“`html

Inter Parfums, Inc. Expected to Show Earnings Growth in Q4 2024

Inter Parfums, Inc. (IPAR) is anticipated to post an increase in earnings when it releases its fourth-quarter 2024 earnings on February 25. The Zacks Consensus Estimate for quarterly earnings has slightly decreased by one cent in the last month, now expected at 80 cents per share. This figure marks a significant rise from 32 cents reported in the same quarter last year.

For the full year 2024, the consensus estimate for earnings is $5.14 per share, reflecting an 8.2% growth compared to last year’s results. However, IPAR has faced an average negative earnings surprise of 3.8% over the past four quarters.

Stay informed about all quarterly releases: Check Zacks Earnings Calendar.

Key Insights Ahead of IPAR’s Earnings Report

Inter Parfums continues to thrive due to strong demand for its products and a diverse brand portfolio. The company has been concentrating on innovation and launching new products, helping it to maintain its position in the competitive fragrance market. Additionally, its growing e-commerce presence has contributed positively. These factors are expected to favor the upcoming quarterly performance. Management projects earnings per share (EPS) of $5.15 for the entire year of 2024.

Despite a booming global fragrance market, Inter Parfums has observed a slower sell-in compared to sell-out, with retailers opting for leaner inventories. While this trend partly stems from industry-wide destocking, it may also signal weakening demand momentum, potentially impacting the company’s fourth-quarter outcomes.

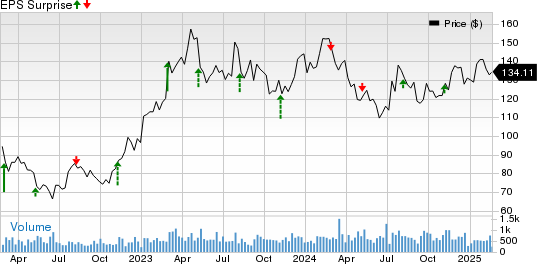

Price and Earnings Performance of Inter Parfums, Inc.

Interparfums, Inc. price-eps-surprise | Interparfums, Inc. Quote

Review of IPAR’s Sales Results

Inter Parfums recently announced its sales figures for the fourth quarter and entire year of 2024, showcasing strong performance fueled by its brand strength. In the fourth quarter, net sales rose by 10% to reach $362 million. For the year, net sales also increased 10% to $1.452 billion.

The company experienced solid growth due to heightened demand for its key brands. GUESS, the top-performing brand in the U.S., reported strong results. Notably, the top six brands, representing approximately 70% of total net sales, saw a 5% increase in the fourth quarter and a 4% rise for the full year. Newer brands Lacoste and Roberto Cavalli made notable contributions, accounting for 8% of quarterly growth and 9% of the yearly increase.

Net sales from Europe amounted to $214 million in the fourth quarter, reflecting a 6% increase from the prior year, and totaled $953 million for 2024, marking a 10% rise from 2023. This growth was driven largely by the success of Jimmy Choo, the introduction of Lacoste, and strong sales across smaller brands. Sales for Jimmy Choo rose by 11% in the fourth quarter and 7% for the full year. The newest European brand, Lacoste, performed exceptionally well, reaching $85 million in its inaugural year.

In the U.S., net sales for Interparfums reached $149 million in the fourth quarter, a substantial year-over-year increase of 16%. For the entire year, U.S. net sales climbed 12% to $511 million compared to the previous year. This rise was bolstered by strong performances from GUESS, Donna Karan/DKNY, and the introduction of Roberto Cavalli.

Earnings Predictions for IPAR Stock

Based on our model, we cannot definitively predict an earnings beat for Inter Parfums this time. A combination of a positive Earnings ESP along with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) enhances the likelihood of an earnings beat, but this situation does not apply here. You can find stocks that have the potential for earnings beats by using our Earnings ESP Filter.

Currently, Inter Parfums holds a Zacks Rank of #2 and an Earnings ESP of -2.64%.

Other Stocks to Consider

Here are some companies that also have favorable conditions to potentially exceed earnings expectations this reporting cycle.

General Mills (GIS) has an Earnings ESP of +7.77% and a Zacks Rank #3. GIS is expecting a downturn in both its revenues and profits when it reports third-quarter fiscal 2025 results. The Zacks Consensus Estimate for General Mills’ quarterly revenue is $5.1 billion, indicating a slight decline of 0.8% from last year’s quarter. The earnings consensus has remained stable over the past week at $1.03 per share, signifying a 12% decrease compared to the same quarter last year. GIS has historically exceeded earnings expectations by an average of 7.8% over the last four quarters.

Freshpet, Inc. (FRPT) has an Earnings ESP of +14.67% and a Zacks Rank #2. The company is set to report its quarterly earnings on February 20, with Zacks Consensus Estimates for earnings and revenues at 44 cents per share and $263.5 million, respectively. Over the last year, FRPT shares have surged by 46.3%.

Grocery Outlet Holding (GO) has an Earnings ESP of +1.32% and a Zacks Rank of 3. The company forecasts a dip in earnings for its fourth-quarter 2024 report. The quarterly earnings per share estimate stands at 17 cents, down 5.6% from the same period last year. However, revenue is projected to grow year-over-year, with quarterly revenue estimated at $1.09 billion, reflecting a 9.7% increase from the previous year. Grocery Outlet has seen an average negative earnings surprise of 2.2% over the last four quarters.

Stocks with High Potential for Growth

Each of these stocks has been specifically chosen by a Zacks expert as a strong candidate to potentially increase by 100% or more in 2024. While not every selection will succeed, prior recommendations have gained +143.0%, +175.9%, +498.3% and +673.0%.

Many of the stocks included in this report are currently undervalued by Wall Street, providing an excellent opportunity to invest early.

“`

Key Earnings Reports on the Horizon: Insights on Notable Stocks

Discover Potential Investments

Explore These 5 Stock Opportunities >>

Stock Analysis Reports Available

General Mills, Inc. (GIS) : Access Your Free Stock Analysis Report

Freshpet, Inc. (FRPT) : Get Your Free Stock Analysis Report

Interparfums, Inc. (IPAR) : Download Your Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report Here

Understanding Upcoming Earnings

For more insights on upcoming earnings, click here to read the article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.