Intel Faces New Challenges as Shares Tumble

Intel (INTC) is in hot water once again. After the issues surrounding the “Coffee Debacle” seemed to be fading, it’s now evident that the launch of Arrow Lake did not go as expected. Adding to the trouble, Intel is encountering fierce competition in a market it once dominated, leading to a nearly 4.5% drop in stock prices during Monday afternoon’s trading.

Performance Issues with New Chip Line

A recent report from The Verge revealed that the Core Ultra 9 200S chip series isn’t performing well, especially in comparison to chips from Advanced Micro Devices (AMD), one of Intel’s key rivals. Intel was aware of these potential shortcomings and has plans in motion to improve the chips’ performance soon.

While there have been some improvements in efficiency noted, a significant “comprehensive update” is expected in the upcoming weeks to enhance performance further. Intel mentioned that addressing these problems should be straightforward, requiring users to simply “flash the BIOS and update Windows.”

Nvidia’s Entry into the CPU Market

Things took another downturn when Techradar reported that Nvidia (NVDA) might be preparing to enter the PC processor market, a territory Intel has dominated for the past two decades. The Nvidia processors are anticipated to be ARM-based and could launch as soon as 2026. More details will emerge in 2025, particularly after Qualcomm (QCOM) loses its exclusive rights to manufacture Windows-compatible processors. This development could further compress Intel’s market position.

Investor Sentiment: Hold or Sell?

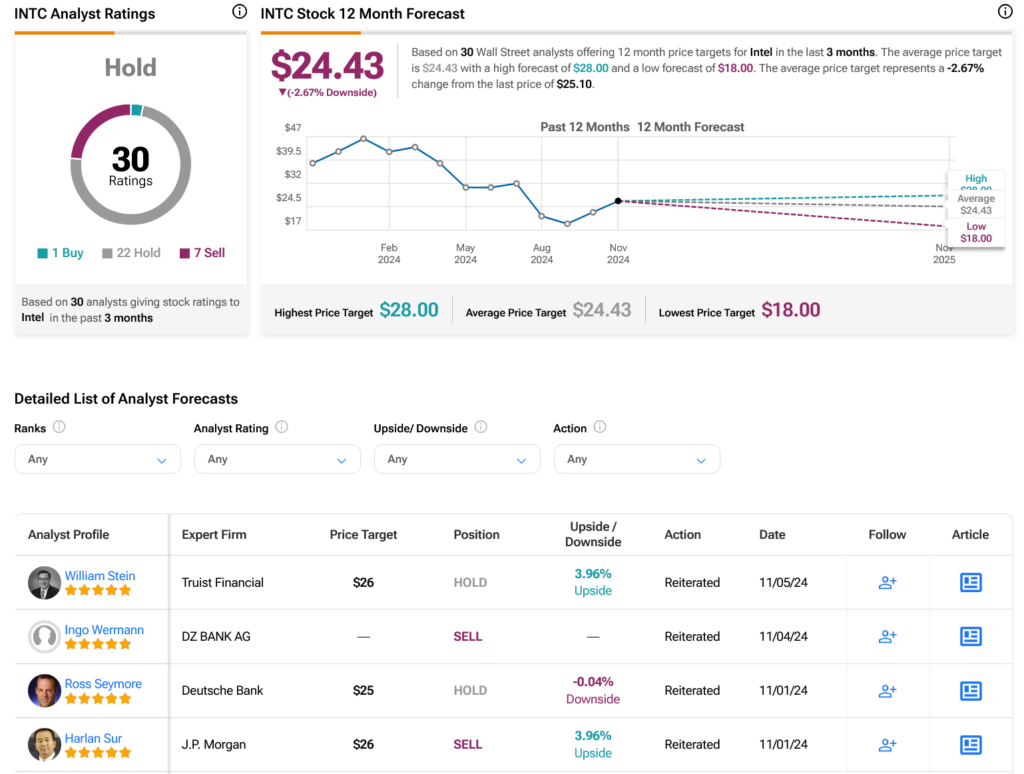

From Wall Street’s perspective, analysts have issued a Hold consensus rating on INTC stock, reflecting one Buy, 22 Holds, and seven Sells in the last three months. Notably, Intel has incurred a 33.7% decline in its stock price over the past year. Currently, the average price target for INTC shares sits at $24.43, indicating a 2.67% downside risk.

See more INTC analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.