Intel Achieves Milestone in AI Benchmarking but Faces Market Challenges

Intel Corporation (INTC) recently announced its achievement of full Neural Processing Unit (NPU) compliance in the MLPerf Client v0.6 benchmark, a vital industry standard for assessing AI system performance. This latest benchmark specifically targets client devices like laptops and PCs and focuses on large language model acceleration and NPU efficiency. The assessment provides clear insights into hardware and software capabilities, specifically in handling AI tasks such as content generation and summarization.

Notably, Intel’s Core Ultra Series 2 processors demonstrated leading performance metrics, achieving the fastest NPU response time at just 1.09 seconds and the highest NPU throughput of 18.55 tokens per second. Additionally, Intel showcased strong GPU performance during this benchmark evaluation, with the Core Ultra processor emerging as the only NPU to meet full compliance, reinforcing its advanced AI compute capabilities.

Strategic Moves to Capitalize on AI Growth

To strengthen its position in the rapidly evolving AI market, Intel has made several strategic initiatives. These span areas from cloud and enterprise servers to volume clients and edge environments. The company’s Xeon 6 processors, featuring Performance-cores, have gained traction due to significant performance enhancements in AI processing. The Xeon platforms not only improve energy efficiency but also simplify software deployment—setting a new benchmark in the 5G cloud-native core, thus attracting interest from software vendors and telecom manufacturers. Intel aims to support over 100 million AI PCs by the end of 2025, backed by robust demand for its Core Ultra Chips.

Additionally, Intel is entering the automotive sector to leverage the rising AI demand within that industry. Its second-generation AI-powered software-defined vehicle system-on-chip features a multi-process node chiplet architecture. This chip promises a tenfold performance boost for generative and multimodal AI and triples graphics performance, therefore enhancing camera and image processing capabilities. These advancements will likely propel demand for Intel’s new AI chip in Advanced Driver Assistance Systems (ADAS).

In a notable move, Intel is divesting 51% of its Altera business to Silver Lake, a leading global technology investment firm. This decision aligns with Intel’s strategy to reshape its portfolio, optimize its cost structure, and focus on core operations to enhance liquidity.

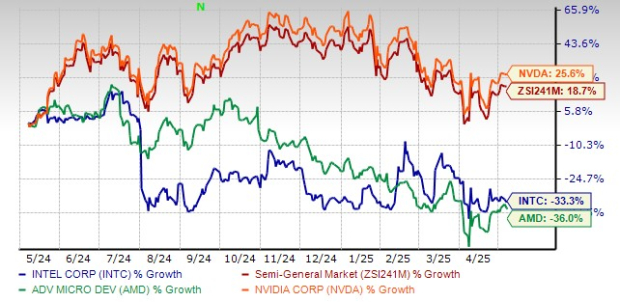

One-Year INTC Stock Price Trends

Over the past year, Intel’s stock has declined by 33.3%, contrasting with the industry’s growth of 18.7%. While Intel has underperformed against its rival NVIDIA Corporation (NVDA), it has outpaced Advanced Micro Devices, Inc. (AMD).

Image Source: Zacks Investment Research

Challenges Due to Competitive Pressures

Despite significant investments in new chip design and manufacturing, Intel is struggling to catch up with NVIDIA and AMD. AMD has solidified its position in the CPU space with its Ryzen and EPYC processors, utilizing a strategy that combines competitive pricing and high performance, thereby challenging Intel’s market share.

In the realms of graphics and AI acceleration, NVIDIA continues to gain traction, fueled by strong demand for generative AI and large language models relying on its advanced GPU architectures. Both NVIDIA and AMD are also expanding their presence in the automotive sector. The mounting competition across various markets is exerting pressure on Intel’s profit margins.

Furthermore, Intel’s debt-to-capital ratio stands at 32%, notably higher than the industry average of 17.3%. As of March 31, 2025, Intel reported cash and cash equivalents totaling $8.95 billion against long-term debt of $44.91 billion. Such high debt levels may restrict its cash flow generation, necessary for meeting future obligations. Additionally, Intel’s substantial operations in China render it vulnerable to escalating Sino-U.S. trade tensions.

Image Source: Zacks Investment Research

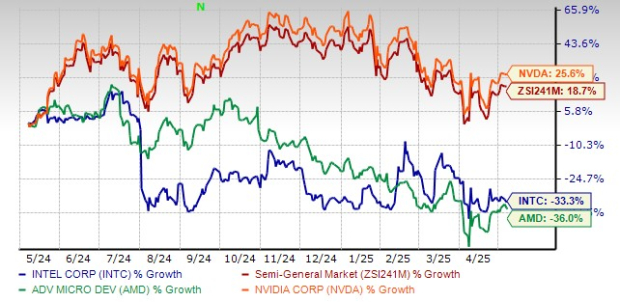

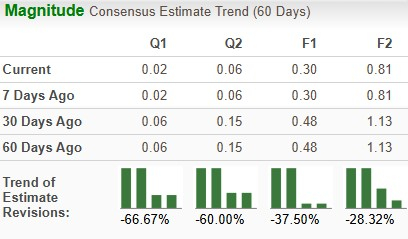

Estimate Revisions Reflect Bearish Sentiment

Recent earnings estimates for Intel have decreased significantly. For 2025, estimates have dropped by 37.5% to $0.30, while projections for 2026 have fallen 28.32% to $0.81. These downward revisions indicate a bearish outlook for the company’s stock.

Image Source: Zacks Investment Research

Conclusion

Intel’s commitment to AI development and the expansion of its offerings for AI PCs, data centers, and automotive markets is commendable. Strategic moves aimed at cost-cutting and liquidity improvement through divestiture are promising. However, intense competition in the commercial PC, server, storage, and networking sectors presents significant challenges. Furthermore, deep links to the Chinese market, trade tariffs, and efforts to replace U.S.-made chips with domestic alternatives hinder Intel’s commercial viability.

High debt levels pose vulnerabilities in economic downturns and geopolitical unrest. Diminishing earnings estimate revisions further reflect declining investor confidence. Although Intel is heavily investing in chipset innovation and AI acceleration, reclaiming its competitive edge proves to be a formidable task. Currently, Intel holds a Zacks Rank #3 (Hold).