Interactive Brokers Group, Inc. (IBKR) released the Electronic Brokerage segment’s performance metrics for January 2024. The segment handles the clearance and settlement of trades for individual and institutional clients worldwide. It reported a surge in client Daily Average Revenue Trades (DARTs) on a sequential and year-over-year basis.

Key Performance Metrics

Total client DARTs for the month were 2,201,000, which increased 12% from December 2023 and 11% year over year.

Cleared client DARTs for the month were 1,957,000, which increased 12% from December 2023 and 10% from January 2023. On an annualized basis, IBKR recorded a Cleared Average DARTs per customer account of 190. The metric grew 10% sequentially but declined 10% year over year.

IBKR’s total customer accounts rose 2% from the prior month and 23% from January 2023 to 2.63 million. Net new accounts were 63,800, witnessing a rise of 59% from December 2023 and 72% year over year.

Interactive Brokers’ total options contracts were 98.7 million in January 2024, increasing 11% from the prior month and 33% year over year. Futures contracts increased 19% on a sequential basis and 23% year over year to 18.5 million.

At the end of January 2024, client equity was $424 billion, which remained flat sequentially but grew 26% year over year. It recorded client credit balances of $102.5 billion, down 2% from December 2023 but rising 3% from January 2023. The company’s customer margin loan balance of $44.3 billion was stable from the previous month and rose 12% year over year.

Stock Performance

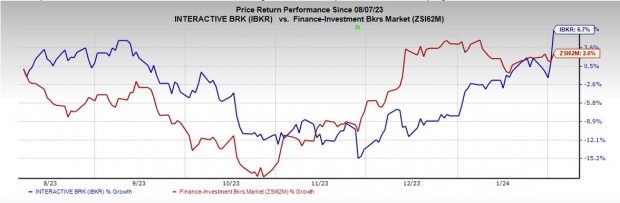

Over the past six months, shares of Interactive Brokers have gained 6.7% compared with the Industry’s growth of 2.6%.

Currently, IBKR carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Competitor Metrics

Two other brokerage firms, Charles Schwab Corporation SCHW and LPL Financial Holdings Inc. LPLA, will come out with their monthly performance metrics in the coming days.

At present, SCHW carries a Zacks Rank #4 (Sell). LPL Financial has a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook names 5 hand-picked stocks with sky-high growth potential in a brilliant sector of Artificial Intelligence. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

Today you can invest in the wave of the future, an automation that answers follow-up questions … admits mistakes … challenges incorrect premises … rejects inappropriate requests. As one of the selected companies puts it, “Automation frees people from the mundane so they can accomplish the miraculous.”

Download Free ChatGPT Stock Report Right Now >>

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.