“`html

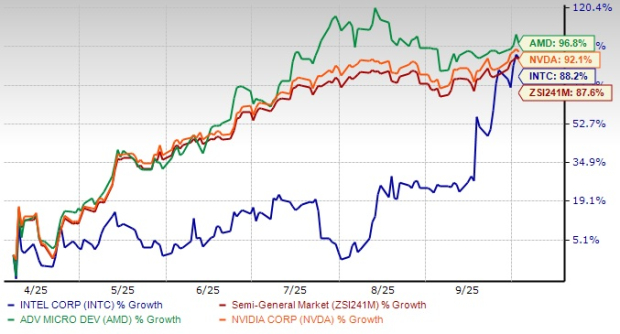

Intel Corporation (INTC) has experienced an 88.2% stock price surge over the past six months, closely aligned with the semiconductor industry’s growth of 87.6%. However, it is outperformed by peers Advanced Micro Devices (AMD), which gained 96.8%, and NVIDIA Corporation (NVDA), which rose by 92.1% during the same period.

Recently, Intel appointed David Zinsner and Michelle Johnston Holthaus as interim Co-CEOs, initiating a review of its operations while maintaining its core strategy. The company anticipates shipping over 100 million AI PCs by 2025 and has introduced the Intel Core Ultra, featuring improved AI acceleration capabilities. Additionally, a substantial $5 billion investment from NVIDIA and a $2 billion investment from Softbank indicate strong financial backing for Intel’s future endeavors.

Despite this positive momentum, Intel faces challenges, including an 86.9% and 63.2% decline in earnings estimates for 2025 and 2026, respectively. Furthermore, U.S.-China trade tensions and shifts in the market are pressuring Intel’s revenue, especially with China being a critical market, accounting for over 29% of its total revenues in 2024.

“`