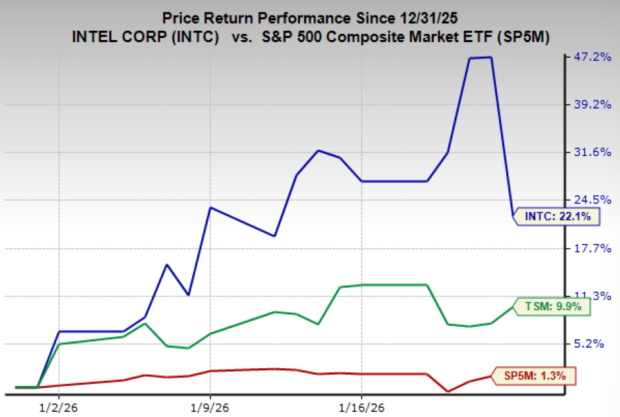

Intel (INTC) reported a 15% year-over-year increase in earnings alongside a 4% decline in revenue for Q1, which is typically a weak period for the company. Despite exceeding earnings expectations, Intel’s stock dropped nearly 17% on the day of the report, although it remains up over 20% for the year. The company’s future hinges on its ability to reinvent itself as a high-end foundry operator to compete with Taiwan Semiconductor (TSMC).

Intel is attempting to establish cutting-edge semiconductor manufacturing capabilities in the U.S. with backing from the government, aiming to reduce reliance on overseas production. Central to this strategy is Intel’s 18A process node, which requires substantial investment and has seen improving yields, crucial for commercial viability. If successful, Intel could secure contracts from major clients like Nvidia and Apple, drastically altering the global semiconductor landscape.

Valuation disparities highlight stark risks, with TSMC trading at about 23.7x forward earnings compared to Intel’s 93x. However, if Intel’s foundry strategy succeeds, it could significantly increase earnings and compress this multiple over time, presenting an asymmetric investment opportunity amid rising demand for advanced chips related to AI technologies.